The Reserve Bank in an unexpected move, slashed benchmark interest rates to their lowest levels since 2000 and extended the moratorium on repayment of bank for three months to ramp up support for the economy which is likely to contract for the first time in over four decades.

The central bank, which advanced the monetary policy committee meeting for the second time since March, extended the three-month moratorium of loan repayments, from June 1 to August 31 and raised the limit on banks’ group exposure to companies.

It also increased and pre and postshipment of credits for exports from 1 year to 15 months and gave additional three months to foreign portfolio investors to meet investment needs.

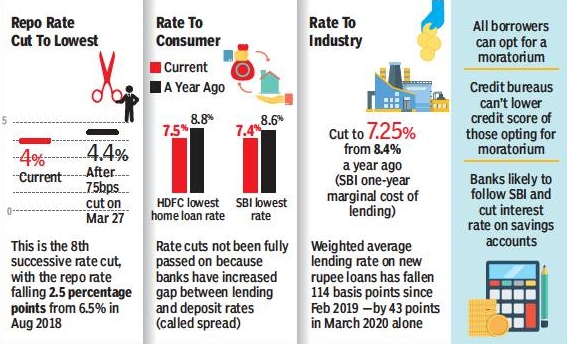

The benchmark repurchase (repo) rate was cut by 40 basis points to 4 per cent, the lowest since the benchmark came into being in 2000, Governor Shaktikanta Das said.

Consequently, the reverse repo rate was cut to 3.35 from 3.75 per cent.

The benchmark rates decide the interest on home, auto and other loans. They also dictate interest rates on savings deposits, which are likely to fall in tandem.

The Governor said the MPC had voted to maintain its accommodative stance, implying more rate cuts in the future if the need arises.

In its first official forecast for economic growth, the central bank said the GDP is likely to contract in FY21 (April 2020 to March 2021) as a direct fallout of the outbreak of coronavirus and ensuing lockdown.

Even before the coronavirus outbreak, the Indian economy was experiencing a slowdown, with GDP growth declining to a projected 4.9 per cent in 2019-20 fiscal, its slowest pace in the last decade.

Das said domestic economic activity has been impacted severely by the lockdown that has been extended till May 31.

Supplementing the government’s COVID-19 stimulus that mostly comprised of credit lines to small business and farmers, RBI said it will facilitate the flow of funds at affordable rates and revive animal spirits.

The RBI supplemented the interest rate cut by extending till August the permission to all banks to give a threemonth moratorium on payment of monthly instalments on all outstanding loans, providing relief to home and auto buyers as well as real estate sector where construction activities are at a standstill.

The moratorium on interest on working capital was also extended by three months.

Also, interest accumulated for the six-month moratorium period can be converted into a term loan, Das said adding the rescheduling of payments on account of the moratorium/deferment will not qualify as default.