Infrastructure Investment Trust

InvITs are vehicles that facilitate investments in the infrastructure sector of the country.

Like a mutual fund, InvITs enables direct investment of small amounts of money from investors in infrastructure and to earn a small portion of the income as return.

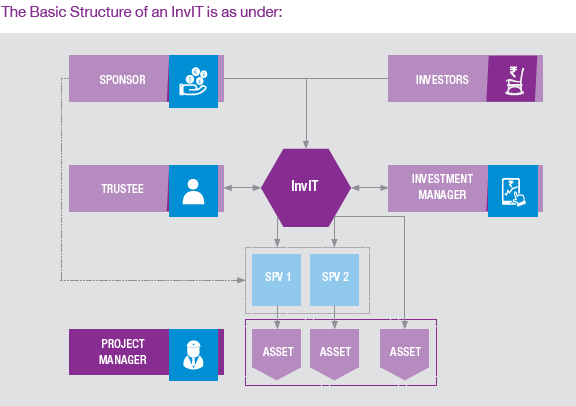

InvITs can be established as a trust and registered with Sebi. An InvIT consists of four elements-trustee, sponsor(s), investment manager and project manager.

InvITs can invest in infrastructure projects, either directly or through a special purpose vehicle. In case of Public Private Partnership projects, such investments can only be through SPV.

Two types of InvITs have been allowed.One is allowed to invest mainly in completed and revenue generating projects and the other in completed / under construction projects. While the former has to undertake a public offer of its units, the latter has to opt for a private placement of its units.

InvIT has to be listed on a stock exchange.

InvITs, as an investment vehicle, may aid:

Providing wider and long-term re-finance for existing infrastructure projects.

Freeing up of current developer’s capital for reinvestment into new infrastructure projects.

Refinancing/takeout of existing high cost debt with long-term low-cost capital and help banks free up/reduce loan exposure, and thereby help them create headroom for new funding requirements.

InvITs may be an enabling vehicle for refinancing such assets as well as creating an investment option which may otherwise not be possible for smaller investors.

InvITs may help in attracting international finance into Indian infrastructure sector.

InvITs will enable the investors to hold a diversified portfolio of infrastructure assets.

InvITs are also proposed to bring higher standards of governance into infrastructure development and management and distribution of income from assets so as to attract investor interest.