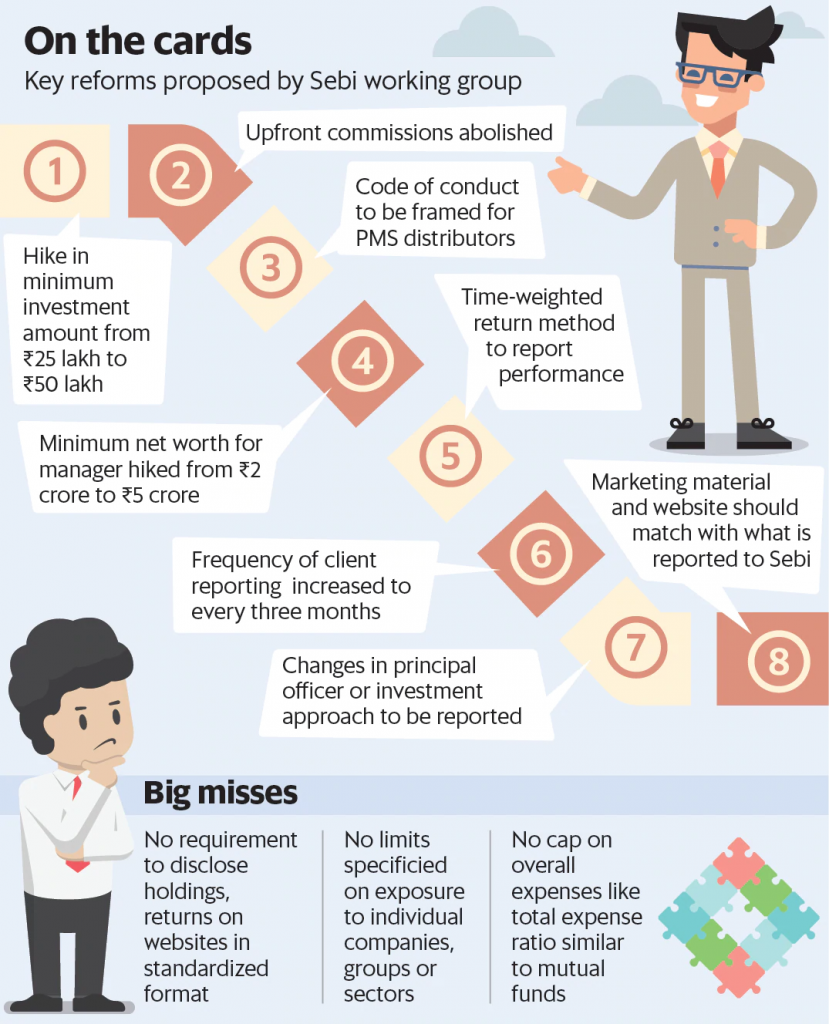

Last week, capital markets regulator Securities and Exchange Board of India announced a series of board decisions concerning portfolio management services. The regulator hiked the minimum ticket size for investing in PMS from ₹25 lakh to ₹50 lakh. It also hiked the minimum net worth required for a PMS provider from ₹2 crore to ₹5 crore. In addition, Sebi announced a series of other decisions such as capping investments by PMS products in unlisted securities, eligibility criteria for PMS distributors and the requirement of a custodian.

The decisions are aimed at lowering the risk for retail investors by improving transparency in PMS products in India.

In addition to its decisions on the investment ticket size and net worth, Sebi has imposed some caps on unlisted securities in PMS products. The regulator has restricted discretionary PMS products to invest only in listed securities, money market instruments and mutual funds. Discretionary PMS products allow the PMS manager to manage the portfolio without needing the client’s consent for every transaction. In case of non-discretionary PMS, which do need the client’s consent for transactions, Sebi has restricted exposure to unlisted securities at 25% of the corpus.

Sebi has also made it mandatory for PMS providers to have a custodian—a third party which will actually hold the securities of clients—thereby reducing the risk for clients in the event that the PMS manager goes bankrupt. The only exception is those PMS managers engaged in purely advisory services (where the securities will not be held with the PMS manager in any case).

Sebi has also enhanced the eligibility criteria for the role of the principal officer of the PMS. In addition to the principal officer and compliance officer, PMS providers will be required to employ one more person who fits the defined eligibility criteria. Sebi also restricted off-market transactions between client accounts in a PMS with certain exceptions.

A number of other decisions related to PMS services are on the anvil, according to media reports. Prominent among these is the decision to give investors a “direct option” for PMS akin to the direct plans of mutual funds. This will allow investors to buy PMS products without paying distributor commissions.

In addition, the Sebi Working Group has recommended that distributors who have passed the National Institute of Securities Markets exams and are registered with the Association of Mutual Funds in India be allowed to distribute PMS products.

PMS managers will also be required to report their performance in a standardized manner. PMS operational charges, except brokerage, will be capped at 0.5% of the corpus, but there will be no overall cap on charges, said the recommendations.

These changes have not been notified and their detailed structure will only be known once official Sebi notifications or circulars are released.

The doubling of the minimum ticket size may drive many investors to platforms such as Smallcase which have no regulatory minimum ticket size.

At its core, PMS products remain highly risky with no regulatory restrictions on sector and stock exposure they take and no overall cap on expenses.