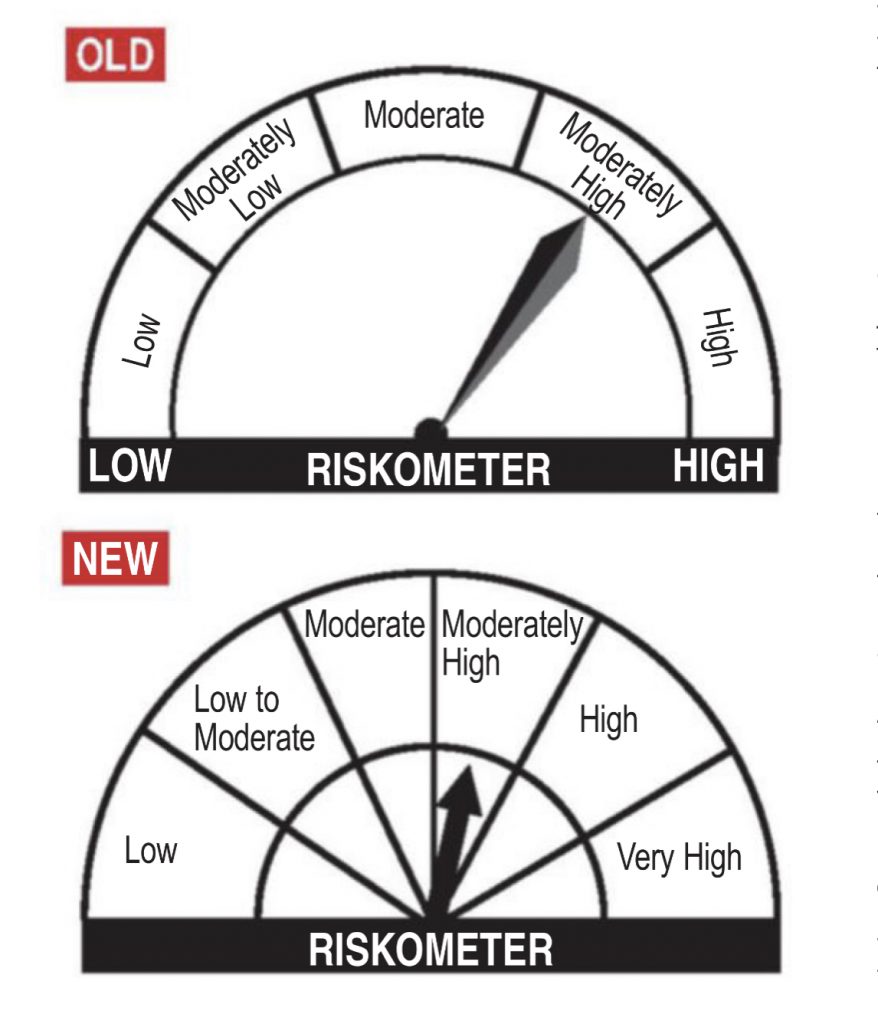

Sebi has revised norms that require fund houses to assess and label risks in various schemes. The riskometer will now capture inherent risks in a fund portfolios in detail.

Till now, the product labelling only identified risks at a category level. Funds across debt and equity spectrum were simply assigned risk grade basis the perceived risk of the category they belonged to. This mechanism failed to identify risks at the individual scheme level. For instance, all credit risk funds were labelled as ‘moderate risk’, allowing few schemes with highrisk bets to pass off as benign risk profile. From 1 January, however, all schemes will be labelled separately for risks. Funds will have to communicate changes in the risk profile to investors on an ongoing basis.

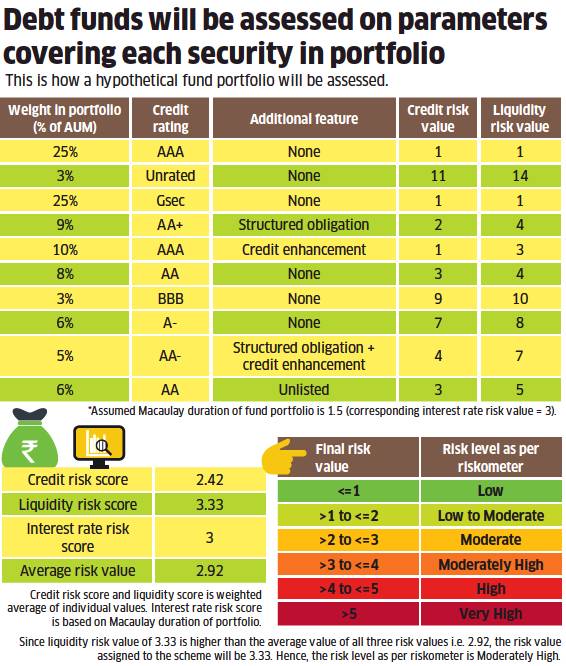

Experts say the revised norms bring more clarity to the debt funds space. As recent credit events showed, risks in debt funds can emanate from different, unexpected corners. Here is why risks in debt funds will become more apparent now: All debt funds will now be labelled on the basis of average score of three distinct risk parameters—credit risk, interest rate risk and liquidity risk. Each metric will be separately assessed as a weighted average of the risk score of all securities within the portfolio.

Credit risk will be scored on the basis of credit rating of individual securities within the portfolio. Interest rate risk value will be assigned basis the Macaulay Duration of the entire portfolio. Till now, appraisal of liquidity risk found no space in the riskometer. Funds were either labelled for credit risk or interest rate risk, depending on the category the scheme belonged to. But recent events have shown that lack of liquidity can be severely damaging to a fund’s health. To capture liquidity profile, the new riskometer will make clear distinction between securities with structured obligations, credit enhancements or any other exotic arrangements with the issuer.

So even if two AAA rated bonds get same credit risk score, a AAA rated bond without any exotic arrangements will be assigned better liquidity risk score than another AAA rated bond with any one of structured obligations, credit enhancements or embedded options. Another AAA rated bond with multiple such arrangements will get an even weaker score. This makes the risk scoring more robust, experts reckon. In fact, the revised mechanism assigns more importance to the liquidity score. If liquidity score turns out higher (lower is better) than the average of the three risk scores, then the fund will be assigned the risk value corresponding to its liquidity score.

However, some experts are not yet convinced that the new mechanism is foolproof. The scoring system relies on weighted average figure—which magnifies the risk profile of larger bets while drowning out the risks existing in smaller sized bets within a fund’s portfolio. So if 95% of a fund comprises highest grade AAA rated securities and the remaining 5% is parked with below AA rated issuers, the final risk score will not fully capture the actual default risk or liquidity risk lying in a smaller section of the portfolio.

However, experts say any gaps in the risk scoring mechanism will likely get plugged with modifications down the line. Even in its current form, the revised riskometer will be able to bring out differences in risk profile of funds within the same category. Investors can now use this tool as a starting point to sift through the clutter while choosing debt funds. Till now, the onus was on the investor to look deeper into a fund’s portfolio for risk. The introduction of a more robust risk scoring system will lighten the burden on the investor. Since the riskometer will be updated every month, existing investors will get alerted if their fund’s risk profile changes drastically. Experts say the new structure will force fund managers to rethink strategies to boost returns.