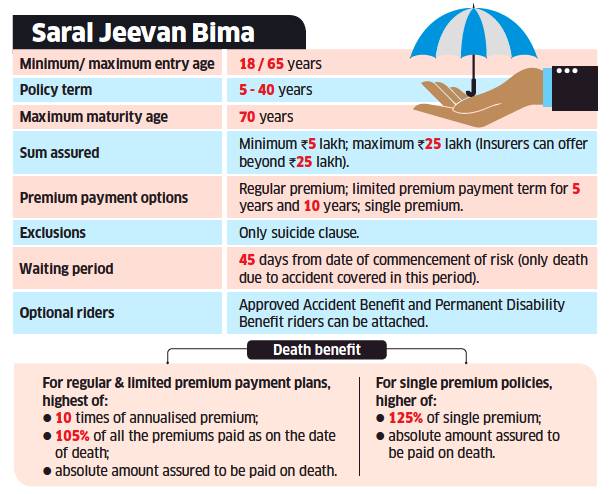

After bringing out a standardised product (Arogya Sanjeevani) in health insurance, the Insurance Regulatory and Development Authority of India (Irdai) has now asked all life insurers to come up with a non-linked, non-participating, individual, pure risk premium life insurance plan. Named ‘Saral Jeevan Bima’ (with insurer’s name prefixed to the product), the standard term plan will have to be brought out by 1 January 2021 and filed by 1 December 2020 for approval.

The plan will pay the sum assured in lump sum to the nominee in case of the death of the insured during the policy term. While the minimum sum assured will be ₹5 lakh, the maximum will be ₹25 lakh (only in multiples of ₹50,000), but insurers can offer a higher sum in keeping with the terms and conditions. For regular and limited premium payment plans, premium can be paid yearly, half yearly and monthly (only for ECS/ NACH), while for the single premium option, one can pay premium only as a lump sum.