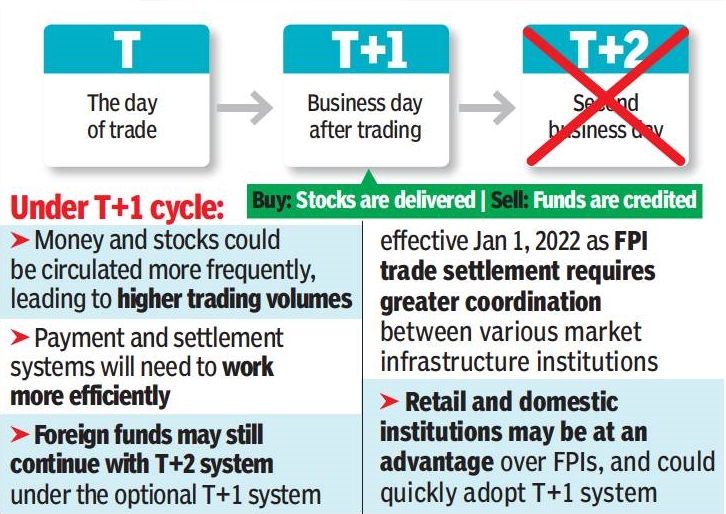

You may not have to wait for two days to see your trades reflect in your account. Come 2022, the trading (buying or selling) will show up in your demat account the next day.

Sebi has decided to shorten the trade settlement cycle despite strong resistance from some stakeholders in the stock market. The regulator has initiated the process of reducing the settlement cycle to T+1 from T+2 system for all stocks in the cash segment. However, Sebi has given stock exchanges the liberty to start it on an optional basis in scrips of their choice. The change is effective January 1, 2022, a circular from the regulator said.

On April 1, 2003, the Indian market had moved to the T+2 settlement cycle from T+3 cycle. Currently, most markets around the world follow the T+2 system.

“Sebi has been receiving requests from various stakeholders to further shorten the settlement cycle. Based on discussions with market infrastructure institutions (MIIs — stock exchanges, clearing corporations and depositories), it has been decided to provide flexibility to stock exchanges to offer either T+1 or T+2 settlement cycle,” the circular from the regulator said.

Accordingly, an exchange may offer T+1 settlement cycle on any scrip after giving a month’s notice about the change, it said. However, Sebi said that once an exchange decides to shift a scrip to T+1 cycle, it has to continue for at least six months. If it decides to switch back the scrip to T+2 cycle, it should give at least a month’s notice.

Last week, the Association of National Exchanges Members of India — a pan-India brokers’ body — had written to Sebi to not introduce the T+1 settlement cycle. According to Anmi, for the smooth running of such a system, there could be operational and technical challenges at several levels, including banks, brokers’ back offices, depositories and other bodies involved in the trading, settlement and post-settlement processes.

Industry sources, however, said that under T+1, tech-driven discount brokerages will be at an advantage over those that are yet to embrace technology in a big way for regular operations. Anmi is dominated by traditional brokers.

While retail investors and brokers have supported the shortened settlement cycle, it has been opposed by foreign portfolio investors (FPIs) due to time-zone differences and increase in operational cost.

Many FPIs in other time zones feel this will become a pre-funded market and this will raise the cost.

Market participants said even if the proposed switch to T+1 is left to the discretion of exchanges, it could once again fuel the old rivalry between the BSE and the NSE.

For decades, changes in the settlement cycle have been a contentious issue in the stock market, dividing powerful lobbies and bourses.