The recent correction in small- and mid-caps has caught many on Dalal Street off guard. The market participants, who have been worst hit, are portfolio management services funds which have heavily banked on illiquid small-cap shares to deliver returns superior to the index. With the tide turning, many of them are stuck with duds.

Porinju Veliyath, founder of Kochi-based Equity Intelligence, who rose to fame in the recent bull run aided by his bold and aggressive bets in the small-cap space, is among the portfolio managers who have been caught on the wrong foot. In a letter to clients — mostly rich — of his fund on Wednesday, Veliyath said he was baffled by the extent of erosion in portfolio value in the short period.

“We have nothing much to do right now, in a market environment which absolutely lacks buying interest, but wait patiently,” said Veliyath in a letter to investors, addressing the underperformance in PMS since January this year.

The disclosed holdings of Veliyath and Equity Intelligence (over 1% in a company) including ABC India, Ansal Buildwell, Palash Securities, Raunaq EPC International, LEEL Electricals, Liberty Shoes, Kerala Ayurveda and Parnax Lab have fallen anywhere between 3% and 35% this year.

Investment advisor SP Tulsian’s firm is said to have written a similar letter to investors, explaining the portfolio’s strategy to clients.

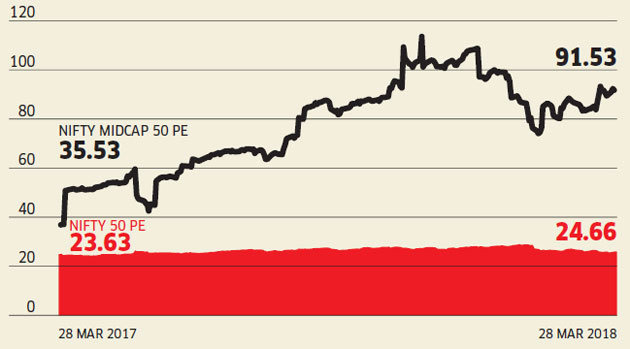

Most PMS firms have been instrumental in driving up prices of small-cap stocks thanks to the huge investor appetite. These portfolio managers stocked up on illiquid shares on expectations that the bull run was there to stay.

Brokers and wealth managers said many equity PMS providers have faced backlash from investors of late. The prolonged fall in these segments has undone most of the gains made by several investors.

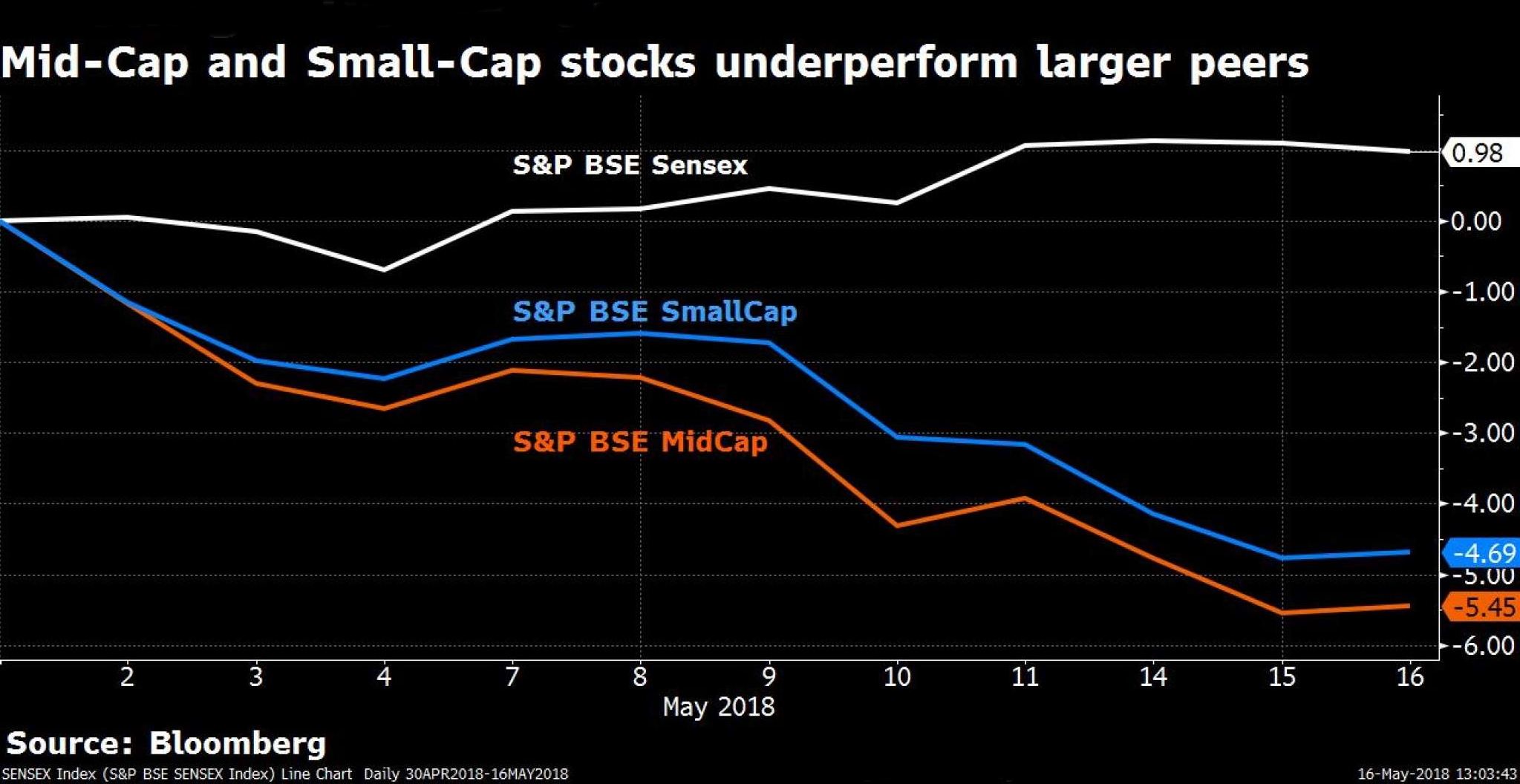

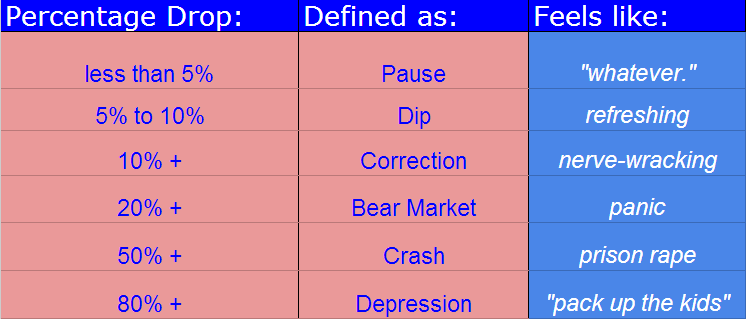

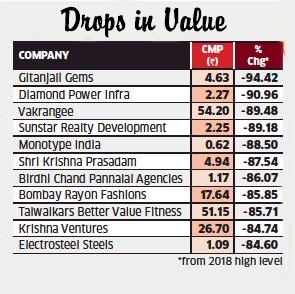

The BSE MidCap index has fallen 9% since the beginning of this year while the BSE SmallCap index has declined 8% during the same period, even as the benchmark Sensex and Nifty are in positive territory for the year and close to record high levels hit at the end of January. Individual stocks have fallen as much as 94% from their 2018 highs.

Market participants warn that more weakness may be in store. The breakdown of the MidCap index below long term average level — the 200-day moving average — indicates bearishness.

Market experts believe investors should prepare for a prolonged bearish phase in mid- and small-cap stocks given the weakening macro situation in the country.

Some experts see a one- to two-year underperformance phase for these segments going ahead. Typically, mid -and small-cap stocks go through two-three years of outperformance followed by one-to-two years of underperformance. This time the cycle of outperformance has lasted from 2013 to early 2018. We may see 1-2-year period of underperformance going ahead wherein these stocks will not do as well as large caps.

Meanwhile, portfolio managers like Veliyath and Tulsian are hoping for a bounce back in the market to help the share portfolio get out of the mess. “We would do some restructuring as required at an appropriate time, in a more rational market. I expect significant bounceback in many of our value stocks going forward,” said Veliyath.

So while investing, it is extremely important to pay attention to the risks involved rather than blindly chasing returns.