The RBI has decided to waive all charges on Real Time Gross Settlement System and National Electronic Funds Transfer transactions — two preferred routes for instantly transferring funds digitally.

The central bank, which levies a minimum charge on banks for transactions routed through its RTGS meant for large-value, instantaneous fund transfers and the NEFT system for other fund transfers, had directed all banks to pass these benefits to their customers. Instructions will be issued within a week, said the RBI statement.

RTGS is an electronic form of funds transfer on a real-time basis. The system is primarily meant for large-value transactions.

The minimum amount to be remitted through RTGS is Rs.2 lakh with no upper or maximum ceiling.

NEFT is a nation-wide payments system facilitating one-to-one funds transfer, usually on the same day. Under this, individuals, firms and corporates can electronically transfer funds from any bank branch to any individual, firm or corporate having an account with any other bank branch in the country. The operating hours of NEFT is from 8 am to 7 pm.

The move comes on the heels of the RBI-appointed Nandan Nilekani-led committee report for deepening digital payments, which earlier this week recommended that banks incentivise digitisation of payments by not charging their customers and small merchants on digital transactions.

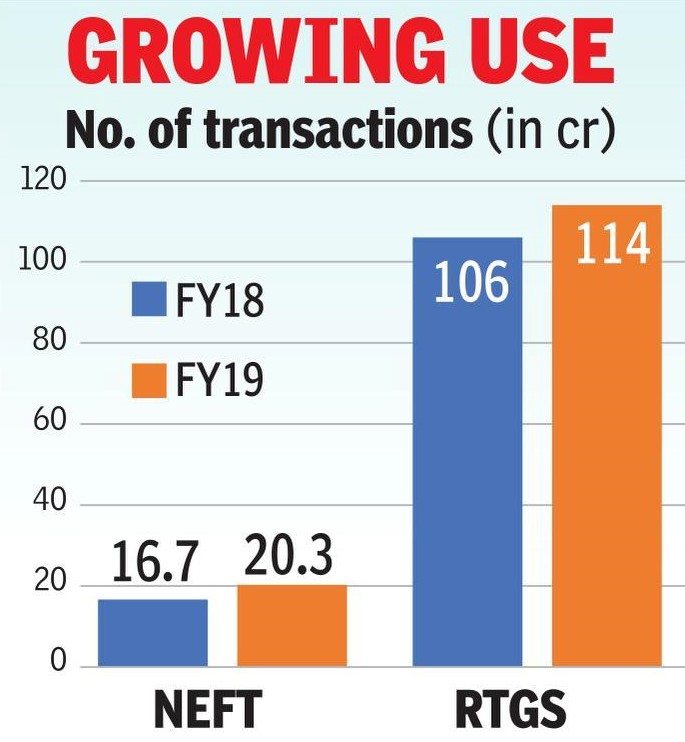

The high-level committee report had stated that the volume of NEFT transactions has steadily grown at a CAGR of 26% over the past four years. However, the number of transactions is small, though the size of transactions is large. The average size of an NEFT transaction over the past five years has varied between Rs.60,000 and Rs.1 lakh. Among banks, SBI had recorded the highest number of online transactions — both NEFT and RTGS.