India has emerged as the most investment-savvy economy in Asia and over two-thirds of the country’s affluent class prefer to make use of various investment products to meet their financial goals and greater social mobility, according to a new study titled ‘The Emerging Affluent Study 2018– Climbing the Prosperity Ladder’ by Standard Chartered.

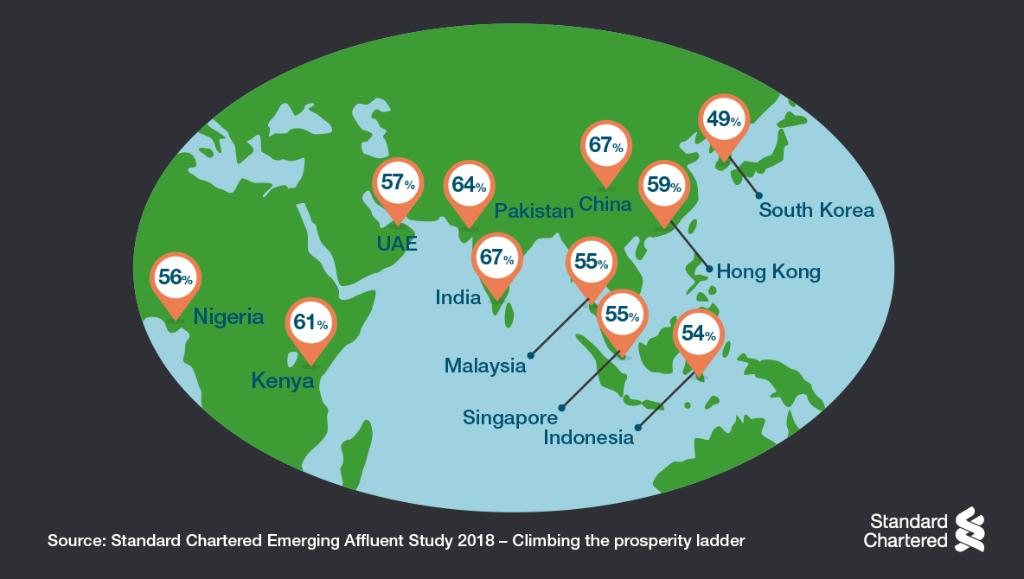

While the number of people climbing the social ladder in the west, when it comes to invest, save and spend, is slowing down, there is an increase in new group of people in Asia, Middle East and Africa who are accumulating wealth and improving their personal well being rapidly and this group of people have been named in the study as ’emerging affluent’. The study examined the views of emerging affluent consumers from 11 markets across Asia, Africa and the Middle East.

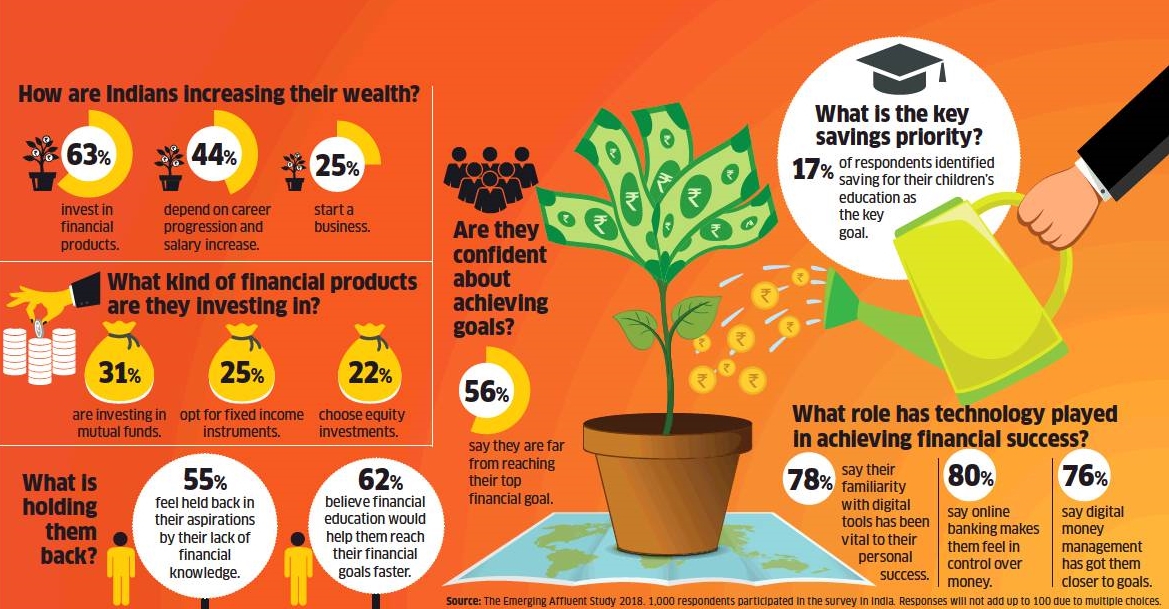

About 63% of these people in India prefer investing in financial products as part of their long-term financial plan to meet financial goals and boost their personal wealth. On the other hand, another popular strategy adopted by these people was career progression and increment in salary (44%), followed by starting a new business (25%) to increase their wealth.

Saving for their children’s education, which is also the top savings priority across the markets, was the number one financial goal for India’s emerging affluents, the study showed.

As per the study, new technology has made it easy to manage money effectively anywhere in the world. Online banking tools are playing a key role in effective money management today as the stock investments, transfers, payments and financial advice is just a touch of a button away today.

Investment products, according to the company for this particular study, refers to fixed income investments, equities, stocks, unit trusts, mutual funds, self-invested pension funds, investment-linked insurance, real estate property funds and real estate investment trusts (REITs).

While 31% of emerging markets affluents in India are choosing mutual funds to meet their financial goals, about 25% are selecting fixed-income investments and 22% are choosing equity investments; with all figures are higher than the average in the study – 1^%, 19% and 18%, respectively.

“The emerging affluent want to know more about money management and believe that a lack of financial understanding is stopping them from succeeding further. 42% said that they felt held back in their aspirations by their lack of financial knowledge,” the study showed.