Fixed income investing is going through its bleakest period in recent years on account of low interest rates and the record-breaking run-up in stocks. But fund managers and investment advisors warn against ignoring this asset class. Investors must maintain their allocation to debt along with gold and equities, as sudden reversals in equities could leave them exposed to heightened risks.

Within debt schemes, short-term, dynamic bond and medium-term funds are recommended by advisors.

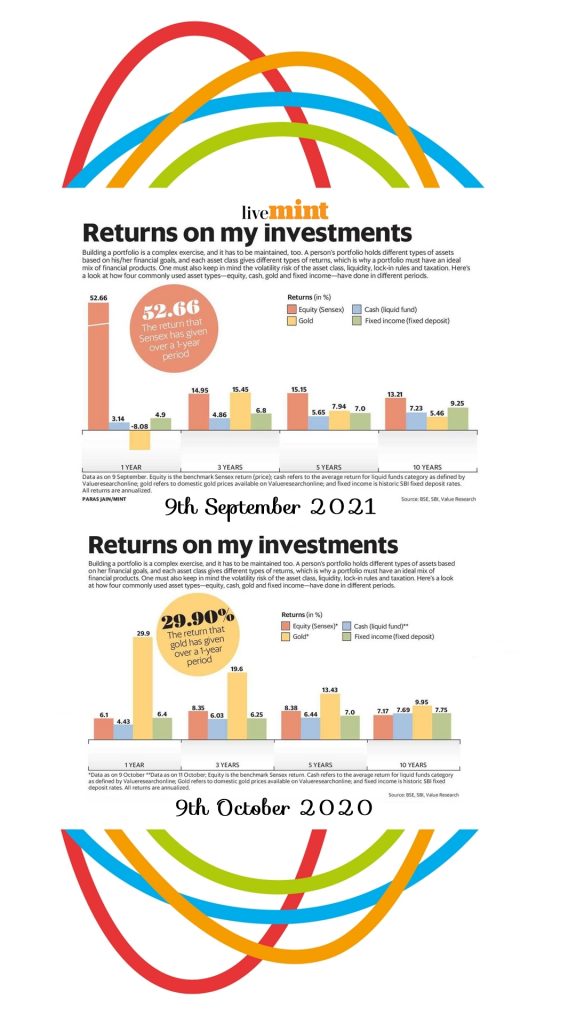

Annualised returns from debt scheme categories have shrunk to 3-6% in line with the decline in fixed deposit rates. In comparison, the benchmark Nifty50 has returned 62%, while the Nifty Next 50 is up 66% in the past one year. Gold prices are down by 8.6% over the last one year.

A study by HDFC MF shows out of 24 fiscal years since FY99, equity has been the best performing asset class in 12 years. Debt and gold have been the best performing asset classes in 5 and 7 years, respectively, underlining the importance of adding debt and gold in the portfolio.

At this juncture, investors should probably have 25-30% in debt and 5-10% in gold with the balance in equities.

Investor money has been flowing into equities through IPOs, secondary market purchases and mutual funds, driven by the one-way upward move in stocks over the last year and a half. While equity has been gaining, gold has lost its sheen and return on bond has been low.

While it is normal for investors to chase past returns and allocate money to the asset class that has given a high return while ignoring the rest, fund managers say it is important to also consider debt and gold in portfolios, especially with valuations stretched and markets at all-time highs.

The optimal approach to investing is to follow asset allocation: invest in equity, debt, cash, gold and real estate in a reasonable way. Do not concentrate all your investment into equities alone. Debt too has an important role in one’s portfolio.

Individuals in the higher tax brackets could consider arbitrage funds or equity savings funds that have a small proportion of equity in the portfolio.

Data sourced from The Mint.

Tweets by Kalpen Parekh.