Bengaluru-based Embassy Property Developments Pvt Ltd, plans to raise Rs.4,750 crore from an initial public offering that opens on 18th March 2019. The price band for the Embassy Office Parks REIT IPO is Rs.299-300 apiece.

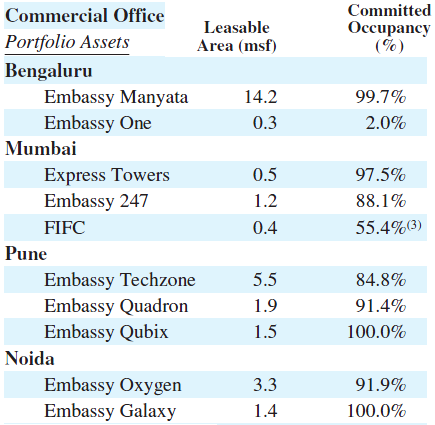

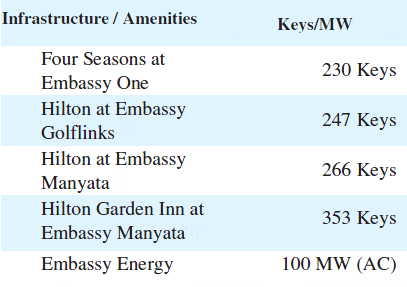

The trust’s portfolio comprises about 33 million square feet of office space across four Indian cities, Bengaluru, Pune, Mumbai and Noida.

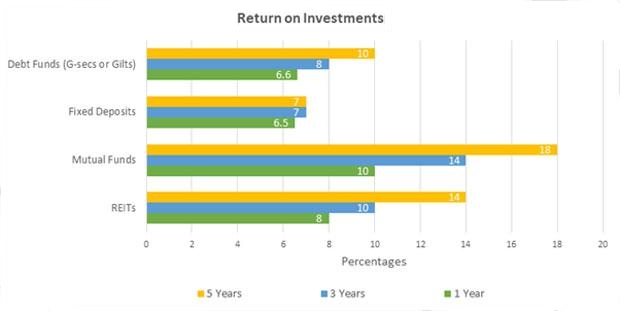

Analysts say the offer is a good investment bet for investors who are looking for a safer investment option as compared to equities and an assured return over a two-three year period.

As per as Sebi regulations, a REIT shall invest only in commercial real estate assets, either directly or through special purpose vehicles. Income earned by REIT could be through rentals or capital gains or both, and it gets distributed to unit holders. A unit shall be as small as Rs.2 lakh.

To safeguard investors, the rules were amended and a clause added where at least 80 per cent of the value of the REIT assets is to be made be in completed and revenue-generating properties, whereas the balance 20 per cent could be invested in under-construction projects.

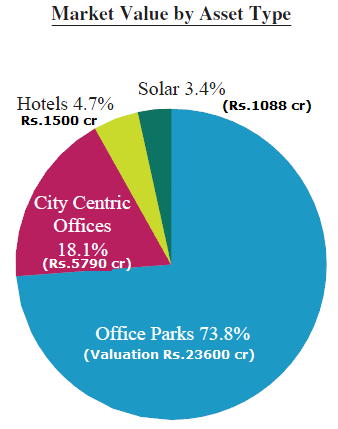

Company’s Portfolio comprises of seven best-in-class office parks and four prime city-center office buildings totaling 32.7 msf as of December 31, 2018.

Company owns a 100 MW solar park which provides green power to their office parks and hotels located in Bengaluru.

Company also owns hotel assets which are managed by well-known hotel operators such as Hilton and Four Seasons.

The Market Value of Company’s Portfolio as of December 31, 2018 as per the Valuer is around Rs.31,000 cr ($4.43 billion).

REIT is an investment tool that owns and operates rent-yielding real estate assets. It permits individual investors to make investment in real estate without owning it and earn an income.

Currently, the minimum investment in a REIT is Rs.2 lakh per investor. Once it is listed, trading will be for a minimum lot of Rs.1 lakh. Income earned by REIT could be through rentals or capital gains or both.

It gets distributed to unit holders. SEBI rules state that REITs shall distribute not less than 90 per cent of the net distributable cash flows to its investors at least on a half yearly basis.

According to industry estimates, the rental yield from a commercial property is in the range of 7-9 per cent, while capital appreciation can be expected to be between 4-7 per cent over the long term.