Sebi came out with an innocuous circular a few days back, imposing some well-meaning reforms in investment advisor regulations.

The short two-page circular makes five changes to the law governing ‘investment advisors’. To recall, investment advisors are a new breed of professionals recognised less than a decade back. They are a subcategory of what was earlier captured under the portfolio manager regulations. Their work was seen as a contrast to distributors. While distributors pushed products as sales agents of manufacturers like mutual funds, investment advisors were seen as an agent of the investor. Thus, advisors can take no money from the mutual fund and are fiduciaries of the investor providing a low-conflict model.

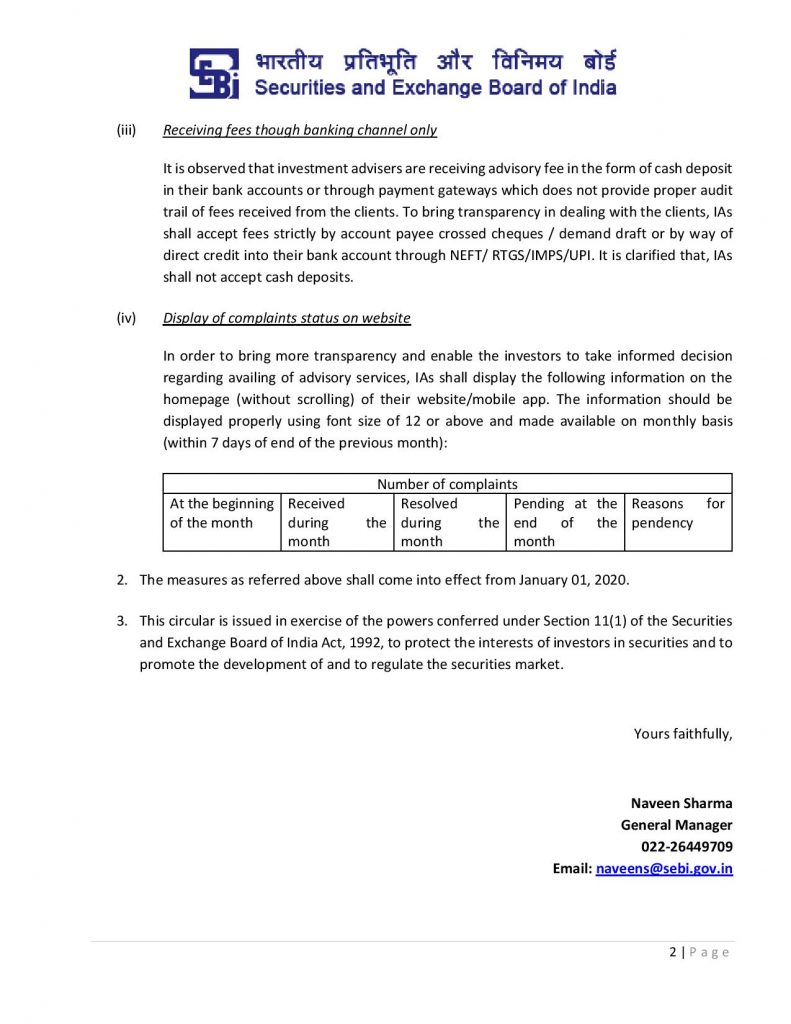

The five changes are: firstly, no free trial for services of advice. Second, no part payment should be accepted from the client. Third, service should be provided only after risk profiling i.e., not give advice without knowing the client’s risk tolerance. This profiling should be followed by a consent obtained through a registered email or physical document. Fourth, barring cash deposits and payment through payment gateways, while allowing only cheques/NEFT/RTGS/IMPS/UPI, as the latter category provides audit trails. Fifth, display of details of investor complaints on the advisor’s website. The circular is effective immediately.