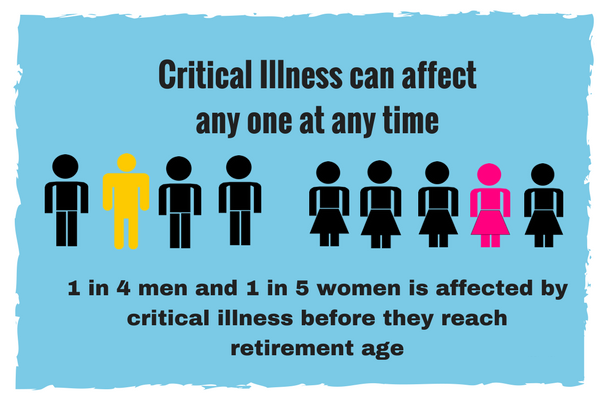

A critical illness policy covers life threatening diseases like cancer, paralysis, heart attack etc.

It can be a standalone critical illness policy or a critical illness insurance rider on another policy.

There is no upper limit for the cover under a standalone policy whereas in a rider it is restricted to the cover of the base policy.

The insured receives the sum assured when diagnosed with any of the critical illness included in the policy.

No hospitalisation is required nor are any bills or receipts required to be submitted to claim benefit.

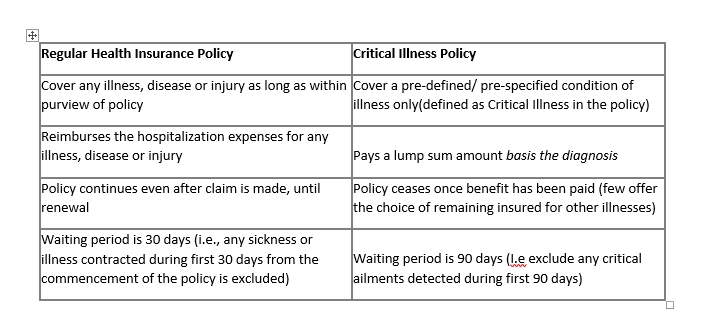

Some policies have waiting period restrictions and critical Illness diagnosed within the waiting period are typically not covered.

The cost of treating a critical illness is high. A hospital bill of Rs.1 lakh per day is not out of the ordinary. For cancer, costs could include surgery of the affected part, chemotherapy, radiation, diagnostics, medication and rehabilitation costs. Often the sum assured of a standard mediclaim policy falls short to cover the hospitalization costs itself.

Then, there are non-hospitalization costs. You may want to take a second opinion before undergoing a major procedure. One may want to consult a doctor abroad. For the period of treatment, which can go for months, one is typically unable to perform regular office duties. This creates double damage for the family. Expenses increase, while income goes down.

Also, a standard health insurance policy is restricted to hospitalization expenses only. For example, Alzheimer could be expensive to treat but most of the treatment happens outside a hospital. Loss of speech, and deafness are other such examples. Cost of external equipment to aid rehabilitation are also not covered in our standard health insurance policies.

A critical illness policy fills this gap. Critical illness policy pays a lumpsum on diagnosis of the covered ailment. Sum assured can go up to Rs.25 crore. Payout is independent of the proceeds from a mediclaim policy. So, you can avail a cashless claim from a health insurance policy and get the critical illness claim as well. Claim for critical illnesses do not require submission of original hospital bills. Insurers primarily ask for diagnostic reports to confirm the ailment.

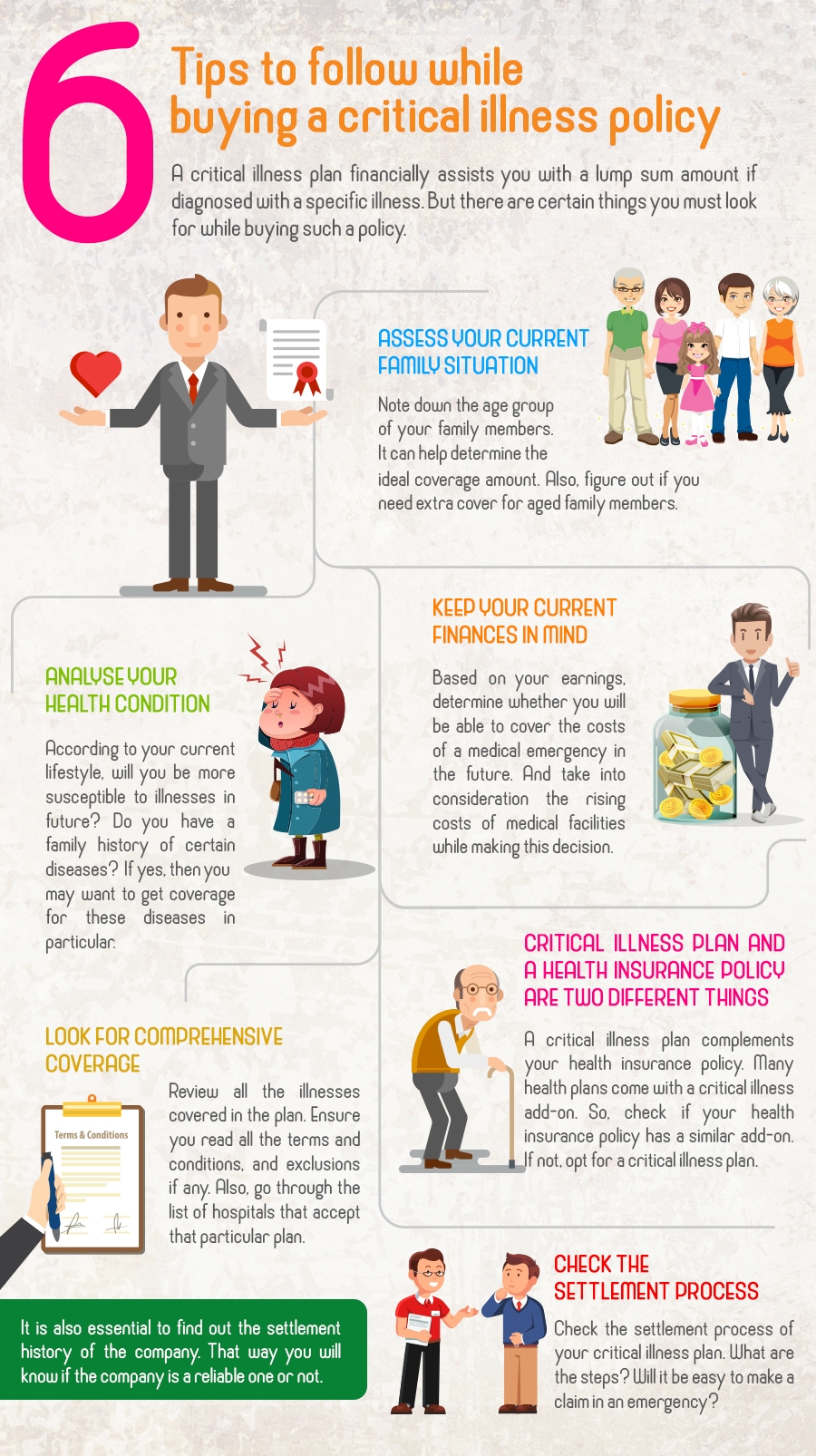

A few critical illness policies cover 30+ illnesses. Many cover 20+. A quick glance at these illnesses can also sometime reveal our vulnerability. Plans that offer coverage for higher number of illnesses are generally preferred. The important illnesses to cover are cancer, coma, stroke, heart attack, major organ transplant and kidney failure. The insurance regulator has standardized the definition of several of these critical illnesses. If an illness is mentioned across insurers, coverage is likely to be similar.

When buying a critical illness policy, one has to select a type of insurer. Life, health, and general insurers, all offer such policies but with slight variations. Life insurers offer a fixed term policy, say 15 or 20 years. Premium remains constant for the term. General and health insurers’ offer annually renewable policies. These have no fixed term and can be renewed life-long. However, premium increases with age.

Life insurers also offer critical illness as a rider to standard term and investment plans. A policyholder needs to tread a little cautiously, as there are many variants of a critical illness rider. Some critical illness riders do not pay a lumpsum, instead future premiums of the investment plan are waived. Though such a rider helps to grow a corpus for the future, a patient is likely to value an upfront benefit more. Some critical illness riders would trigger an annuity payment for a defined term. This helps to cover loss of future income. Another set of critical illness rider would pay lumpsum but reduce the policy’s death benefit. These are called accelerated critical illness riders.

A stand-alone critical illness policy, for its simplicity in execution and comprehensiveness is the preferred option.