Insurance Regulatory and Development Authority of India has made it mandatory for car and bike buyers to purchase at least three years of third-party insurance for cars and at least five years of third-party insurance for bikes. Third-party insurance is the most basic kind (usually the cheapest) of motor insurance. It does not cover the damage done to the car but makes sure that any third person involved in an accident is covered by insurance.

This move will ensure that the buyer does not operate on the roads without a valid insurance. While the car/bike owner will end up paying more, this move means that the damage done to the third party is covered for at least three or five years, depending on the vehicle.

From Sept 1, while purchasing a car, the buyer will now have to be aware of the different permutations and combinations of the types of insurance.

Types of insurance

With the new IRDA regulations, a car buyer will have to purchase at least three years of vehicle insurance at the time of purchase. However, there are different kinds of insurance which need to be taken into consideration.

The buyer will essentially have three options while making the purchase.

The first option is that they just buy basic third party insurance for three years. This insurance does not cover the damage done to the vehicle but only the third party that is injured during an accident.

The second option is to pay for third party insurance for three years and comprehensive insurance for one year. This will result in a higher premium but will cover the damage done to the car including the third party.

The third option is to pay the entire insurance (third party + comprehensive) for all three years. With this option, the buyer won’t need to pay the premiums for the next three years. In the occasion of an accident, where the premium needs to be modified, the third party insurance will remain active at all times during the three-year tenure.

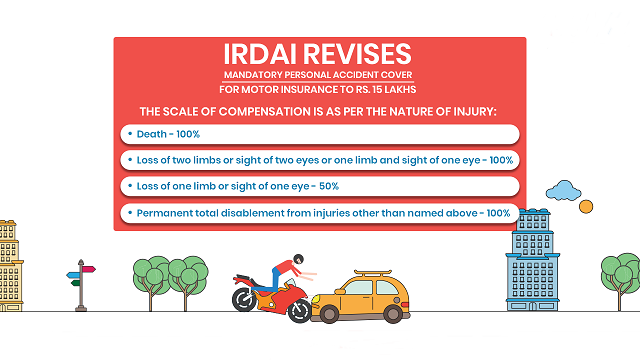

Car and bike owners will now get a compulsory personal accident cover of Rs.15 lakh under their motor insurance policies. Earlier, the mandatory cover was Rs.2 lakh for cars and Rs.1 lakh for two-wheelers.

A premium of Rs.750 per annum will be applicable for the Rs 15-lakh cover, a significant jump from the Rs.100 premium for cars and Rs.50 for two-wheelers earlier. The expense is over and above the mandatory third party insurance product.

Personal accident cover for vehicle owners is mandatory as per insurance regulations.

Due to an increase in the sum assured for the personal accident cover, all vehicle owners and drivers will be eligible for insurance benefits for death and permanent complete disability. General insurers are required to mandatorily provide it both for third party liability as well as comprehensive covers.

An individual wanting a cover above Rs.15 lakh can buy one by paying a higher premium, said Insurance Regulatory and Development Authority of India.

In an October 2017 judgement, the Madras High Court had said enhancing the compulsory personal accident cover will add to some solace to the victims of road accidents.

The owner of the insured vehicle holding an ‘effective’ driving license is termed as owner-driver for the purposes of this section. The cover is provided to the owners, and their drivers, while driving a vehicle.

The PAC is a compulsory complement of a motor insurance policy and is available both for a third-party cover and a comprehensive cover that includes own damage liability. The cover is provided to the ‘Owner-Driver’ while driving the vehicle including mounting onto or dismounting from or traveling in the insured vehicle as a co-driver.

The personal accident policy covers not only death but also any disability. The scale of compensation is as per the nature of injury

(i) Death 100%

(ii) Loss of two limbs or sight of two eyes or one limb and sight of one eye. 100%

(iii) Loss of one limb or sight of one eye 50%

(iv) Permanent total disablement from injuries other than named above. 100%

While the new rules of third-party insurance applies only on cars and two-wheelers purchased after September 1, 2018, the hike in the PAC applies to all motor insurance policies.