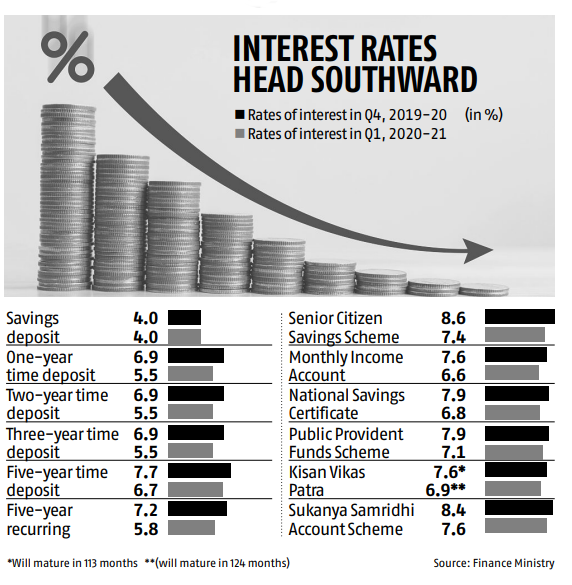

Your money in small savings schemes, such as public provident fund, would fetch you much lower rates of return in the first quarter of 2020-21.

This is because the government went for one of the steepest cuts of up to 1.4 percentage points in these interest rates to facilitate banks to lower their rates.

The move came days after the Reserve Bank of India announced 75 basis-points cut in policy rate.

The popular public provident fund scheme will now fetch 0.8 percentage points lower interest rate at 7.1 per cent against the current 7.9 per cent.

Similarly, national savings certificate will now yield 6.8 per cent rate of return, down 1.1 percentage points from 7.9 per cent.

Monthly income account will see one percentage point cut in returns at 6.6 per cent against 7.6 per cent at present. Even senior citizens will get 1.2 percentage points lower return as their scheme — Senior Citizens Savings Scheme – will earn 7.4 per cent against 8.6 per cent. In time and recurring deposits, the steepest cuts of 1.4 percentage points were made in one year, two-year, three-year time deposits and five-year recurring deposits.

Savings scheme will earn four per cent interest rate, the same as the present. Given the RBI’s mandate is to keep inflation at an average four per cent, the real interest rate here will be zero per cent.

PPF is still an attractive option, giving 7.1 per cent interest income that is tax free.

PPF still gives 0.85 per cent higher returns than what State Bank of India offers at its five-year fixed deposit rate at 6.25 per cent. Five-year fixed deposits in small savings scheme fetch 6.7 per cent.