Fund managers and investment advisors are recommending investors to book profits in their mid- and small- cap share portfolios following the sharp rally in prices. Investors should restrict exposure to these stocks to about 25-35% of their total portfolio, they said. Mid-caps appear better valued than small-caps at this juncture, said fund managers.

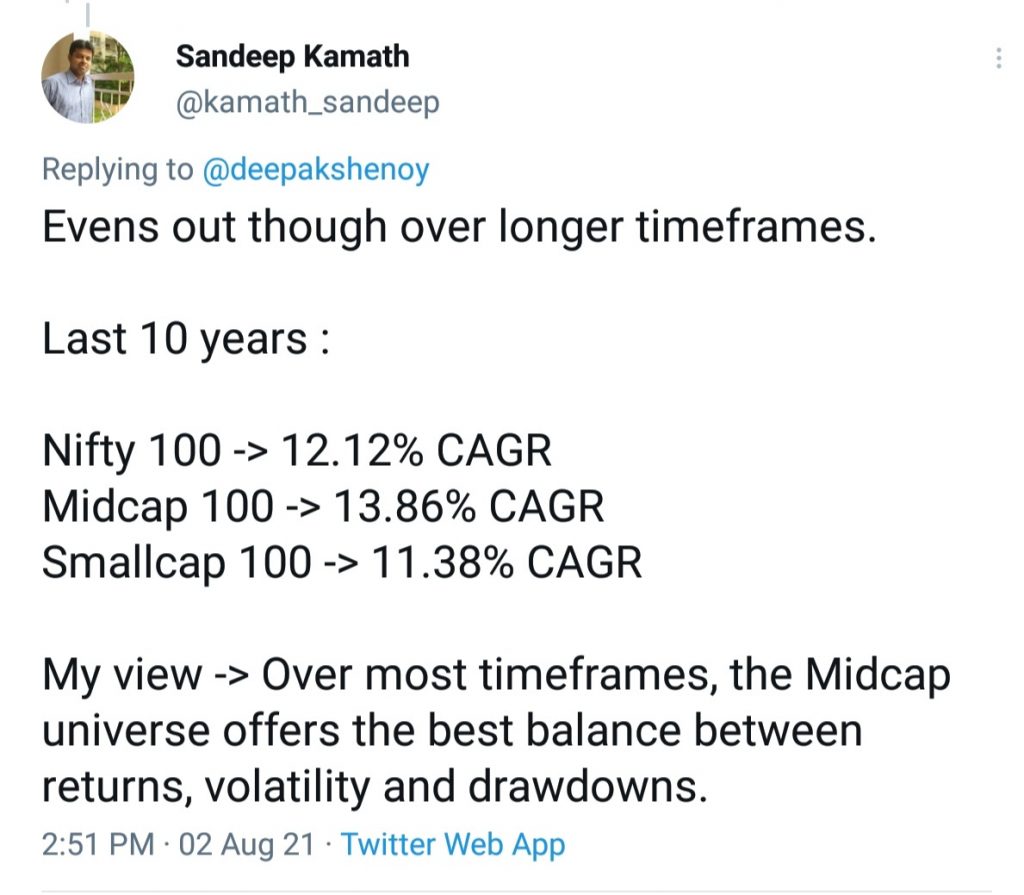

Mid- and small-cap stocks have risen sharply over the last one year. The Nifty Small cap 250 is up 105% in the past one year, the Nifty Midcap 150 is up 79% while the Nifty 50 has gained 50%.

The run-up in the share prices have made valuations of smaller companies expensive compared to their larger peers. The Nifty 50, comprising large-cap stocks, trades at a PE (Price to Earnings) ratio of 27.31 times. In comparison, the Nifty Midcap 150 trades at a PE ratio of 35.3 times and Nifty Small Cap 50 trades at 38.65.

While mid- and small-caps have performed considerably well over the past 12 months, 40% of midcaps are still presently trading below their five-year average PE multiples compared to 25% in the prior peak of 2018.

The rally in small- and mid-cap stocks have been driven by demand from individual investors, deprived of better returns from other traditional asset classes. Investment advisors said once the bull run in these share categories end, the action will shift back to the large-caps.

Investors should hold 25-30% of portfolio in mid- and small-cap funds and reallocate to large-cap or international funds.

Investors should avoid making lump sum investments in small-cap shares at this juncture, they said.