Fixed deposit holders are likely to look for alternate investment avenues after the fourth cut in deposit rates by the State Bank of India in this calendar year. Depending on liquidity needs and risk apetite, Financial Planners suggest investors could spread their deposits across a mix of AAA-rated company deposits, small savings schemes and government bonds, to make good the loss in interest income due to falling deposit rates.

For example in AAA-rated deposits such as Bajaj Finance, Mahindra Finance and PNB Housing Finance an investor can earn 8.3-8.4% from a three year deposit.

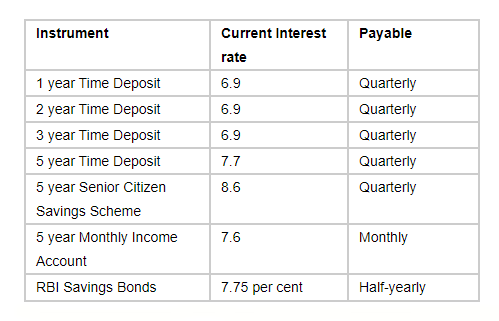

LIC Housing finance and ICICI Home Finance, both-AAA rated, pay investors 7.95-8% for a three-year deposit. Senior citizens and retirees looking for monthly income could opt for the post office MIS which pays 7.6%. Investors looking for absolute safety and no risk could invest in Government of India bonds that offer 7.75% with a tenure of seven years with an option to receive half yearly interest payments.

With the fourth rate cut by SBI, depositors earned 6.8% on a three-year deposit in February 2019 will now earn only 6.25%.

Depositors who have been feeling the heat of the recent steep cuts in deposit rates can find themselves in a stickier spot. In a bid to cushion its margins from the blow of adopting an external benchmark — repo rate — to price its floating-rate MSME, housing and retail loans, SBI has trimmed the interest rate on its savings deposits (of up to ₹1 lakh) to 3.25 per cent from 3.5 per cent, effective November 1, 2019.

The interest on savings accounts was deregulated from October 2011. But only a few banks — YES Bank, Kotak Bank, IndusInd Bank and Lakshmi Vilas Bank — chose to offer higher rates (5-7 per cent) to their depositors. Other banks, including SBI, offered a uniform 4 per cent for a very long time, even in rising-rate cycles.

Two years ago, SBI was the first bank to cut savings deposit rate by 50 basis points to 3.5 per cent. Other banks were quick to follow suit, and there was a spate of similar cuts across banks. Most banks currently offer 3.5 per cent for their low-value savings deposit (for deposits of up to ₹25-50 lakh).

SBI’s move to trim rates on its low-value savings deposits to 3.25 per cent is likely to trigger another spate of cuts across banks, given the imminent pressure on their margins owing to repo-linked loans.