What is a Government Security (G-Sec)?

A government security is a tradeable instrument issued by the central government or state governments. It acknowledges the government’s debt obligations.

Such securities are short term — called treasury bills — with original maturities of less than one year, or long term — called government bonds or dated securities — with original maturity of one year or more. In India, the central government issues both: treasury bills and bonds or dated securities, while state governments issue only bonds or dated securities, which are called the state development loans. Since they are issued by the government, they carry no risk of default, and hence, are called risk-free gilt-edged instruments.

Who are the players in the G-Secs market?

Major players in the G-Secs market include commercial banks and primary dealers besides institutional investors like insurance companies. PDs play an important role as market makers in G-Secs market. A market maker provides a firm two-way quotes in the market i.e. both buy and sell executable quotes for the concerned securities. Other participants include co-operative banks, regional rural banks, mutual funds, provident and pension funds. FPIs are allowed to participate in the G-Secs market within the quantitative limits prescribed from time to time. Corporates also buy or sell G-Secs to manage their overall portfolio.

Why are G-secs volatile?

G- Sec prices fluctuate sharply in the secondary markets. The price is determined by demand and supply of the securities. The price is influenced by the level and changes in interest rates in the economy and other macro-economic factors, such as, liquidity and inflation. Developments in other markets like money, foreign exchange, credit and capital markets also affect the price of the G-Secs. Further, developments in international bond markets, specifically the US Treasuries affect prices of G-Secs in India. Policy actions by RBI like change in repo rates, cash-reserve ratio and open-market operations also affect their prices.

How can investors buy G-secs?

Investors can buy G-secs directly through a few broking platforms or indirectly using the mutual fund route. Mutual funds are also more tax efficient as they offer indexation benefits if held for more than three years. On the other hand, interest received from a government security is taxable in the hands of the investor.

Online broking firm Zerodha enabled a digital platform for retail investors to buy G-secs with a minimum investment of ₹10,000. NSE India too launched NSE goBID which is an aggregator for buying and selling G-secs online and via an app for retail investors.

Though the Reserve Bank of India introduced the non-competitive segment in G-secs back in 2001 to enable retail investor participation and this was extended to treasury bills in 2016, but the segment hasn’t really gained popularity. Facilities offered by banks like IDBI Bank Ltd and Axis Bank Ltd also failed to kindle widespread interest from retail investors.

Retail investment in corporate bonds is not a new concept, but G-secs have been largely perceived as inaccessible for retail investors. This is because the process for buying these bonds was not simple. Most participants are institutional buyers with very large-sized bids which are unsuitable for retail demand.

In 2017, RBI notified that stock exchanges could act as aggregators for non-competitive bidding for retail investors to access G-secs. Even as the process is now getting simpler, awareness remains an issue.

Admittedly, bond investing is not an easy concept to grasp. Firstly, you must make a bid, which can sound daunting, but it just means applying for the bond and put the face value as your bid price, which is similar to investing in an equity initial offer.

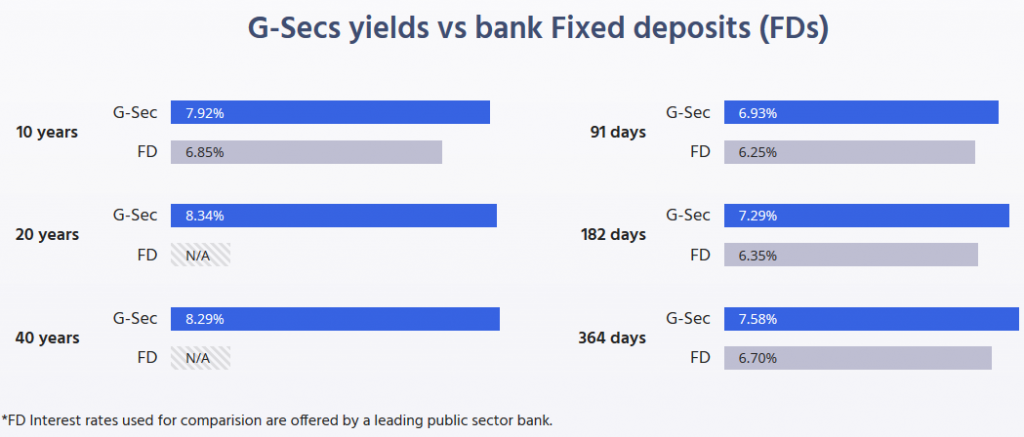

G-SECs VERSUS FDs

Please note, these rates keep changing..Please cross check before investing!

What’s good?

Highest credit quality as bonds are issued by Government of India

Available for short and long tenures

Returns better than average return from FDs

What’s not?

Difficulty in mid-tenure exit due to lack of secondary market liquidity

Daily price change of the bond can be confusing if tracked

The bonds can’t be pledged unlike other financial securities

Fixed deposits cater to 5-10 years’ tenure but for anything more than that the choice is limited and long-term G-secs could fill the gap often hard to grasp for the average retail investor.

You will also come across term yield, which may confuse you. If all you are looking for is safety and regular income, then ignore the term yield. Just look at the bond’s coupon or interest rate, which is what you will get annually and hold the bond till it matures. At maturity, you will get the face value you paid and any remaining interest payout.

The other difficulty is exiting before the bond matures. What if you need the money now? Technically, you can sell the bond in the secondary market or via stock exchanges just like you sell shares. However, there is very little demand for these bonds and there may be no buyers when you plan to sell. Zerodha has said it will act as the market maker and buy bonds which investors want to sell in the secondary market.

Then, you can’t pledge G-secs for taking a loan.

While these hiccups may cause discomfort, G-secs are ideal for long-term allocation.

The bonds are issued by the government, making them the safest investment if you are concerned about losing your money. If you are comfortable investing in National Savings Certificates or Public Provident Fund, then investing in G-secs should not be a concern.

Short-term rates for G-secs can fluctuate, but the benefit may be more visible when you consider locking into long-term, 10- 30-year G-secs.

Another benefit of investing in G-secs is they offer various investing tenures. You can invest for your short-term, 3-6-month requirement in 91-day or 181-day treasury bills or you can choose the 10-year G-sec for your long-term debt allocation.

Lastly, it’s a low-cost affair. Zerodha charges ₹6 per ₹10,000 trade and NSE doesn’t charge anything. You will have to, however, pay for the demat charges.

On both Zerodha and NSE platforms, the registration process is simple and can be done online if you have a demat account. Once bought, the bonds will be stored in your demat account. For the NSE goBID platform, you must choose your broker with whom you are registered to facilitate this transaction. Your personal details and PAN number will also be required.

You can also use G-sec funds, known as gilt funds. There are long- and short-term gilt funds and those which invest in 10-year G-secs only. While investing through the MF route gives you better liquidity if you are unsure about the tenure, the fund can invest in a collection of G-secs with varying maturities. For example, a long-term G-sec will be able to invest in 10-year and 30-year G-secs. Since MFs have to declare the price or NAV every day, you may find a lot of fluctuation in daily value. While this may not impact your long-term return, it can make you anxious in the interim. Costwise too the direct option works better.

While your medium-term—5-8 years—debt allocation may be better served by other small savings schemes, G-secs are a god option for long-term allocation of 10 years and more. Whether you pick a fund or choose to go direct, investing in G-secs for your debt allocation is now an option that you can consider seriously.