Mrs Shah invests ₹5 lakh in five-year post office time deposits on 1 April 2021 for 6.7% per annum. She will receive an annual interest of ₹34,351 every year for the next five years. However, after the completion of three years (say on 2 April 2024), she breaks her POTD to meet a financial emergency. Due to premature withdrawal, she receives ₹4,50,140 from the post office. She faces an interest loss of 48%, as per current rules. The interest loss is also very heavy in case of premature withdrawal of post office time deposits of other tenures. In general the loss in these cases is much more than in the case of premature withdrawal of fixed deposits with banks.

Here is how the loss of 48% mentioned above happened. Till the completion of three years of the deposit tenure, Mrs A would have been paid ₹ 34,351 every year at 6.7% per annum. However, as she broke her POTD she was supposed to receive ₹17,351 at the interest rate of 3.5% per annum. The excess interest ₹49,860 [₹1,03,053 (₹34,351 X 3) – ₹53,193 (₹17,731 X 3) paid to her in the past three years was recovered from the principal of ₹5 lakh.

POTDs offer sovereign guarantee and a higher interest rate as compared to bank fixed deposits. However, this comes at a much higher cost of liquidity which most people are not fully aware of. Where banks usually charge a penalty of 0.50-1% for premature withdrawals, for POTD the charge will be much higher as it will depend on how long you have stayed invested.

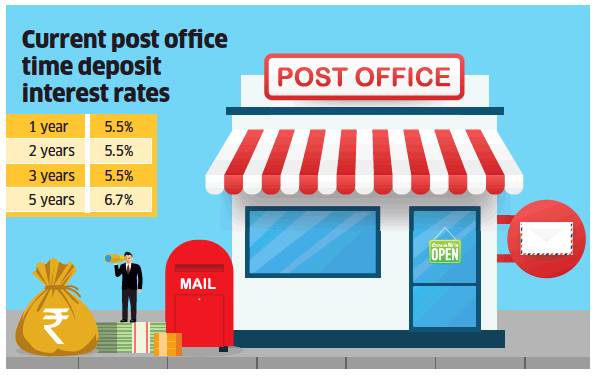

POTDs are available in four investment tenures: one year, two years, three years and five years. Do keep in mind that premature withdrawal is not allowed from POTD before the expiry of six months, regardless of the tenure. This is different from a bank FD where it can be prematurely withdrawn the very next day.

The amount of money you will receive in case of premature withdrawal from a five year POTD depends on how long you have held it.

If the five-year time deposit is closed after the completion of four years from the date of deposit, then the interest payable to you on that deposit would be equal to that payable on three-year time deposits at the time the five-year TD was originally opened. Further, if the time deposit has also completed some months beyond four years, then only post office savings account interest will be paid for the completed months.

If the five-year deposit is withdrawn after the completion of one year but any time before four years, then the interest paid on premature withdrawal will be 2% less than the rate specified for a deposit of one-year, two-year or three-years, as the case may be.

The premature withdrawal rules in case of two-year and three-year post office time deposits are similar to the rules that apply to a five-year time deposit in case the five-year POTD has completed less than four years.