Liquid funds are the least risky of all mutual funds because it has been designed—and is meant to operate—as a proxy for your savings bank account.

But with liquid funds giving slightly higher returns than your bank account, this is a good vehicle to park your short-term cash. Additionally, many liquid funds allow you instant redemption and you get your money in half an hour, at most.

Returns from liquid funds aren’t as volatile as other debt funds because much of its underlying securities don’t get marked to market prices. Liquid funds are also used as a tool to invest in equity funds by setting up a systematic transfer plan.

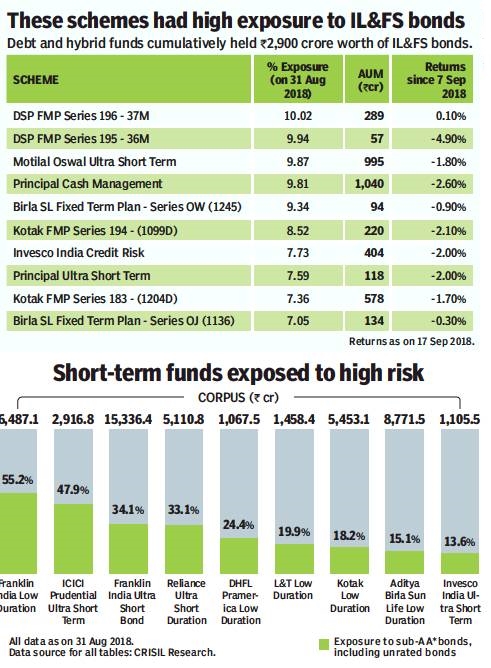

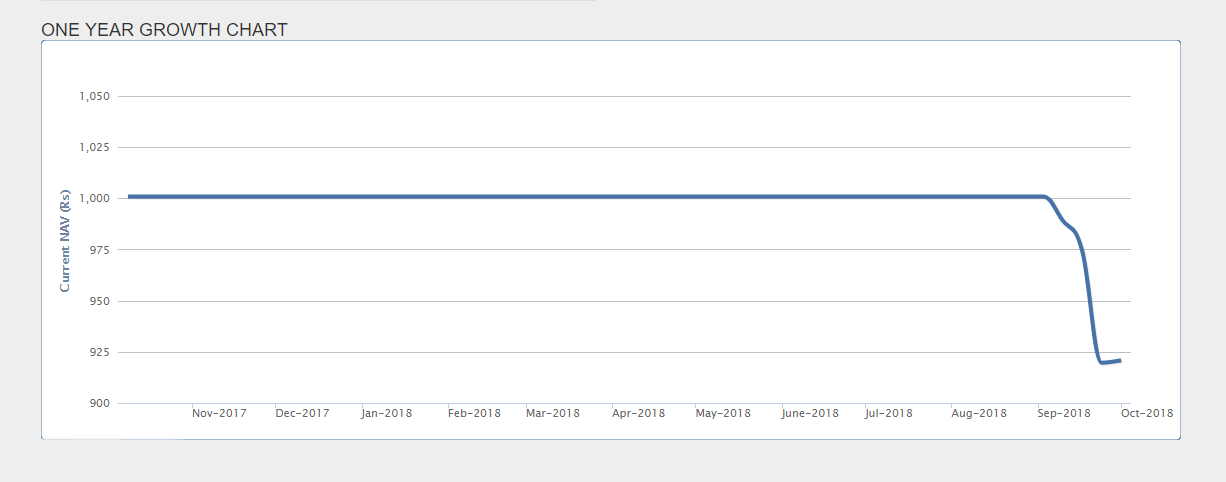

The Infrastructure Leasing & Financial Services Ltd default has brought the risk in debt funds upfront and close to investors. Some investors panicked because fund types they thought were zero risk saw negative returns. However, experts say that if your time horizon for the investment is longer, there is merit in staying invested rather than exiting post a sharp fall in NAV.

The NAV is calculated daily. It is nothing but the per unit value of the sum of the market value of all securities from which any expenses and liabilities are deducted.

Now let’s assume the NAV of one unit in a debt scheme is ₹11. If the face value or the original per unit value of the scheme was ₹10, then the current NAV is showing a gain of ₹1 or 10%. Now let’s assume that XYZ Ltd security in the portfolio has defaulted and there is no chance of recovering the investment. It is decided that the entire value of the investment be written off from the portfolio. If the security was 10% of the scheme, then ₹1 has to be taken away from the per unit NAV to represent its write-off at original cost. That immediately brings the NAV down to ₹10 from its current level of ₹11 and effectively is a 10% negative return on the day that the write-off was affected (we have assumed constant returns from other securities ).

Does this mean that your debt fund will not be able to deliver your expected return? The answer to this will depend on the time horizon of your investment. Say, if you need the money in a week from the write-off, then the fund will not be able to deliver. But if you need the money a year from the write-off, then chances are that it may deliver close to what you were expecting.

The reason fund returns can look up over time despite a big default like this is thanks to a diversified portfolio. The returns in a debt scheme come from the interest paid out by securities and any gains made on selling them. If the fund does not sell and holds the security till maturity, it will get back the principal and the returns then consist only of the periodic interest payments.

The default in the example mentioned earlier pertained to 10% of the portfolio and has a negative impact on the value of the scheme today; but if you remain invested, the rest of the portfolio will continue to deliver interest and in some cases even capital gains. If the aggregate yield or interest of all the securities in the portfolio put together is 8% and there are no capital gains—then over the next one year you will still earn 8% minus scheme expenses, just by remaining invested. As a result the NAV gains Rs 0.72 for the year (assuming zero expenses for simplicity).

Your loss at the end of the year from the peak value of ₹11 is ₹0.28 per unit. On the other hand, had you exited immediately after the write-off you would have realised a loss of ₹1 per unit.

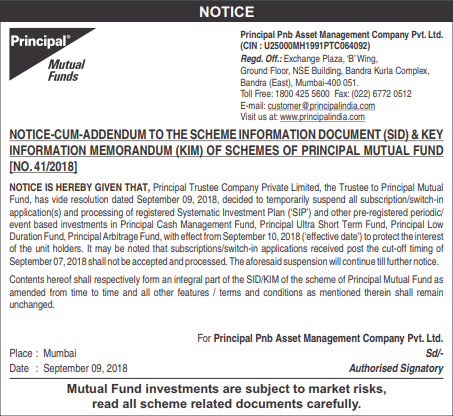

Some debt schemes of Principal Mutual Funds have been affected this time….take for example: Principal Cash Management Scheme….

Liquid funds are very low risk, but not risk free. Despite the fund management team’s best efforts, sometimes bonds held by liquid funds default. Owing to their very short maturities, this remains a remote possibility – but the risk still exists on paper. When a bond held by a liquid fund defaults, the fund needs to write off its value. This results in a hit on the fund’s NAV. In a nutshell – liquid funds are very low risk, but not risk free.