With volatility on the rise in the run up to the elections, many financial planners recommend arbitrage funds to investors who are looking for tax efficient returns in the short period typically less than a year…

What is an arbitrage fund?

An arbitrage fund is a category of equity mutual fund that leverages the price differential in the cash and derivatives markets to generate returns. The scheme simultaneously buy shares in the cash segment and sell futures in the derivatives segment of the same company as long as the futures are trading at a reasonable premium. This category of funds do not take a naked exposure to any individual company or a index as each buy transaction in the cash market has a corresponding sell transaction in the futures market. They make money from low-risk buy-and-sell opportunities available in the cash and futures market and their risk profile is similar to that of a debt fund. In fact, many arbitrage funds use Crisil Liquid Fund Index as their benchmark.

Why is there higher investor interest in arbitrage funds?

There is higher interest amongst investors in arbitrage funds ever since the long-term holding period for debt funds was increased from one to three years. Since arbitrage funds maintain an average exposure of more than 65% to equity, they are treated as equity funds, their holding period for long-term capital gain is one year. From the start of April 2018, long-term capital gain from equity is taxed at 10%.

Is arbitrage a safe strategy for investors?

Wealth managers point out that arbitrage funds rank high in the pecking order when it comes to safety. The fund manager creates a market neutral position by buying in cash market and selling in futures. Higher the volatility higher are the opportunities. With elections around the corner, volatility will increase and hence they are a good bet.

What returns have these funds generated in the past?

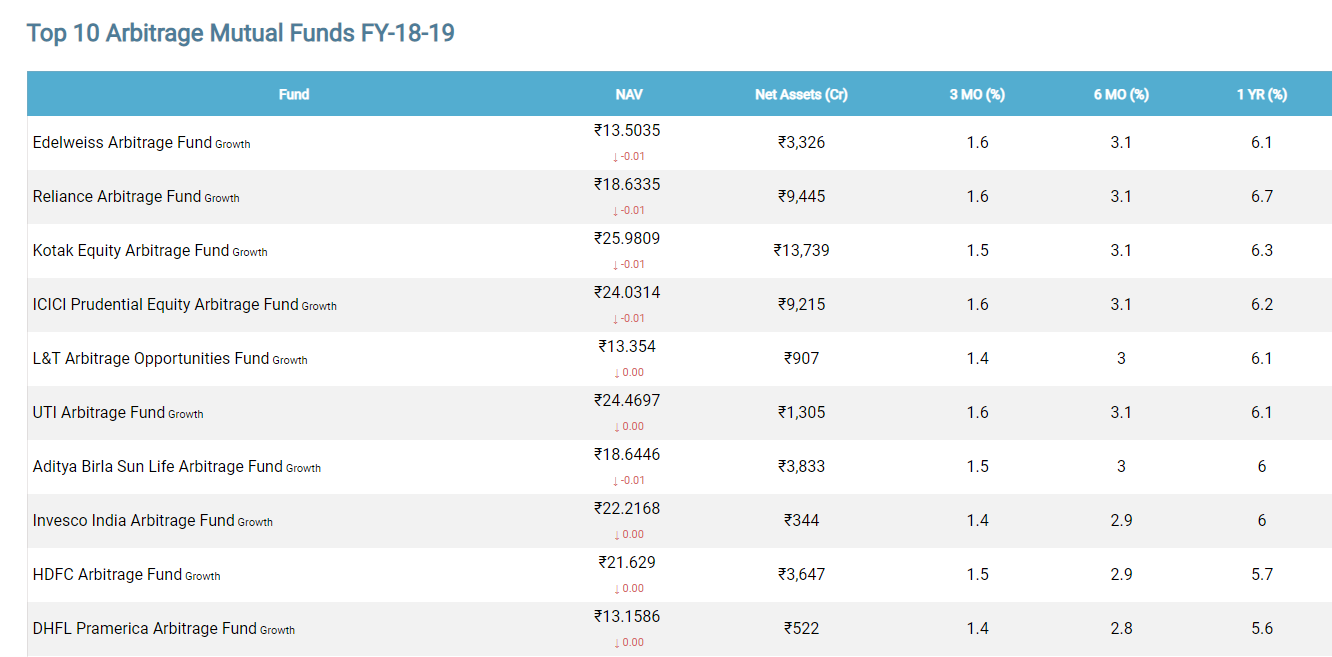

Returns from arbitrage funds depend on arbitrage opportunities available between the spot market and the futures market. Such opportunities are high in bull markets. As the assets under management in this segment increase, all this money will be chasing similar arbitrage opportunities and hence returns could be lower. Over the last one year, this category of funds have given an average return of 5.65%. Over a three year period investors have earned a return of 6.10%.

….as on 26.12.2018