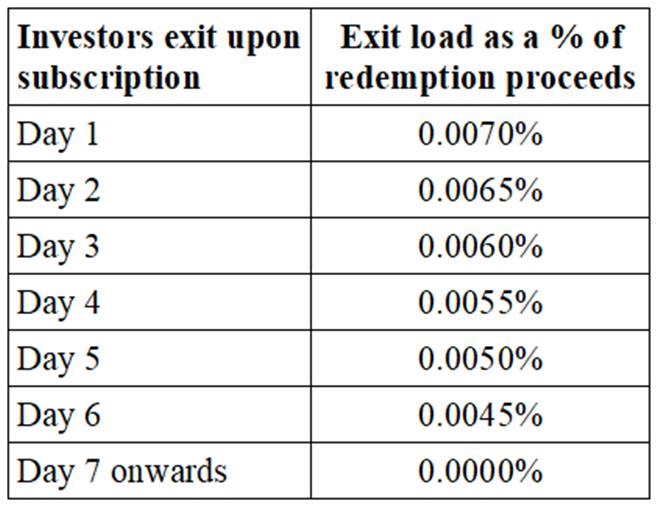

Beginning October 20, liquid funds will levy a graded exit load for redemptions made by investors within 7 days of investment. The graded exit load has been set at 0.0070% on redemption on day 1 after the investment, 0.0065% on day 2, 0.0060% on day 3, 0.0055% on day 4, 0.0050% on day 5, 0.0045% on day 6 and nil from day 7 onwards.

Many banks, insurance companies, corporate treasuries, stock brokers and HNIs have been using liquid funds to park money for as short a time as a day.

Analysts believe this could affect the flows into liquid funds, as many investors who invest for less than 7 days will be forced to look for other modes of investments. Liquid funds are the largest category of mutual funds and have assets worth ₹5.15 lakh crore, or roughly 20% of the mutual fund industry’s assets, as of September 2019.

Investors who park money in the category to manage daily liquidity will shift to overnight funds. But many fear that this money could move out of mutual funds as investors seek returns equivalent to liquid funds.

Investors with direct access to TREPS (Tri-party repo) could move there. About ₹10,000 crore to ₹25,000 crore of liquid money is estimated to be invested on a daily basis. Over the past year, liquid funds have been a safe haven for many investors as they do not have any duration and do not carry any credit risk. They have returned 6.88% over the past one year.

There will be no impact on investors parking money in liquid funds and staggering them to equity funds using systematic transfer plans. This is because most fund houses take a week to register an STP.

An exit load will reduce volatility in liquid fund flows as only that money which intends to stay for more than 7 days will flow into this category.

Sebi has also mandated that liquid funds should hold at least 20% of their net assets in liquid assets such as cash, government securities, treasury and repo on government securities from April 1, 2020.

Sebi on Tuesday formalised a graded exit load structure on liquid funds. In a letter addressed to the Association of Mutual Funds in India, the market regulator informed that it approved the proposal on graded exit loads made by the industry body. It also said that since the interest rate scenario can change over time, the load structure should be reviewed annually by Amfi in consultation with the Sebi.

A seven-day bank FD in State Bank of India earns just 4.5% (annualized). However, the average liquid fund return is 6.88%. Bank FDs also have TDS on accrued interest, while resident investors don’t need to pay TDS on capital gains in mutual funds. However, they have to pay self-assessment tax on these gains.