Systematic Investment Plans in mutual funds, where investors put in small sums of money every month over a period of time, have caught the fancy of retail investors with volumes hitting an all-time high of Rs.4,200 crore a month in April. The number of SIPs in the mutual fund industry has doubled in the last three years. From 51.96 lakh SIPs in 2013-14, they have more than doubled to 1.28 crore by March 2017. SIPs, which collected Rs.1,206 crore per month in 2013-14, got more than Rs.3,989 crore in March 2017.

Systematic Investment Plans in mutual funds, where investors put in small sums of money every month over a period of time, have caught the fancy of retail investors with volumes hitting an all-time high of Rs.4,200 crore a month in April. The number of SIPs in the mutual fund industry has doubled in the last three years. From 51.96 lakh SIPs in 2013-14, they have more than doubled to 1.28 crore by March 2017. SIPs, which collected Rs.1,206 crore per month in 2013-14, got more than Rs.3,989 crore in March 2017.

The average ticket size of SIPs has increased from Rs.2,322 per SIP to Rs.3,121. In the same period, the number of folios grew from 4.05 crore to 5.59 crore.

Data from CAMS MFDEX, which represents 92% on the MF industry for 2016-17, show that new SIP registration volume jumped by 33% from 44.98 lakh to 55.95 lakh in 2016-17, while assets under management of SIPs rose to Rs.1,17,706 crore, a jump of 52% from Rs.77,159 in the previous year.

SIPs encourage people to save, and by investing through this mode, investors average out their investments over a length of time, which in turn saves them from being hit by market fluctuations.

Investors are switching to equity SIPs as returns from fixed deposits, small savings schemes and even gold are falling. While SIPs of mutual funds are also available in debt funds, investors are preferring equity SIP because of double digit returns given by most funds in the last one year.

Analysts say SIPs have been gaining popularity among Indian mutual fund investors in the last three years. In fact, the number of folios, or individual investor accounts in mutual funds, increased to a record 5.54 crore at the end of March 2017, from 4.77 crore in March 2016.

In the individual category, around 26% of the investments come from B-15, or beyond top 15 cities, indicating rising investments from small towns.

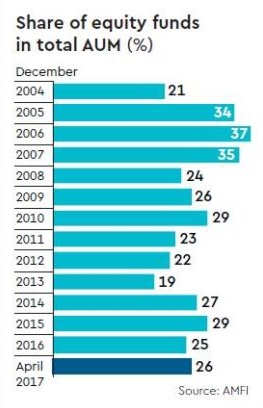

Equity assets under management now constitute 26% of aggregate mutual fund AUM. A report by Deutsche Bank shows that on an average, equity AUM has been 23% of aggregate mutual fund AUM over the last 15 years. This was 37% in December 2006.

SIPs are convenient to start and are happening through all modes -physical forms, wealth management websites, asset management websites, stock exchange websites, registrar sites, mobile apps and online distribution portals. Once an SIP is registered, the instalment is debited every month at a predetermined date, thereby making many investors save forcibly.

Interestingly, all kind of investors have latched on to SIPs. Whether meeting long-term goals or eliminating market timing or just creating wealth, investors have jumped on the SIP bandwagon in a big way .Operationally too, SIPs are flexible, as you can start them or close them any time you wish, without any penalty. SIPs can be started with small amounts too.

Wealth managers believe SIP eliminates timing as well. Since it is impossible to know where the markets are headed in the near term, SIPs help investors.