An investor needs to remember that treating SIPs as a short-term avenue can be counterproductive.

SIP is a method of investing in a particular mutual fund scheme at a pre-decided frequency. It offers multiple benefits. First, it ensures a disciplined approach to investing as an investor puts in a small amount at regular intervals instead of a lump sum at any stage. Second, it reduces the negative impact of market volatility through rupee cost averaging, which essentially means one gets to buy more units of the fund when the underlying market is falling and vice versa, thereby averaging the buying cost per unit downwards. Third, the minimum SIP investment can be as low as Rs.500, which is another incentive for small investors to come in.

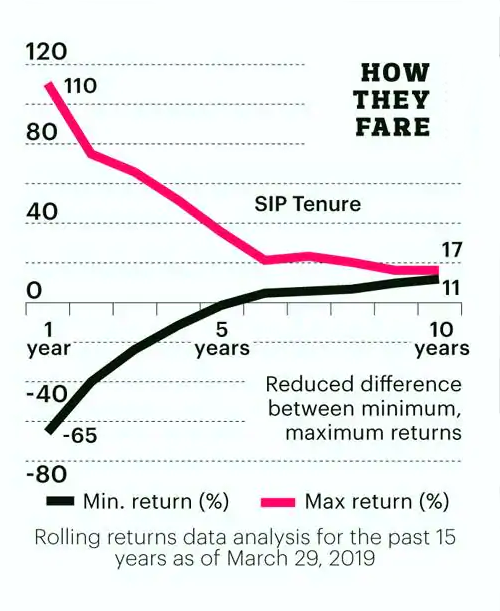

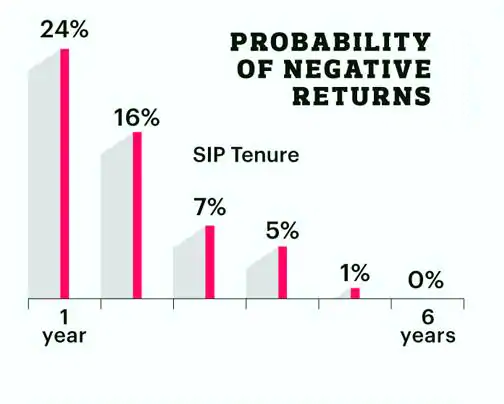

In spite of disciplined investments, investors may face capital erosion for an investment horizon up to five years. However, as the tenure increases – to six years or more – the probability of negative returns reduces to zero. In fact, the minimum rate of return for a six-year SIP is slightly more than 4 per cent and increases to a respectable 11 per cent over a 10-year horizon :

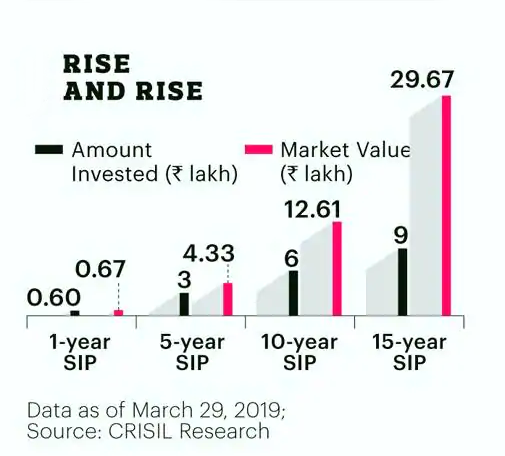

While SIPs are a good option, one needs to continue these for a long time to derive maximum returns on investments. Given adequate time, these investments can grow and create wealth as they benefit from compounding and other advantages. An analysis of SIP investments across equity categories reveals that a monthly investment of Rs.5,000 in equity-oriented funds* over the past 15 years – totalling Rs.9 lakh – would have more than tripled to Rs.29.67 lakh :

*Based on an index created out of large-cap, large and midcap, multicap, focussed, value/contra, midcap and small-cap equity-oriented mutual fund categories.