A drop in bond yields indicates a rise in bond prices, which boosts the returns of debt funds. The 10-year bond yield has risen from a low of 6.4% in August this year, shrinking the returns from long-term debt funds focused on the duration play. Moody’s upgrade has pushed up bond prices. Will the good times last, or is it time for investors to move out of duration funds?

The rise in bond yields was prompted by several factors, including the spike in global crude oil prices. Rising oil prices raised fears that a higher import bill would dent the fiscal maths for the government. Additionally, investors were worried that the recent sharp cuts in GST would widen the fiscal deficit, forcing the government to borrow to fund the gap. Higher borrowing would increase the supply of bonds and push down existing bond prices. Foreign portfolio flows into the bond market have also moderated in response to the spurt in oil price and a rise in US treasury yields. Hawkish statements from the RBI on inflation have also put paid to any expectations of rate cuts in the near future. Adding fuel to the fire has been the RBI’s large open market operations—selling bonds to the tune of ₹40,000 crore since September—to mop up excess liquidity in the system. Such large issuances have put further pressure on the bond market, sending yields soaring.

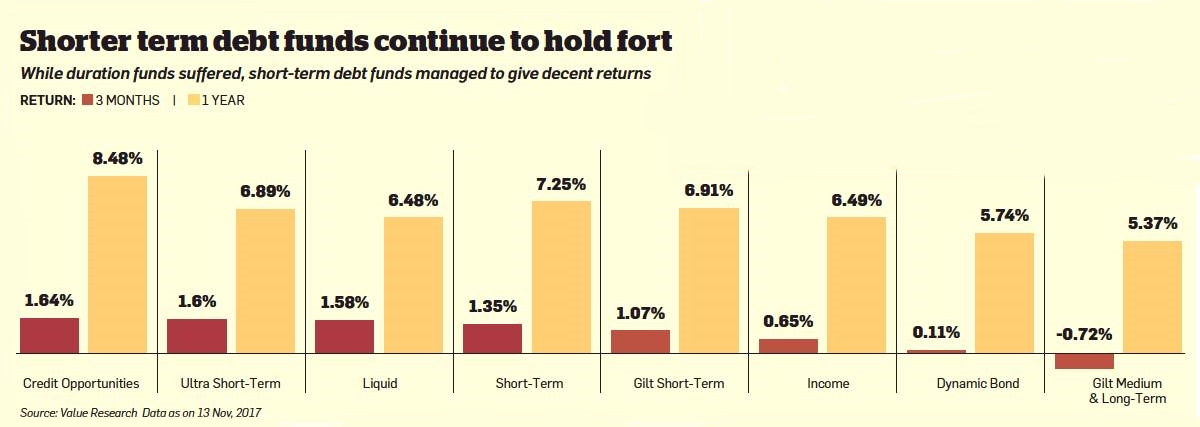

Consequently, medium- and long term gilt funds saw their returns dip over the past three months. Short term debt funds also saw returns slip but continued to hold firm. These funds invest a chunk of their corpus in short-term corporate bonds and are therefore insulated against volatility in the bond market. Experts are advising investors to move into short-term and ultra short term bond funds.

At the same time, some think that Moody’s upgrade may not have a lasting impact on yields. Not everyone is recommending a complete exit from the duration segment. The bond market could recover once the RBI’s open market sales come down and the surplus paper is absorbed.

While short-term bond funds are comparatively safe, choose carefully. Do not opt for funds with the highest return profile without checking its underlying portfolio. Make sure it is tilted towards AAA or equivalent instruments that denote higher safety. Some funds tend to line their portfolios with AA or lower rated securities (higher yield but higher risk of default) to earn higher returns through income accrual, or interest income. Also, check the fund’s expense ratio. A high expense ratio will reduce the returns for the investor.