The Reserve Bank of India announced a road map to reduce some of the Rs 9-lakh-crore-plus surplus liquidity which it had infused last year to alleviate the economic impact of the pandemic. The policy, which kept all key rates unchanged, was seen as dovish as the RBI has chosen to tip-toe towards its objective of policy normalisation (reducing liquidity in the system) without disrupting financial markets.

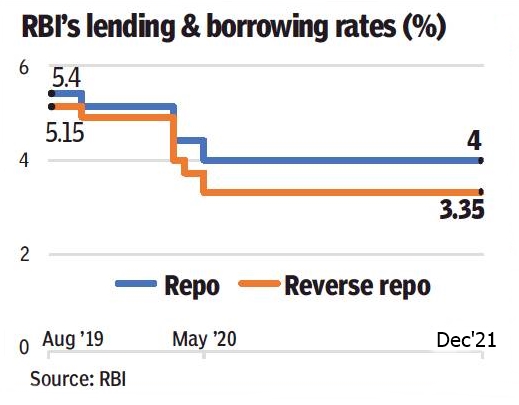

The monetary policy committee voted unanimously to retain the repo rate, at which the RBI lends to banks, at 4%. The reverse repo rate, at which it borrows from banks, was maintained at 3.35% too. The MPC also voted 5:1 to retain an accommodative policy with external member Jayanth Varma casting a dissenting vote. However, the central bank will be draining Rs 1.5 lakh crore more from the system. It has managed to do this by increasing the variable rate reverse repo auction, which is currently Rs 6 lakh crore, to Rs 6.5 lakh crore by December 17, and Rs 7.5 lakh crore by December 31.

In his post-policy conference, Das said the central bank’s overarching priority was a revival of growth and it would focus on growth without losing sight of price stability. “Various segments of the economy have crossed their pre-pandemic levels, but in certain key components like private investment and private consumption, which are very critical for the growth of GDP, we are still lagging pre-pandemic levels,” said Das. The governor also highlighted the downside risks to the economy from global factors, including the uncertainty from the Omicron variant.

While the repo rate hike is not seen to be happening this year, economists expect the surplus liquidity to normalise by January 2022.