Large banks led by State Bank of India, ICICI Bank and Punjab National Bank, and the country’s biggest mortgage financier Housing Development Finance Corp raised benchmark lending rates by 10 to 20 basis points, confirming that the upward move in interest rates was here to stay.

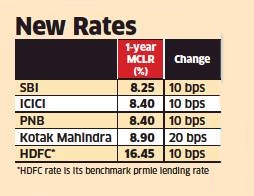

SBI raised its benchmark marginal cost of funds based lending rate by 10 basis points across all tenures, effective from June 1. Consequently, SBI’s one year MCLR now stands at 8.25%. One basis point is 0.01 percentage point. SBI’s private sector rival ICICI also hiked its MCLR by 10 basis points, taking its one-year benchmark rate to 8.40%.

Mortgage lender HDFC also increased its benchmark home loan rate by 10 basis point effectively making home loans more expensive for individual borrowers. The benchmark prime lending rate for HDFC will now go up to 16.45% from 16.35% effective June 2. The hike reflects the increase in cost of funds in the last 6 to 9 months. Higher crude prices and softer local liquidity are pushing inflation higher.

Brent crude hit $80 a barrel last month, the highest in almost four years, fuelling concerns of higher inflation in India that imports around 80% of its oil requirements. Every $10 increase in the price of crude adds 30-40 basis points to the country’s inflation, according to estimates by Japanese brokerage firm Nomura Holdings.

The hike in rates also reflects the upward move in the 10-year yield, which has risen quite sharply over the last few months. The yield on the 10-year benchmark government security is closing in on 8% for the first time since May 2015, with concerns over higher rates leading traders to sell their investments. The 10-year bond ended at 7.85% on Friday 1st June 2018. It has climbed more than 85 basis points since November 2017.

HDFC’s rate increase was the second since April, when it had raised benchmark rates by 20 basis points. The latest increase means that rates on home loans between ₹30 lakh and ₹75 lakh will now go up to 8.70%, while loans above ₹75 lakh will cost 8.80%. Loans up to ₹30 lakh have been raised to 8.55%. Women borrowers will get loans at 5 basis points lower for all the above slabs.

Besides SBI and ICICI, private sector bank Kotak Mahindra also raised its benchmark lending rate between 10 and 20 basis points. Kotak’s one-year MCLR rate is now at 8.90%.

Public sector banks PNB and Union Bank of India have also increased their lending rates by up to 10 basis points effective June 1.