We connect you with Certified Financial Planners who have met the stringent standards of education, examination, experience and ethics.

FPSB India is the principal licensing body that awards CFP Certification in India. CFP Certification is the highest level of Certification worldwide in the field of Financial Planning.

Our partnered CFPs:

- Are FEE-ONLY advisors. Since they are not attached to any company or bank, they do not have any targets to meet and don’t have to push you towards any specific product.

- Aspire to keep the number of their clients limited to a select few, thus enabling them to provide custom-tailored financial guidance, superior customer service, and precise attention to personal detail in each client relationship.

- Do not track every movement of the stock market with bated breath, nor do they panic at the rise and fall of global financial tides.

- Aim to provide calm, clear, reasoned financial guidance. Their purpose is to provide you and your loved ones with financial security that will last generations, to cultivate and nurture a financial plan with care and vision.

- Would love to serve as your financial sherpa on the journey of life, so you can live the adventure as you fully imagine.

You would experience continuity… now and in the years to come. That means you need not start explaining every time, from the start.

Ethics & integrity are the bedrock principles on which their practice itself is built and they are committed to doing things transparently.

If you’re interested in a path of financial wellness that will bridge your life’s dreams and desires with your fiscal means, give us a call or drop a message.

What is Financial Planning?

Financial planning is the act of managing your income; setting your financial goals and then allocating your assets across investments keeping in mind your limitations and requirements.

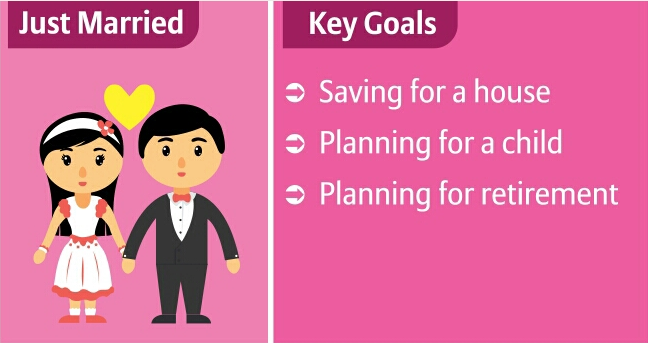

Life goals can include buying a home, saving for your child’s education, planning for retirement, or leaving a legacy.

A financial plan has to be planned by individuals keeping in mind their stage in life cycle and their needs.

Every financial plan differs. This is because it has to be tailored to suit an individual’s needs and wants.

While planning your finances, you have to take in consideration all your goals, large or small. This is why you need to prioritize your goals.

Everyone has to understand their current state of life before planning for the future. The financial plan is like a bridge connecting your today and future.

What is Wealth Management?

As the name suggests, wealth management is all about managing one’s wealth. This predominantly deals with preservation of wealth and further accumulation. As part of wealth management, investors often actively try to identify and take advantage of profit-making opportunities.

What is the difference between Wealth Management and Financial Planning?

Wealth management and financial planning are fundamentally similar. However, there is a key difference – you can only manage wealth if you already have it. Financial planning, on the other hand, is even for those who aim to amass wealth.

Financial planning, thus, is required by everybody, whatever your financial goals may be.

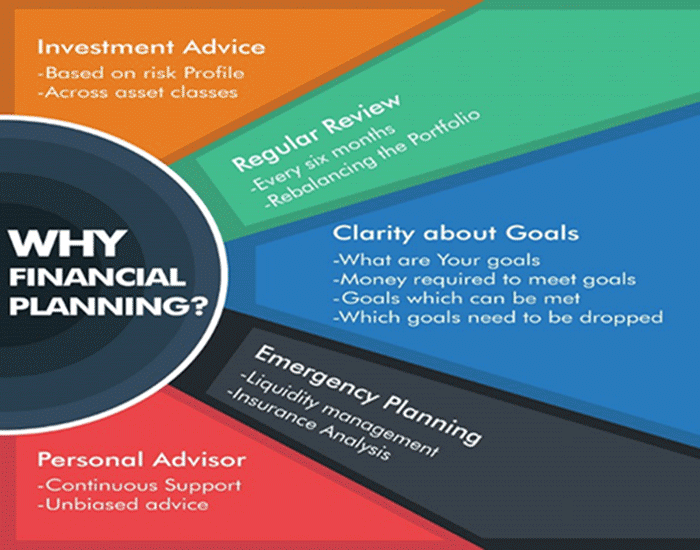

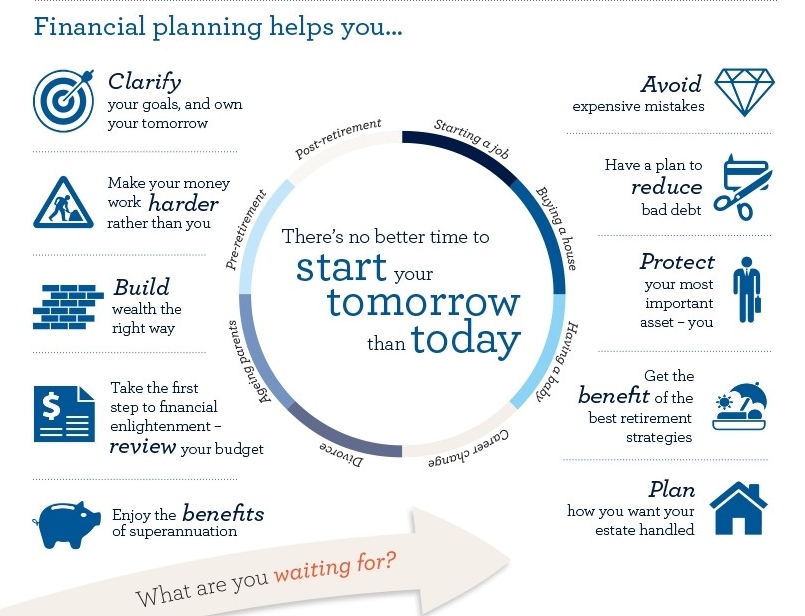

Why Do You Need a Financial Plan?

If you don’t know the destination, how will you know when you’ve arrived? A financial goal is something that has a time frame and that can be quantified. An aspiration such as a “comfortable retirement” is hard to plan for. The financial planning process will help you define and quantify your goals.

Determining a proper investment allocation is critical. The allocation should reflect the goals you are trying to attain as well as your tolerance for investment risk.

- Are you saving enough? Whether you want to fund your children’s college education, save for retirement, or buy a new house, most financial goals mean periodic savings. The financial planning process will help you identify how much you will need to save periodically-and in total for each of your goal.

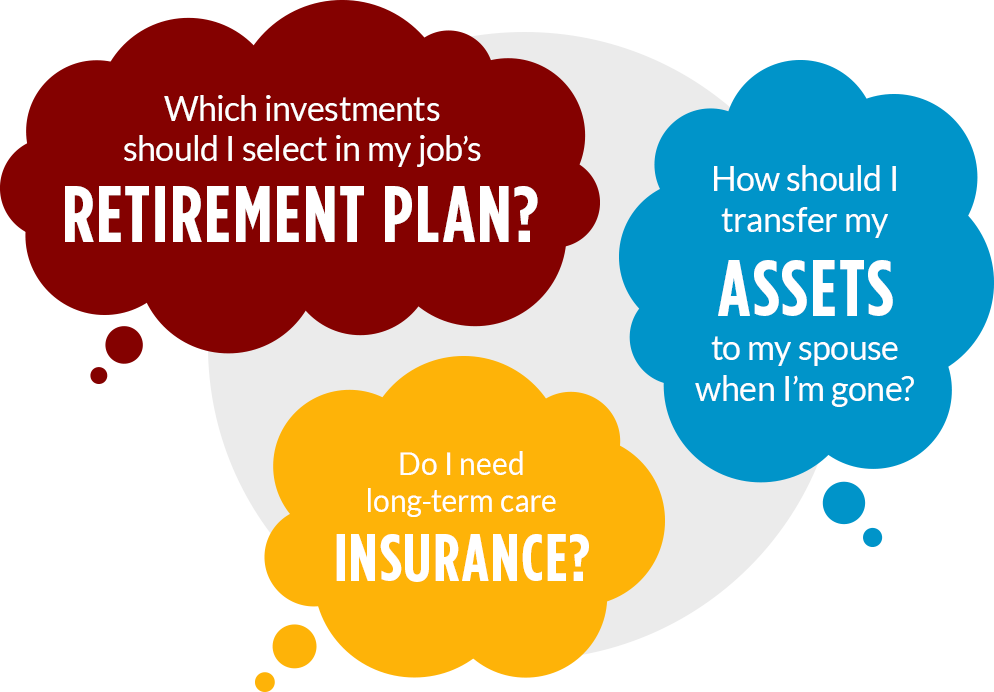

- What will happen to your assets upon your death? Most of us have someone to whom we would like to pass on whatever wealth we have accumulated during our lifetime. Estate planning is a central part of the financial planning process. Do you need a will or a trust? Are your nominees on provident fund accounts and insurance policies up-to-date? What would happen to your assets if you died today? Is this what you intended?

- Are you properly insured? Do you have enough life insurance, and do you have the right kind of policy for your situation? Do you have disability and long-term care insurance? Do you need this coverage? A financial plan addresses all of these issues.

- Are you fully using all of the benefits available to you through your employer like EPF, NPS contributions? This question addresses issues from health insurance all the way to your provident fund account. Understanding what is available to you and how to best use these benefits is crucial.

In general, the financial planning process can help you take a thorough look at all aspects of your financial life and organize them in the most efficient fashion for your situation.

What are the Benefits of Financial Planning?

To sum up, a financial plan can give you a clear picture of your present, a strategy about where you are going, and peace of mind about your future.

You will have much greater confidence of where you are going in life.

Financial planning also helps reduce your stress levels and you start to enjoy life more.

Who is a Financial Planner?

A financial planner is someone who uses the financial planning process to help you figure out how to meet your life goals.

The planner can take a “big picture” view of your financial situation and make financial planning recommendations that are right for you. The planner can look at all of your needs including budgeting and saving, taxes, investments, insurance, estate and retirement planning.

It is this big picture approach to your financial goals that set the planner apart from other financial advisors, who may have been trained to focus on a narrow aspect of your finances.

What a good financial planner will do for you that you cannot do yourself is to take an objective, unemotional look at your situation. He will then apply his expertise, training, and experience to your unique financial needs.

Always hire a fee-only financial advisor, someone who does not earn a commission based on selling you a financial product. This eliminates a huge potential conflict of interest.

Have a trained financial planner give an objective and unbiased look at your given situation, and allow them to use their experience and knowledge to meet your individual financial needs.

Who is a CFP?

Financial planners who hold CFP certification have met education, examination, experience and ethics requirements.

Only those who have fulfilled the certification and renewal requirements of FPSB India can display the CFP certification marks, which represent a high level of competency, ethics and professionalism.

A CERTIFIED FINANCIAL PLANNER professional will put your needs and interests first at all times.

A CFP has the knowledge, skills and experience to help you to review all of your options so you can make informed decisions about what you want from life both now and in future.

CFPs have been tested to make sure they meet rigorous international competency, ethical and professional practice standards. This means that not only will you have peace of mind regarding the technical accuracy of their advice but also the integrity that underpins it.

They’ll work with you to make sure you’re in control of your finances and achieve your life goals.

The best financial planning results come from working with a CFP professional. When seeking objective, expert and trusted financial planning advice you should always look for those who carry the CFP mark.

CFP certification is the only globally recognized mark of professionalism for Financial Planners.

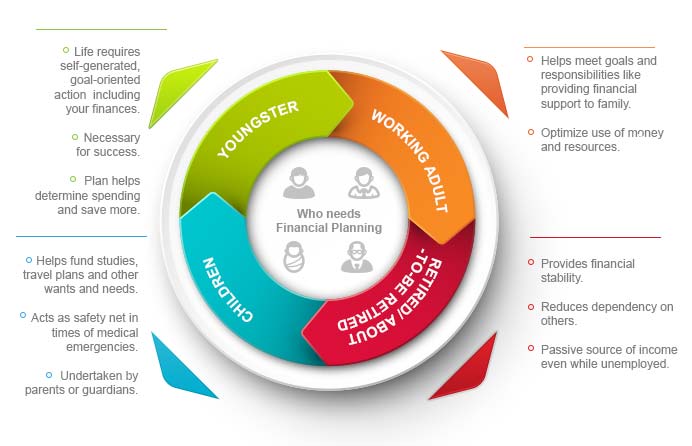

Who needs Financial Planning?

Almost everyone requires financial planning. Whoever has financial goals and wants to achieve them in the most efficient manner requires financial planning. You don’t have to be extremely rich to have a financial plan. Neither do you have to be very old and approaching retirement. It does not matter how much you earn or what your age is.

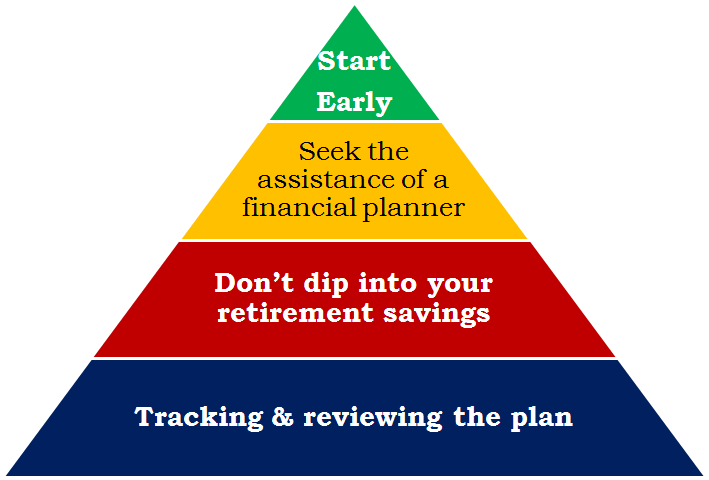

When should I start?

Financial planning helps infuse discipline in your life and an early start lets the Magic of Compounding kick in. You need to be aware that this plan cannot come to fruition overnight, but beginning now is the best time to start this journey.

No matter what your income level or what your hopes for the future, you need a solid plan to achieve your goals. Drifting through life without carefully set goals and well-researched methods of achieving them is a recipe for disaster. To enable your money to offer you more of what you want out of life, start creating a financial plan today.

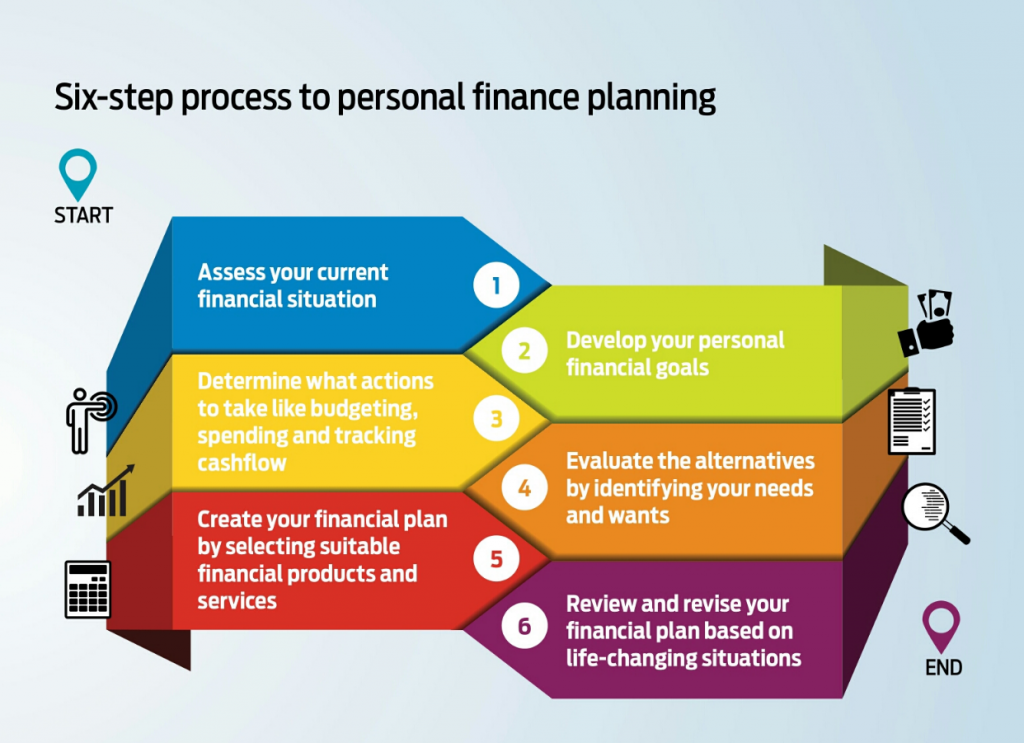

How is Financial Planning Done?

A financial plan differs from individual to individual, as something important for one may not be important for others. However, broadly, we can say that it should include the following activities: