One of the biggest paradoxes in India has been that it had huge savings, but rarely productive. Lethargy led to bank deposits reign supreme and gold was an obsession. Times are changing and financial assets are getting an upper hand.

The rapid fall in deposit rates in the last one year has shaken the belief many Indians had in their favourite instrument for investments: the fixed deposit. This process quickened after demonetisation as banks sharply reduced deposit rates.

What has been a no no in many families is now becoming a reality. People are veering towards equity and bond investments like thousands of other Indian middle class families, and also to fixed income mutual funds, which are more tax efficient and yield better than fixed deposits.

There is a quiet revolution taking place in India’s retail savings space. The slow and steady change in the savings profile of the country could in the next decade ensure a steady flow of funds to other asset classes such as stocks, bonds, and even real estate investment trusts which are slowly becoming a reality after a decade in the making.

The change is already visible. Household financial savings in shares and debentures increased to 0.7% of GDP in fiscal year end ed 2016, from 0.4% in fiscal 2014 and fiscal 2015. The proportion of fixed deposits dropped to 4.7% of GDP in fiscal 2016, from 4.9% in fiscal 2015 and 5.8% in fiscal 2014, central bank data shows.

Even physical assets like land and gold, which used to be dominant assets in an Indian family’s portfolio, are losing their weightage. These are down at 10.8% of gross financial savings in 2014-15 from 15.5% in 2011-12.

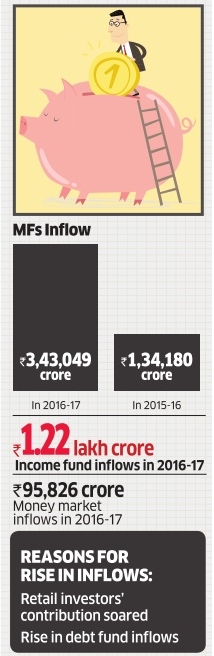

Other data also points to a preference for financial assets though it may be a bit skewed because of the bullish sentiment. Net inflows into domestic mutual funds and the equity market are on the rise. In the three calendar years ending 2016, a whopping Rs.1.43 lakh crore has come into the local market through mutual funds compared to a net outflow of Rs.27,070 crore in 13 years starting 2001.

Data from the insurance industry also shows a similar trend. Assets of the insurance industry are up 75% at Rs.28 lakh crore in the past five years.

A favourable tax policy, urbanisation and a new breed of young investors are driving this push towards high yielding investments.

More and more investors are seeking higher post-tax returns. Younger investors, in particular, are more entrepreneurial and risk-taking. They prefer stocks and equity instead of FDs because interest rates do not match their expectations of real returns.

Interest earned from bank fixed deposits is treated in the same tax slab as the investor’s income, which can be as high as 30%. But equity returns are tax-exempt after one-year holding period. Returns from equity mutual funds are tax-free after one year, and debt funds have a tax rate of 20% after indexation benefits after three years.

In the last two years, one-year bank deposit rates have fallen 135 basis points, while five-year deposits are down around 150 basis points. Even the tax-free public provident fund rate has dropped to 7.9% in 2017, from 8.7% in 2014 mainly in response to interest rate cuts by the RBI. In contrast, the 30-share BSE Sensex has delivered a 32% return in the last one year.

It is not as if all small investors are moving towards equities en masse. Some investors, particularly senior citizens, who have seen many such interest rate cycles are staying put because they prefer safety of investments to sky-high returns, and rightly so.

The younger investors in the age group of 20-45 years, who are not fussed about guaranteed returns, are rapidly moving towards equity investments. More than 50% of money flowing into equity funds on an average is through systematic investment plans.