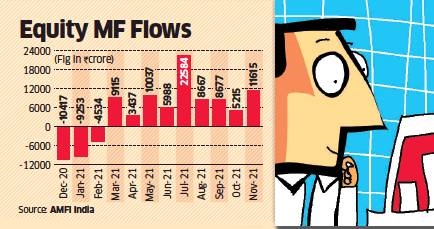

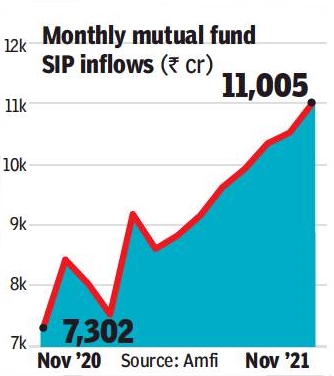

Investors doubled down on their investments in equity mutual funds in November amid the selloff in the stock market. Equity schemes received ₹11,614 crore in November, marking the ninth straight month of net inflows, as against ₹5,215 crore in October; while the popular SIP or Systematic Investment Plan collections crossed ₹11,000 crore for the first time ever in November.

The mutual fund industry’s assets under management grew to ₹38.45 lakh crore in November, their highest levels ever with debt funds garnering ₹14,900 crore.

The benchmark Nifty declined 6% in November led by a selloff by foreign funds. Flows from domestic investors have cushioned this fall.

All the 23 open-ended equity-oriented and hybrid scheme categories reported inflows, a reflection of investor confidence in the stock market.

SIP flows, which are monthly investments mostly into equity-oriented schemes, touched their all-time high of ₹11,005 crore in November, higher by ₹486 crore compared to the previous month.

Within hybrid funds, investors continued to allocate to the balanced advantage fund category where fund managers dynamically allocate to equity based on valuations. This category saw flows to the tune of ₹6,094 crore in November.

Equity savings funds and conservative hybrid funds, which allocate between 10% and 40% of their corpuses to equities, saw inflows of ₹869 crore and ₹514 crore, respectively. With plain-vanilla equity schemes, bulk of the flows went to flexi-cap funds and large-cap categories garnering ₹2,660 crore and ₹1,624 crore, respectively.