Soon, a new investment vehicle providing access to bonds of state-run enterprises will be available to retail investors. Edelweiss AMC recently got the government’s permission to launch India’s first bond ETF (exchange traded fund) which will invest in central public sector undertakings.

Like equity ETFs, bond ETFs are passively managed products that mirror indices tracking specific segments of the market, such as government, corporate and PSU bonds. This is similar to how equity ETFs invest in line with indices covering specific baskets like the Nifty50, Nifty Next 50 and Nifty Quality 30, among others. Further, bond ETFs typically come in one of two flavours. They either track a specific maturity bucket like short, medium or long term or they track a target maturity where they invest in bonds with similar maturity as the product.

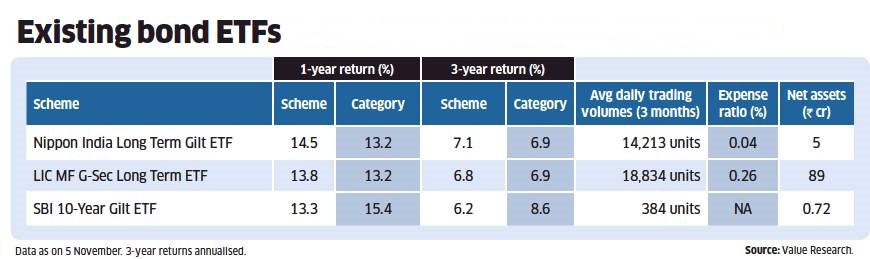

While bond ETFs are not new in India, there have not been too many takers. At present, only three GSec ETFs are available, all with miniscule assets and poor trading volumes.

The entry of newer bond ETFs comes at a time when traditional bond funds are only just emerging from a painful period of being whiplashed by multiple credit defaults. Investors, who were already indifferent towards bond funds, have grown more wary about this segment in the wake of these incidents. Bond ETFs will not be immune to such events either. Bond ETFs cannot assure return to investors any more than conventional bond funds. However, certain categories of bond ETFs such as target maturity bond ETFs can provide predictable returns if held till maturity, similar to fixed maturity plans. These have a defined maturity date.

Bond ETFs claim to be different from traditional bond funds by offering high liquidity, transparency and lower costs. The cost angle is the most distinguishing facet of bond ETFs. Being passively managed products, these charge a much lower fee than actively managed bond funds. While the latter charges up to 2% as expense ratio annually, bond ETFs are available at a fraction of the cost. Nippon India ETF Long Term Gilt, for instance, charges only 0.04% expense ratio. LIC MF GSec Long Term ETF levies 0.26% annually. This cost differential can make a world of difference over time.

Transparency is another factor where bond ETFs score over traditional bond funds. The entire portfolio held by the bond ETF is disclosed on a daily basis to investors. This is unlike conventional bond funds which disclose portfolios at the end of every month. Further, since bond ETFs are listed on exchanges, they provide live price updates after every trade. This allows the investors to know the worth of the underlying portfolio better.

Being listed on the exchanges, bond ETFs also claim to offer liquidity—ability to buy and sell units instantly—for the investor. The fund company will try to ensure healthy trading volumes for the ETF on the exchanges by appointing market makers. The liquidity in bond ETFs will depend on how actively market makers buy and sell units on the exchange in bulk. This will allow the investor to fetch a purchase or sale price closer to the fair value of the ETF, as indicated by its NAV. However, several ETFs in India are plagued by crippling illiquidity. In the absence of trading volumes, investors often end up buying or selling at a steep premium, or discount to the prevailing NAV.

If evidence is anything to go by, the initial liquidity in these products will be low, restricting investor’s ability to move in and out at a desired price. If the ETFs are not able to amass a decent corpus size, poor liquidity will continue. Conventional bond funds do not face these issues. Further, whereas a traditional bond fund has the leeway to hold a less liquid instrument with higher yield, an ETF cannot afford to accommodate such instruments. As such, the return potential for a bond ETF may be constrained.

Bond ETFs may be a good first stop for investors who are looking to transition away from bank fixed deposits in their fixed income portfolio, reckon experts. However, ascertain whether the ETF enjoys a sizeable corpus. It is best that investors avoid investing during the new fund offer period, as its asset base is only known once the fund opens for regular flows. While lower cost does significantly enhance the return potential of the ETFs, the absence of liquidity can effectively wipe out any cost benefits you enjoy.