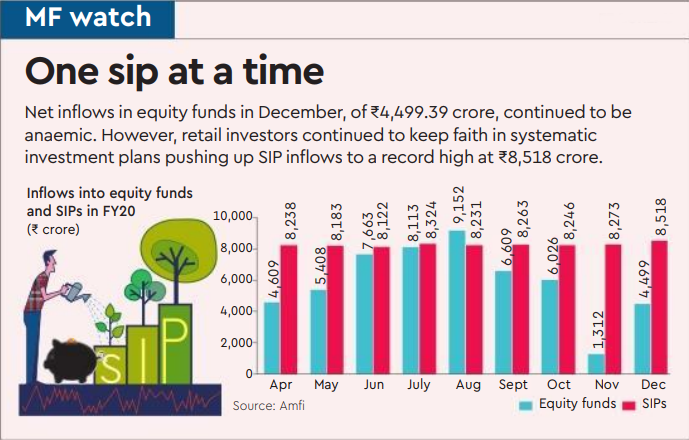

Inflows into equity mutual funds revived in December after a three-month decline as investors pumped money into these products afresh with the stock market hitting record highs during the month.

Investors put ₹4,499 crore into equity schemes in December compared to ₹1,311 crore in November — the lowest monthly flows in three-and-a-half years. Assets under management of the industry fall by ₹61,810 crore to ₹26.54 lakh crore on account of outflows from debt schemes.

Flows into mutual fund schemes through Systematic Investment Plans continued to remain strong at ₹8,518 crore — the highest ever in a month, an addition of ₹245 crore over the previous month. This is the 13th successive month in a row where SIP inflows remained north of the ₹8,000-crore mark.

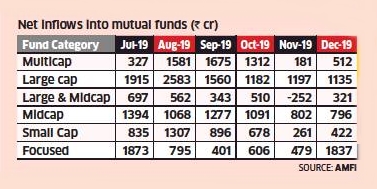

Among various categories, large caps saw inflows of ₹1,135 crore, midcap schemes got ₹796 crore and small cap received ₹421 crore.

In October, equity mutual fund schemes had seen inflows of ₹6,026 crore, while in September and August, these products attracted ₹6,609 crore and ₹9,152 crore respectively.

The outflow from balanced funds, which invest 65-75% of their money into equities, continued in December. The category saw outflows of ₹2,040 crore. In November, the category saw outflows of ₹4,932 crore.

Debt funds saw outflows of ₹78,426 crore due to quarter-end redemptions primarily from liquid and overnight funds.

Among debt funds, banking and PSU funds that primarily invest in a portfolio of AAA companies saw strong inflows of ₹4,770 crore. Investors continued to shun credit risk funds with the category seeing outflows of ₹1,191 crore.

Overnight funds and liquid funds saw outflows of close to ₹80,000 crore as corporate investors withdrew due to quarter end considerations. Arbitrage funds, which invest in a mix of shares and stock futures, saw inflows dip to ₹612 crore compared to ₹5,353 crore in the previous month.