One of the major drawbacks of fixed-income instruments like fixed deposits is that they fail to beat inflation. Moreover, interest on FDs is also taxable. However, you have an option to win the race against the rising prices without taking market risks. To beat the price rise, invest in the Reserve Bank of India’s Inflation Indexed National Savings Securities-Cumulative bond which offers investors a return that’s 1.5 per cent more than the inflation based on the consumer price index.

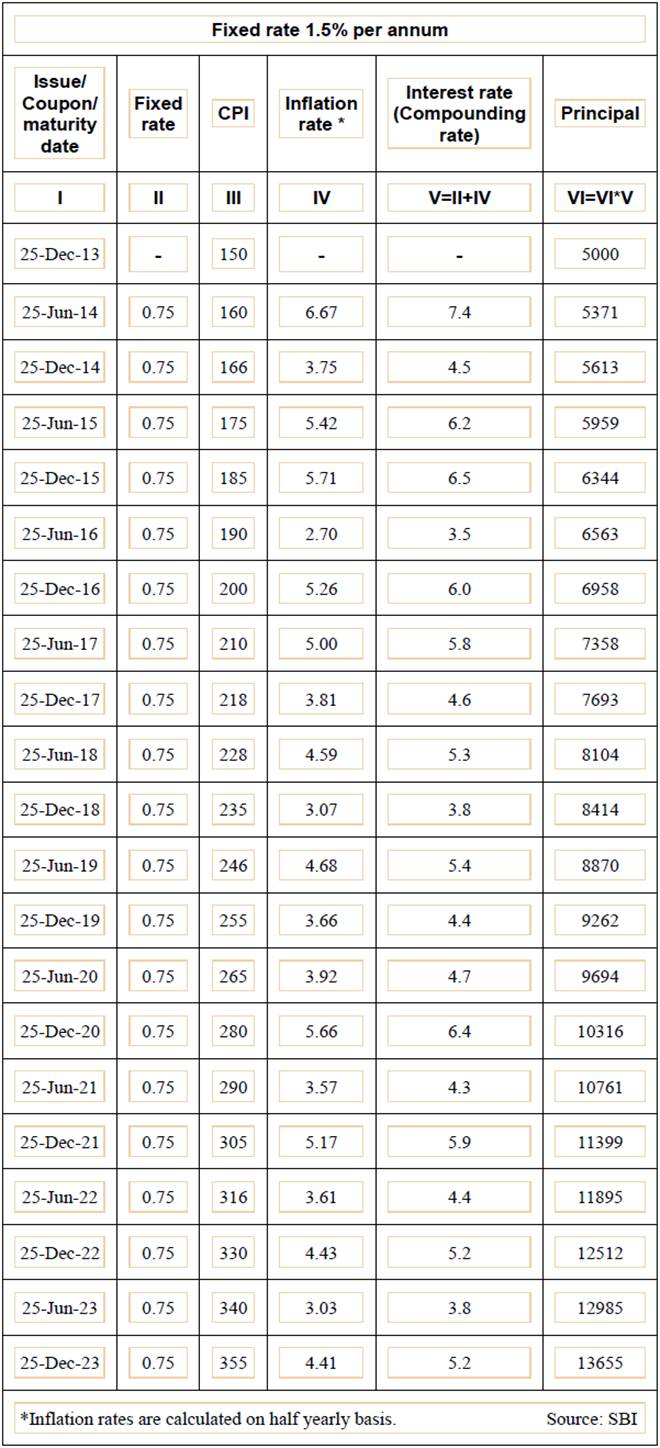

So, there will be two parts in the interest rate – first is the fixed rate of 1.5 per cent per annum and second is the prevailing inflation rate. As a result, the rate of interest will fluctuate along with the inflation rate, but don’t worry, it will not turn negative in case of deflation and will not fall below 1.5 per cent even if the inflation turns negative.

As the name of the bond suggests, there will be no interest pay out, but the interest will be accrued and compounded in the principal on half-yearly basis and paid along with principal at the time of redemption. The interest is taxable, but TDS is not applicable.

Any retail investor, which includes – individuals, Hindu Undivided Family, charitable institutions registered under section 25 of the Indian Companies Act and Universities incorporated by Central, State or Provincial Act or declared to be a university under section 3 of the University Grants Commission Act, 1956 (3 of 1956) – may approach any authorised bank or the Stock Holding Corporation of India and apply for the bond. The authorised banks are Nationalised Banks including State Bank of India as well as private sector banks like HDFC Bank, ICICI Bank, and Axis Bank.

While the minimum investment amount is Rs.5,000, the maximum limit is Rs.10 lakh per annum for individual investors and Rs.25 lakh per annum for institutions such as HUFs, Charitable Trusts, Education Endowments and similar institutions which are not pro-profit in nature.

Premature withdrawal is allowed, but a penalty at the rate of half of the last payable coupon will be charged from the investors. For example, if last payable coupon was Rs.1,000, penalty of Rs.500 would be charged. Senior citizens are allowed to withdraw prematurely after one year, but other people may do so only after 3 years from the date of investment. Loans are also available against the bonds.

Interested investors may download the form from the RBI website: https://rbidocs.rbi.org.in/rdocs/content/pdfs/INS181213AF.pdf

and approach their banks along with the KYC documents.