Here’s a look at how 2018 was for your taxes:

TAX ON EQUITY:

On the direct tax front, this year’s budget brought in a lot of changes. One change which did not go well was the introduction of long-term capital gains tax arising from transfer of listed equity shares or units of equity-oriented fund or units of business trusts. An LTCG at the rate of 10% will be applied on gains exceeding ₹1 lakh. Although, gains made up to January 31, 2018 will be grandfathered or exempt.

INTRODUCTION OF STANDARD DEDUCTION:

For the salaried individuals, this year a standard deduction of up to ₹40,000 was introduced in lieu of transport allowance and reimbursement of medical expenses.

Earlier a deduction of ₹19,200 was allowed as transport allowance and ₹15,000 for medical reimbursement.

RISE IN PENALTY AMOUNT ON LATE ITR FILING:

To make tax payment more stringent, you have to pay a penalty of ₹1,000 to ₹10,000 if returns are filed after due date whereas earlier an interest rate of 1% of the tax amount was applied for every month after the due date till the returns were filed.

DEDUCTION LIMIT UP FOR SENIOR CITIZENS:

Senior citizens saw some good news in 2018. The deduction limit under section 80DDB was enhanced; this deduction is allowed when an individual or HUF taxpayer pays for the medical treatment of critical illness for himself or family members.

The deduction limit has been increased to ₹1 lakh for senior and very senior citizens compared with ₹60,000-₹80,000.

The limit for Section 80D was also increased to ₹50,000 from ₹30,000, which qualifies for deduction for premium paid towards health insurance policies for senior citizens.

A new section 80TTB is inserted to the Income-tax Act, 1961 to allow deduction of up to ₹50,000 to the senior citizen who has earned interest income from deposits with banks or post office or co-operative banks.

After introducing this new deduction, the existing deduction of up to ₹10,000 under Section 80TTA shall not be allowed to the senior citizens.

Another incentive introduced for senior citizens is that the threshold limit to deduct TDS on interest income (from bank, or post office deposits) has been increased to ₹50,000 from ₹10,000.

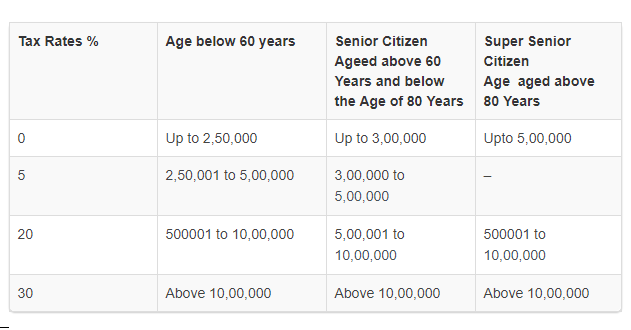

Tax Rate for Individual / HUF / AOP / BOI:

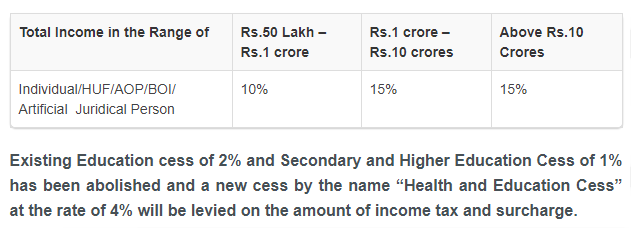

Rate of surcharge on Individual / HUF / AOP / BOI / Artificial Juridical Person: