The RBI on Friday kept key interest rates unchanged and the monetary policy committee vowed to persist with an easy stance as long as necessary to revive and sustain growth and continue to mitigate the impact of Covid on the economy.

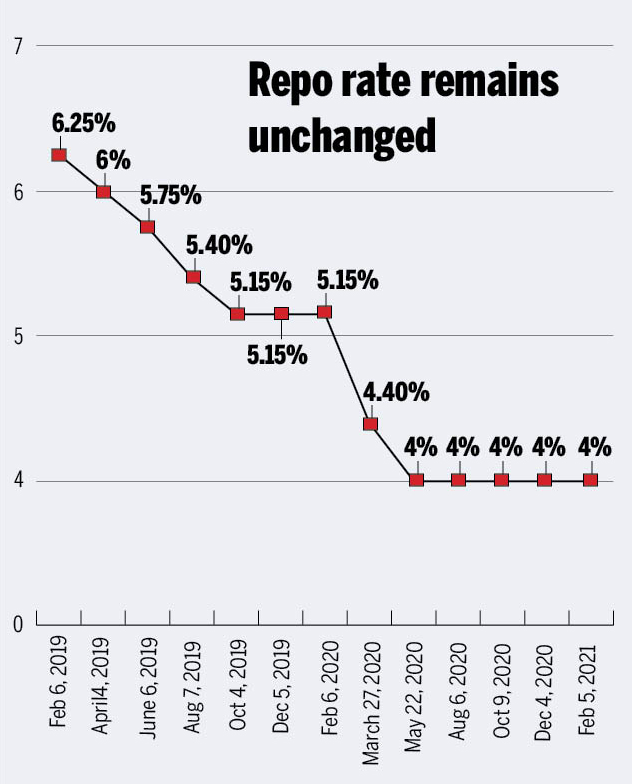

The decided to keep the policy repo rate (the rate at which the RBI lends money to commercial banks) unchanged at 4%. It also retained the GDP forecast for FY22 at 9.5%, while raising the inflation forecast to 5.7%, stating that it expects the pressure to ease on the prices front with the arrival of the kharif crop and the impact of the supply side measures. This is the seventh consecutive meeting when the RBI has kept rates unchanged.

“The outlook for aggregate demand is improving, but the underlying conditions are still weak. Aggregate supply is also lagging below pre-pandemic levels. While several steps have been taken to ease supply constraints, more needs to be done.The recent inflationary pressures are evoking concerns; but the current assessment is that these pressures are transitory and largely driven by adverse supply side factors,” RBI governor Shaktikant Das said in his policy statement.

“The conduct of monetary policy during the pandemic has been geared to maintain congenial financial conditions that nurture and rejuvenate growth. At this stage, therefore, continued policy support from all sides — fiscal, monetary and sectoral — is required to nurture the nascent and hesitant recovery,” said Das.

The implication for borrowers is that there is not much scope for interest rates to come down, barring some pass-through of earlier cuts by lenders. The RBI has cut the repo rate by 250 basis points (100bps = 1 percentage point) since February 2019 and banks have responded with a 217bps cumulative decline in their weighted average lending rate.

Announcing the MPC decision, Das said that members were unanimous on retaining the repo rate at 4%. However, one member, J R Varma, voted against the proposal to continue with the ‘accommodative’ stance

Das said that the new variable rate reverse repo, which could soak up a large part of liquidity was not a reversal of the accommodative phase. He said that the policy had to be nuanced as it had to address conflicting objectives.