Market regulator Securities and Exchange Board of India has approved the proposal to introduce a framework for accredited investors in the Indian securities market. Recognising this to be a “a class of investors who may be considered to be well informed or well advised about investment products”, the market watchdog chalked out the salient features and benefits of this framework during its board meeting.

The definition of accredited investors tends to vary from country to country. This category of investors usually features high-net worth individuals or entities that have access to complex and high-risk investments.

The new framework will define the eligibility criteria for accredited investors, who may be individuals, HUFs, family trusts, sole proprietorships, partnership firms, trusts and body corporates, based on financial parameters and information as may be specified by SEBI.

Eligible subsidiaries of depositories and specified stock exchanges, and other specified institutions will be recognised as accreditation agencies. These agencies will grant accreditation status and issue Accreditation Certificate to accredited investors.

The framework will also set the modalities of accreditation and procedure to avail benefits linked to accreditation. Accredited investors usually enjoy special status under financial regulation laws.

As per the proposed framework, accredited investors shall have flexibility to participate in investment products with an investment amount lesser than the minimum amount mandated in the AIF Regulations and PMS Regulations.

AIF for accredited investors, where each investor has a minimum investment of ₹70 crore, may avail relaxation from regulatory requirements such as portfolio diversification norms, conditions for launch of schemes and extension of tenure of the AIF, SEBI stated.

Accredited investors with minimum investment of ₹10 crore with registered PMS provider, may avail relaxation from regulatory requirement with respect to investment in unlisted securities and can enter into bilaterally negotiated agreements with the PMS provider, the regulator further added.

The Securities and Exchange Board of India had issued a consultation paper on accredited investors, on February 24, 2021

Once recognised, such AIs could also be given relaxations on certain existing regulations.

For example, the consultation paper proposes that an AI investing in the scheme of a portfolio management service (PMS) firm can invest less than the minimum required sum of Rs 50 lakh.

Similarly, new lower limits could be laid down for alternative investment funds (AIFs) or other products.

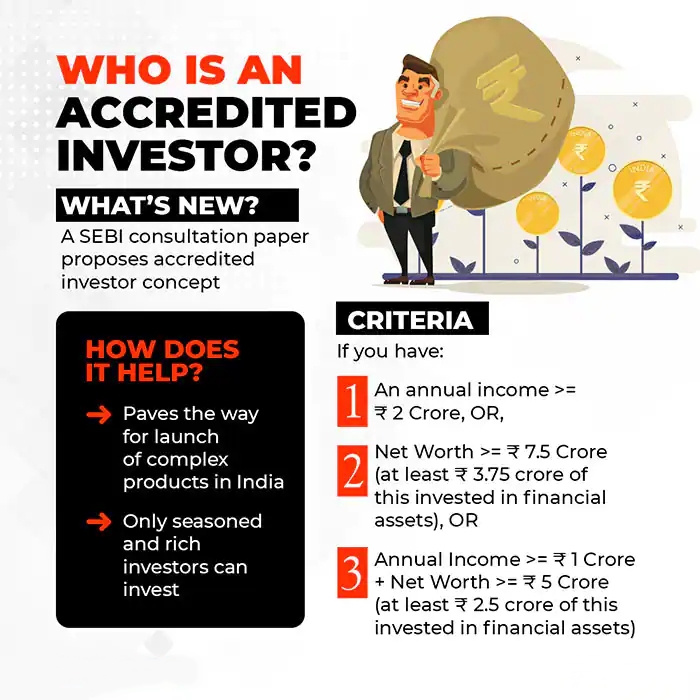

The consultation paper says only those investors who meet certain criteria of net worth, financial assets or income are allowed to get themselves registered as AIs.

An individual investor, who wants to be recognised as an AI, needs to fulfil one of these three conditions.

Her annual income must be at least Rs 2 crore. Or her net-worth must be at least Rs 7.5 core or more, with at least Rs 3.75 crore in financial assets; Or, her annual income must be at least Rs 1 crore, and networth must at least be Rs 5 crore, with investments in financial assets worth at least Rs 2.5 crore.

According to SEBI, such an investor classification will also help it to focus its ‘regulatory resources’ on investors that need more protection – investors not so well-informed and vulnerable to wrongful practices such as mis-selling.

Investment products offered to AIs will be regulated, but not as heavily as other avenues.

The paper says that the flexibility allowed in designing AI-targeted investment products will encourage more innovation.

Introducing a new investor class that is well aware of various aspects of such investments will allow complex products to be launched without much compliance burden.