Mutual funds are the fastest-emerging investment option for the long-term creation of wealth. However, the availability of a large number of mutual funds in the market has made it a difficult task to select the best plan to suit your requirement, budget and preferences. Have I picked the right mutual fund? Or which is the best mutual fund to invest? The answer to these questions is based on your risk profile and investment horizon. One size never fits all.

You should go for equity schemes if you have

# High risk appetite

# Long-term financial goals

# Minimum investment horizon of five years

Similarly, you should go for debt schemes if your risk appetite is low or you need some regular income with short-term requirements.

Also, among equity funds, every investor should have a different set of portfolio according to one’s risk profile. For example,

# A conservative investor should invest in equity-oriented balanced schemes or large cap mutual fund schemes.

# A moderate investor should invest in diversified and large cap mutual fund schemes.

# An aggressive investor should pick up mid and small cap funds.

However, you also need to keep in mind that past performance is no guarantee for the better performance of a fund in the future also. So, you need to select your fund carefully.

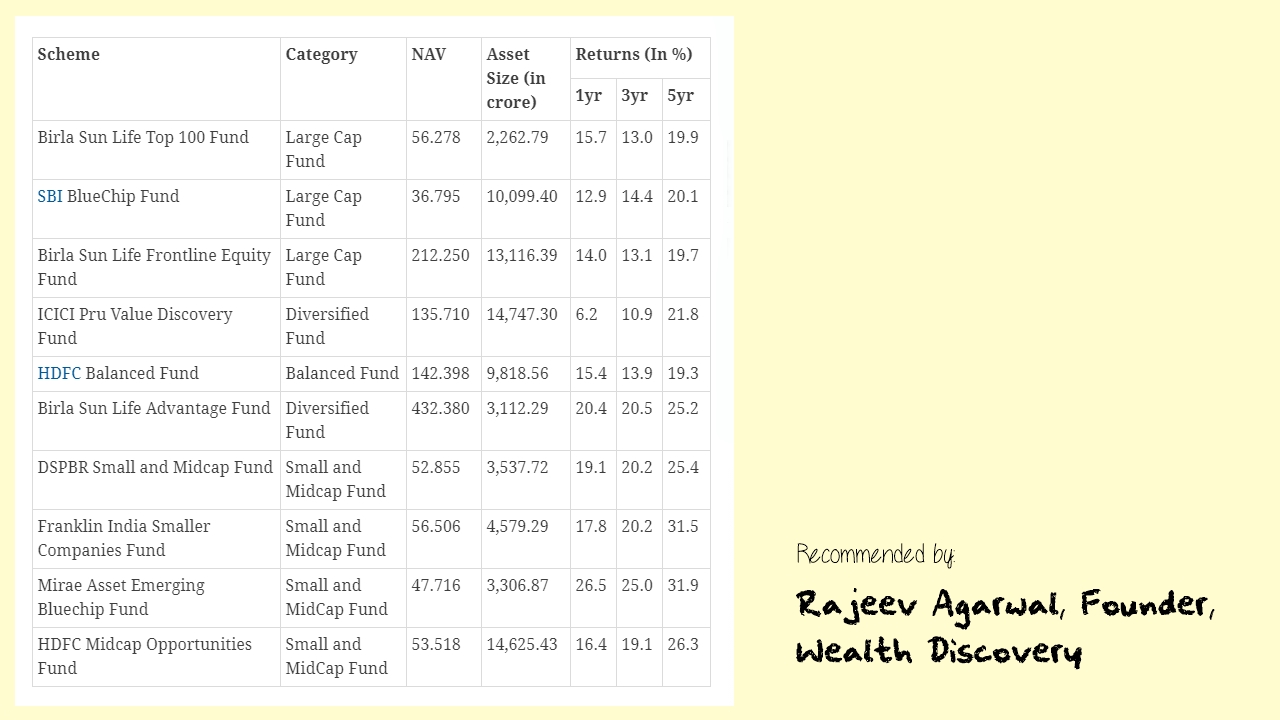

(These mutual funds have been recommended by Wealth Discovery. Although due care has been exercised by them while selecting these funds, you are advised to consult your financial adviser before investing in any of these funds.)