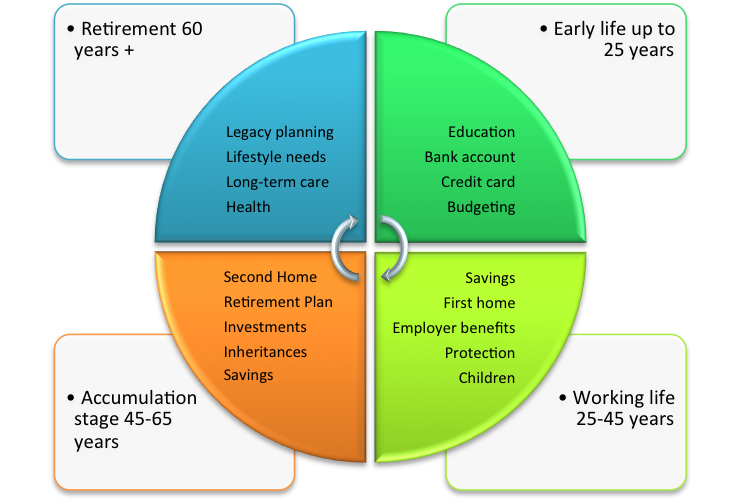

Life-Cycle Financial Planning

Financial and tax planning are frequently done in a vacuum without consideration of the changing risks that one faces over one’s lifetime. The passage of time alters the nature of the risks, and requires you to reconsider how you are managing them and whether you should reprioritize them at different times of your life. Life-cycle financial planning helps you understand the dynamic nature of the financial risks presented and develop a plan that evolves over time to meet those changing needs.

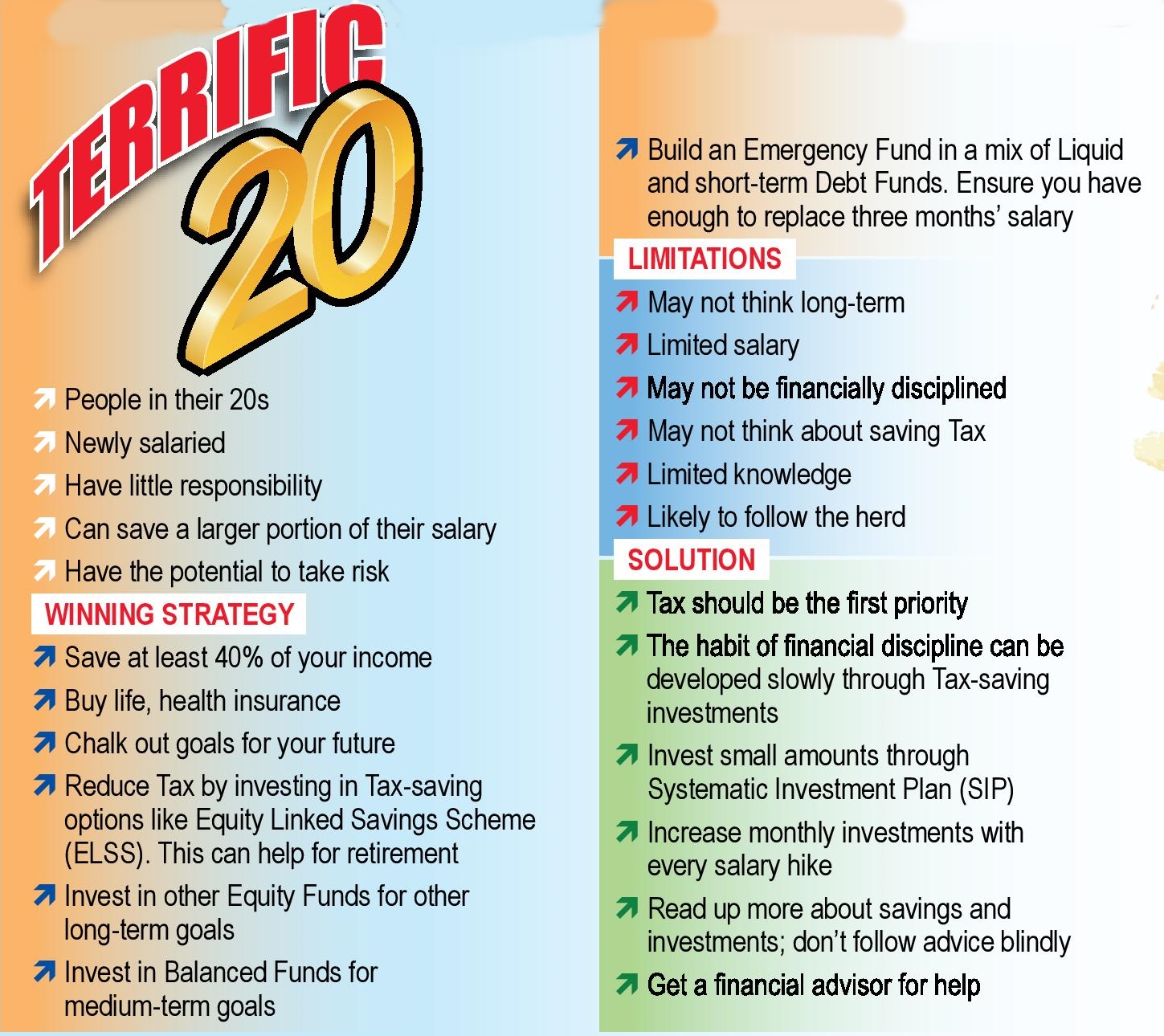

The early working years (ages 25 to 45)

The early working years are years when your career is developing and your largest financial burdens are likely a mortgage, supporting a growing family and the looming costs of college. During these years, it’s important to:

Establish an emergency fund. The starting point for financial planning during this phase is establishing an emergency fund of approximately six months of income. This fund is your self insurance in case you lose your job or have an unexpected health event that costs more than your health insurance covers. The discipline of having an emergency fund is a constant during your entire work life, although it may be possible to taper and eventually eliminate this fund as you near retirement.

Prepare for the unexpected with health, life and disability insurance. During the early working years, the greatest financial risks are driven by the fact that you have a fairly long period of working years ahead of you, and that you also have significant future expenses (e.g., a mortgage and education / wedding expenses for children). The risk, then, is that if something happens to you to prevent you from working during that time, those who depend on your income will not have the income you and they expected. Of course, health, life and disability insurance can all help you manage these risks, and it is critical during the early working years that you have access to and use such products to protect yourself and your family.

While health insurance protection is a constant need, life insurance may not be critical before marriage. Once married, the need will increase with each child you have.

Start saving for retirement. While the number of years to retirement is relatively long, the more you save during the early working years, the less pressure there will be to save and seek high investment return in your later working years.

Start saving for college. During the early working years, it’s also important to set up a college savings plan for your children.

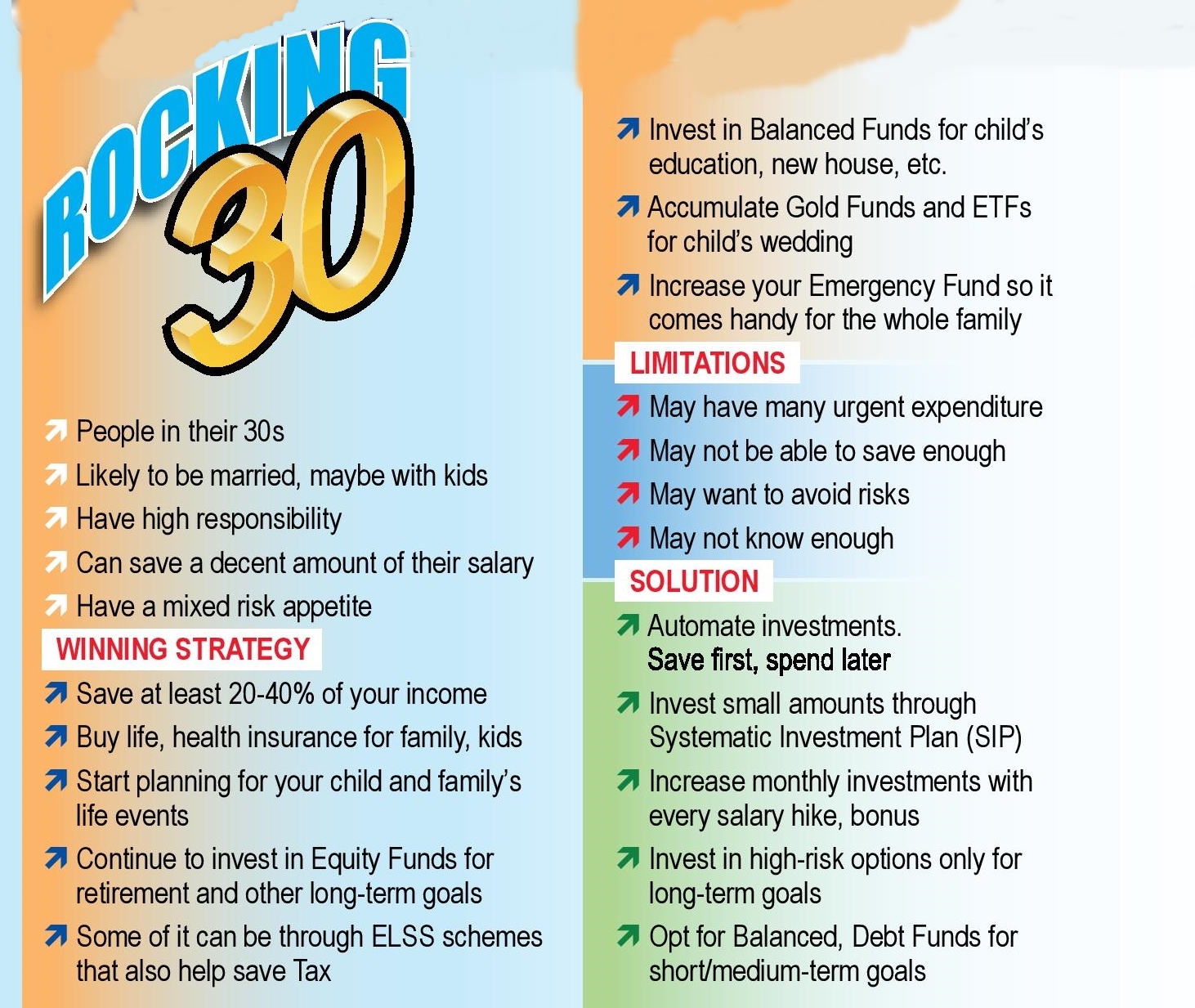

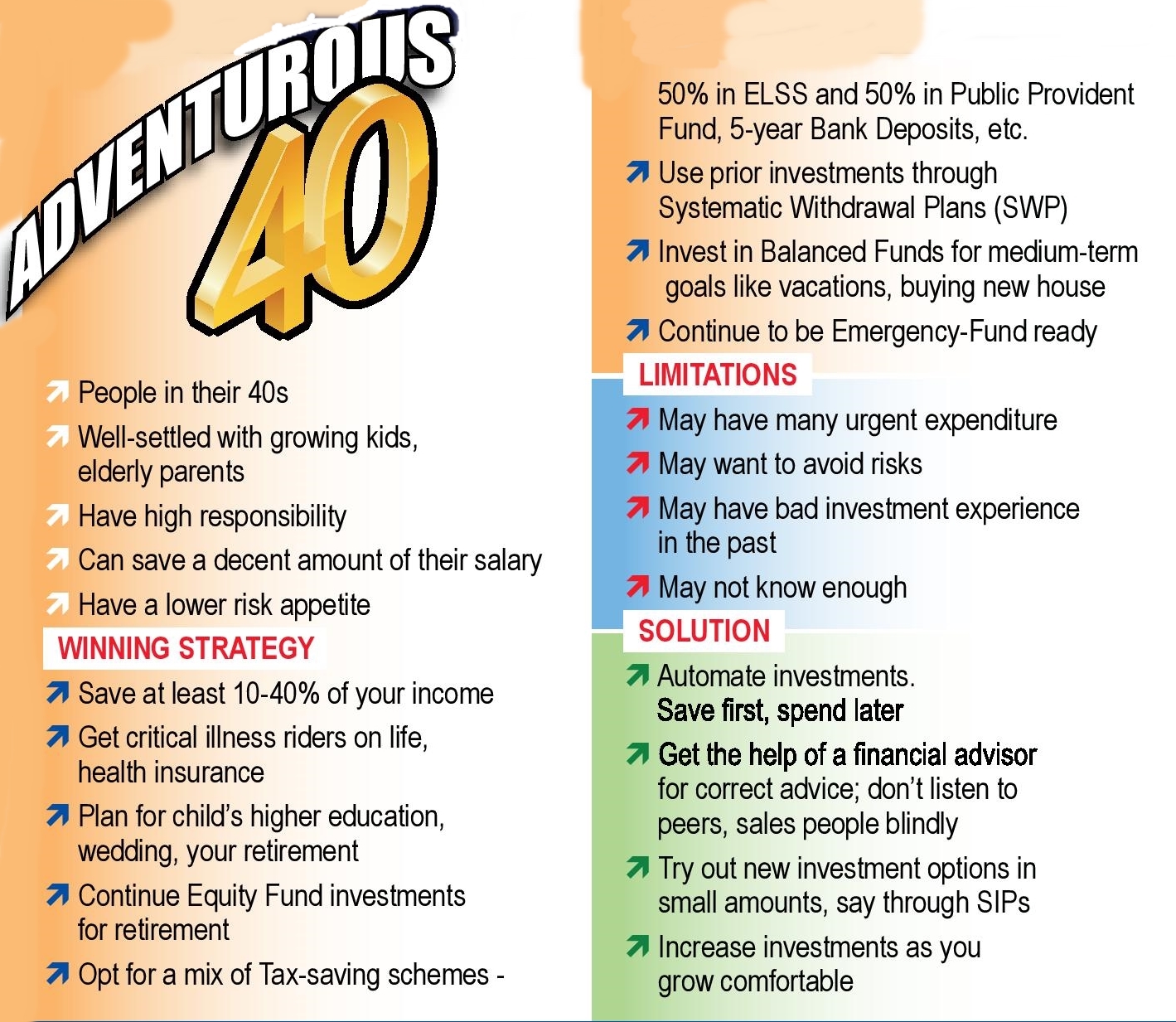

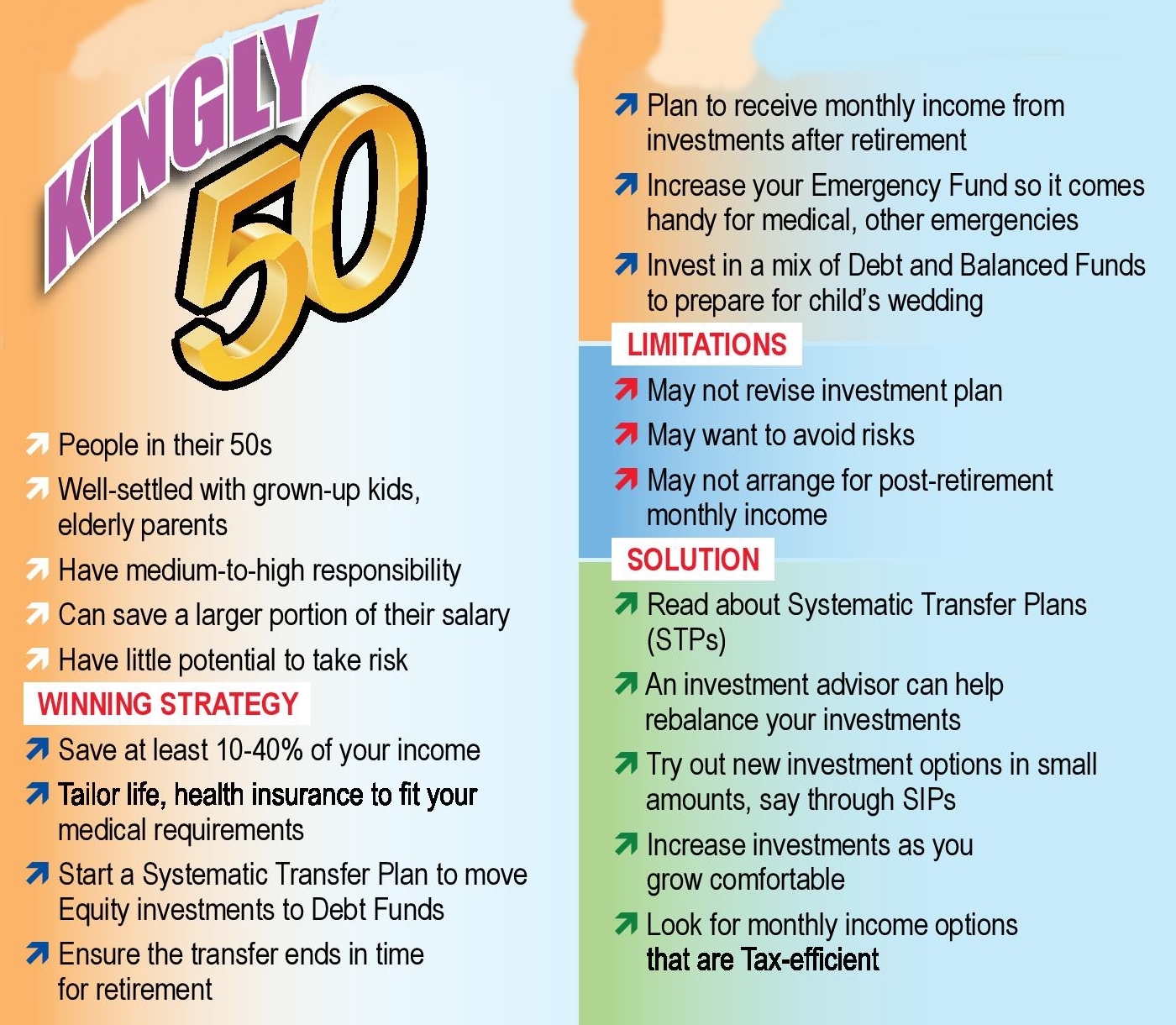

The later working years (ages 45 to 65)

The later working years are characterized by paying college tuition, helping children become financially independent, possibly caring for your parents or parents-in-law and paying off your mortgage. During the later working years, it’s important to:

Prepare for a chronic illness with long-term care insurance. During the later working years, life insurance might become less critical for your planning, except for life insurance that is needed for estate tax planning or that can pay for chronic illness.

A catastrophic illness could well deplete your lifetime savings, so long-term care insurance is also something to consider because the odds of chronic illness increase with age and the cost can be prohibitive if you wait for retirement to obtain coverage. A reasonable alternative to pure long-term care insurance may be a rider to a life insurance policy that can fund such health care expense.

Understand how much retirement savings you need. The later working years are critical retirement savings years, as the number of years you are working and building up your retirement nest egg are declining.

During these years, it is important to start thinking about your retirement assets as sources of income to live on. To the extent your retirement assets are before-tax assets, you need to consider the tax impact of distributions so you can understand how much after-tax income you will have in retirement. You pay your rent and other bills with after-tax money, so it is important that you understand many of your retirement assets have an embedded tax liability and you only have a portion of the asset to generate living income.

Review sources of retirement income. As you think about how your retirement savings can generate income for living in retirement, you should also start to consider the various sources of retirement income at your disposal and what they will mean for your retirement position.

Once you have determined the amount of annual or monthly retirement income your assets should safely generate, compare that with your retirement income goals. Your retirement income goals can be as simple as 80 percent of your pre-retirement income, or you can get finer and map out your retirement costs and target that amount. The bottom line here is, again, reasonably conservative assumptions that you can refine over time and will hopefully get more and more precise as you get closer to your retirement age.

You should have a high degree of confidence that you will receive your base retirement income payments, for as long as you live. If your retirement income base and additional income are insufficient for your needs, greater saving is required to meet your goals.

Consider an annuity. During these years, consider whether you want to purchase an annuity product that will further increase the amount of guaranteed lifetime income you are to receive. You should retain liquidity to manage emergency matters, but you still may want to increase the amount of your retirement assets that provide guaranteed lifetime income so you know, at least with respect to that portion of your retirement nest egg, you have offloaded investment and longevity risk.

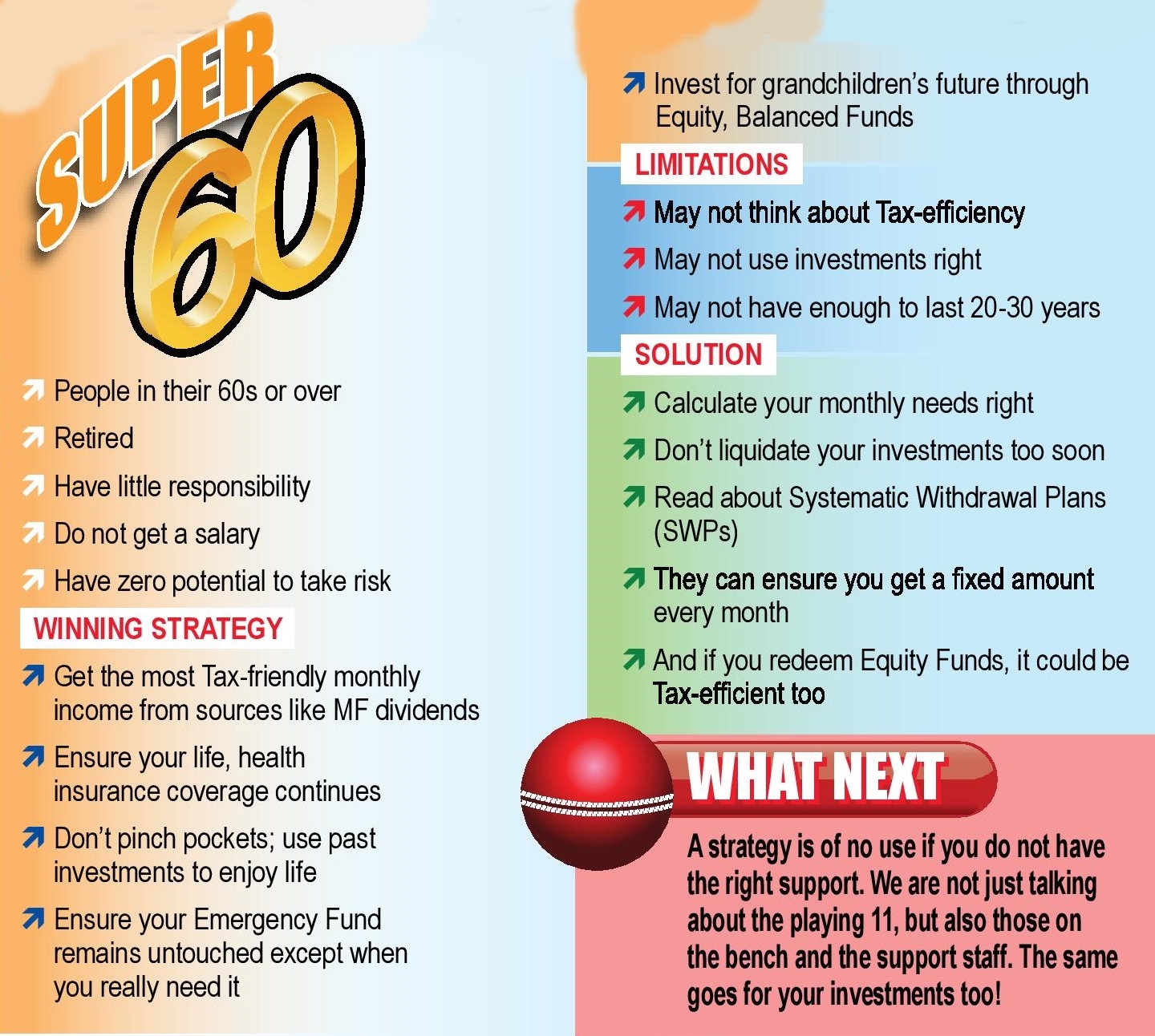

After work ends (ages 65 and on)

As your working years come to an end, your priorities will shift from saving to living off your savings. During this time, you’ll need to:

Decide when to stop working. The decision as to when to stop working is probably the most important decision in terms of influencing how long your retirement savings will last. Each year you work is a year you do not need to be supported by your savings, and possibly another year you can add to your savings. While it might seem like a right to retire by age 65, the notion of retirement at such an age is a relatively recent phenomenon, and it might well be better for you financially, emotionally and physically to work longer.

Maintain an income stream. After you retire, the focus of financial planning will center on maintaining your retirement income stream. This requires you to manage and monitor the investment performance of your assets and the inflation that will likely be eroding your purchasing power year by year, and ensuring your expenses are not exceeding your plan. To the extent you have not done so already, you can still purchase an annuity that will guarantee you lifetime income while relieving you of responsibility for making sure the associated asset is not depleted by poor investment return and your living longer than expected.

Plan for health and long-term care costs. Another point of focus will be health care. As retirement continues, health care spending becomes the largest retirement cost and the most likely to cause the type of financial stress that thwarts your retirement planning.

During these years, life and disability insurance are no longer primary needs, other than life insurance for estate planning or to support long-term care costs.

By employing a life-cycle approach, you will be able to adjust your planning over time to better match your focus to the risks that are increasing and away from those that are decreasing.