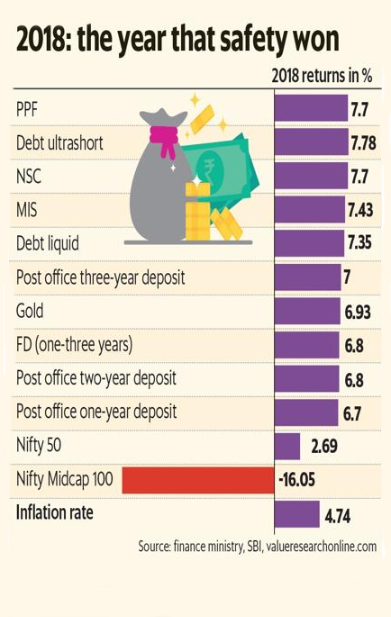

Risk shunners won and thumbed their noses at equity investors in 2018. The Public Provident Fund, the one true friend of many middle-class Indians, regained its pole position this year with an annual post-tax return of 7.7%.

The National Savings Certificate also returned 7.7%, but post tax, PPF turns out better. For the guaranteed return-seeking investor, there were several other products that did well in this space. The top five ultra short-term debt funds, which invest in securities with maturities between three months and six months, returned an average of 7.78%, but this was not a guaranteed return.

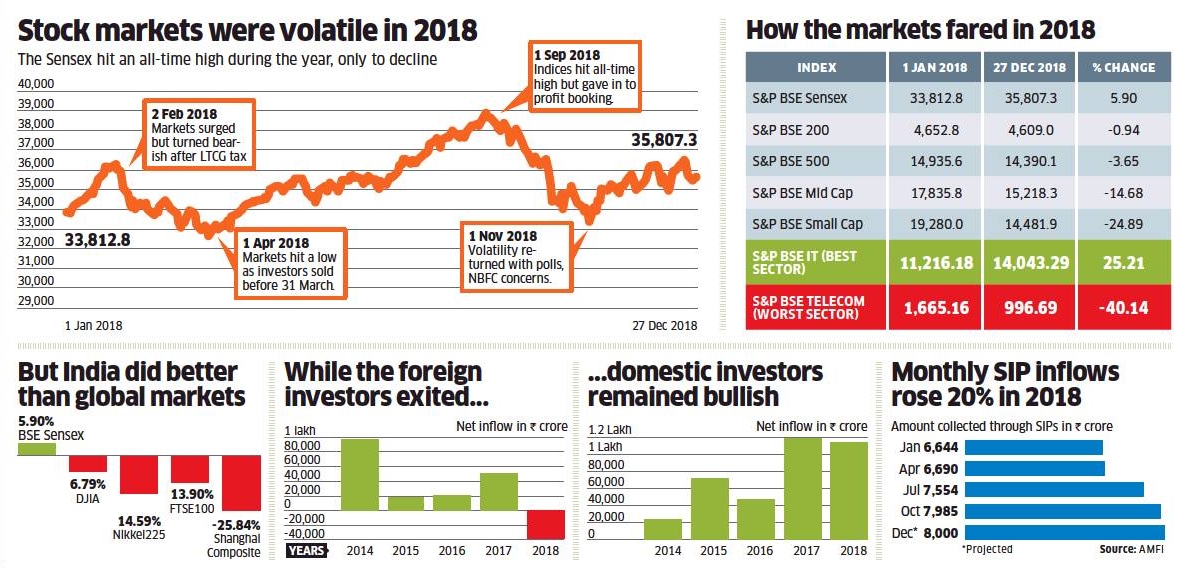

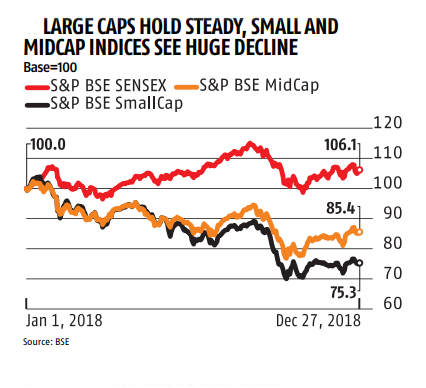

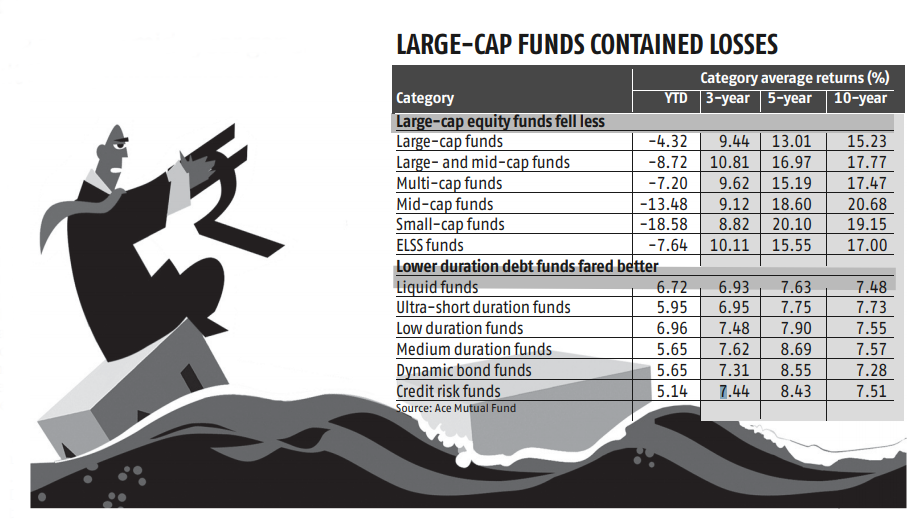

In contrast, it was a bad year for stock pickers, with mid- and small-cap shares falling sharply.

Equity, real estate, and even actively-managed debt funds have given lower returns than the State Bank of India one-year fixed deposit returns in 2018. Gold gave marginally higher returns, but that too was in line with what many public sector and private sector banks offered.

Experts say there is limited visibility on debt in 2019, while also pointing to uncertainty in other asset classes, with real estate under pressure on funding issues and equities being hostage to election volatility. Gold, though, may be a relative oasis of safety. While sharp returns are not expected, it will end at a higher level than it is currently.

Gold gave returns of 6.8 per cent in 2018, according to the India Bullion and Jewellers Association’s figures as of December 21.

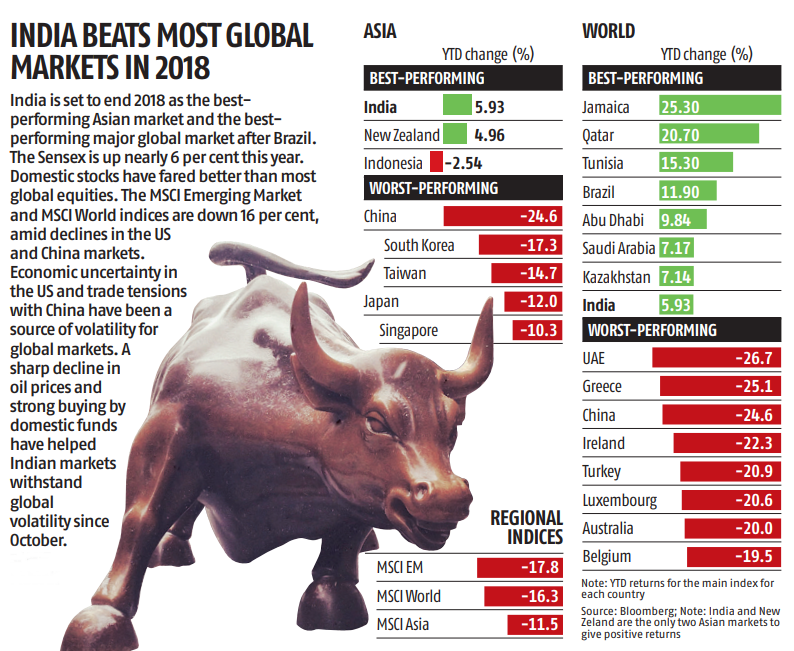

The figures till December 24 showed that equity returns ranged between 1.26 per cent for Nifty in 2018 and 4.15 per cent for the Sensex. Most equity mutual funds did worse than the leading indices. For large-cap funds, one-year returns are slightly below zero, according to Value Research data, while mid-caps and small-cap funds have lost around 12 per cent and 20 per cent, respectively.

Experts tracking equities point out that there is more hope on earnings, though elections can bring in a fair amount of volatility. HDFC Securities has a calendar year target of 12,400 points for the Nifty 50 index.

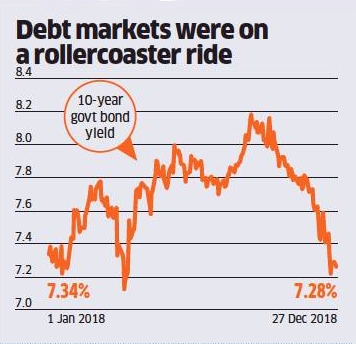

A number of debt funds have faced losses in 2018 because of their exposure to finance major IL&FS. The institution, with over Rs.900 billion in outstanding debt, began to default on its obligations in September, catching off guard many funds that had invested in this highly rated institution. The outlook is not bullish for 2019, which has implications for real estate too.

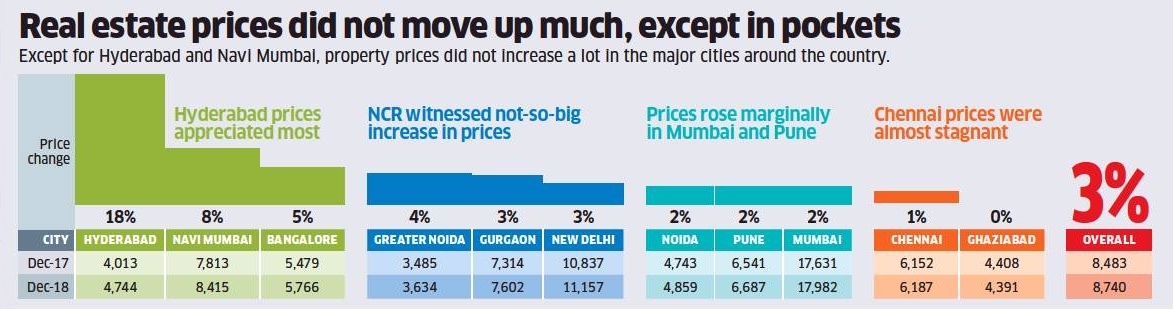

Ratings agency ICRA has said that while there is stability in the commercial realty segment, the outlook for the residential real estate sector remains negative. The segment has been looking to NBFCs to meet funding requirements. Many NBFCs have faced liquidity issues following the IL&FS crisis. This has affected real estate companies’ funding costs and availability of capital in an environment of low demand from buyers.

Real estate investors earned no capital returns in 2018 and almost the entire returns came of rental income.

Investors who looked at last year’s winner in 2018 did badly. The one-year total return on Nifty Midcap 100 index in 2017 was 49%, making fixed deposits and PPF look poor investments in comparison.

Investors in 2019, who look at 2018 returns and rush to invest in PPF, fixed deposits and gold, may be making a similar mistake. Instead, a well-balanced portfolio with some investments in safe products and some in equity would be a better choice.

Financial planners advise against putting capital to work by anticipating what might go up or down. It is better to create a sound asset allocation plan and stick to it through volatile periods to build wealth.

“Don’t chase returns, don’t think you can predict the markets,” said an expert.