Tweets by Kirtan A Shah, CFP

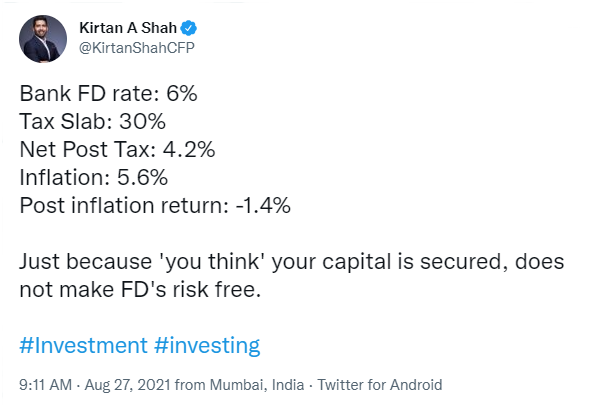

It’s a misconception that FD, RBI Bond, PPF etc have no risk. The reason we don’t see the risk in them is because for us, risk ONLY means loss of capital.

1. There r 3 risks to keep in mind while we do fixed income investing

a. Default Risk-Investment has a risk of default. You might not get paid the interest or ur capital may not come back in full. FD, RBI Bonds, PPF generally may not have this risks but corporate FD’s do

b. Interest Rate Risk-After u invest, Interest rates going up or down can also be a risk

(i) Imagine investing in a bank FD for 5 years at 5% right now & a year later interest rates go up, u will still keep receiving the same 5% & not the increased rate, this is a risk

(ii) Investing in an FD at the peak of say 8% for 1 year & after 1 year when you receive the maturity & you try & reinvest, the rate on the new FD is lower say 6%, this is also a risk, re-investment risk. FD, RBI Bonds, PPF – Have this risk.

c. Liquidity–How soon can u get ur investment back at fair value?

Lets say if u invest in a PPF, lock-in theoretically is 15 years. If u invest in a bank FD for 5 years & try removing before 5 years, there will be a penalty. Again FD, RBI Bond, PPF all has this risk

(2) What should investors do?

Investors first have to decide which risk are they willing to take. Each instrument will have some or the other risk. Like say,

(a) Fixed Deposit – Has Interest rate risk & liquidity risk

(b) Corporate Deposits – Has all 3

(c) Government Securities – Liquidity & Interest rate risk

(d) Mutual Funds – All 3 risks are expected to be managed well, provided you have picked the right scheme depending on your requirement.

Nothing in fixed income is fixed and everything has risk. You have to decide which and how much of the risk are you comfortable with for the return expectations you have.

- How do u access risk? What do u keep in mind?

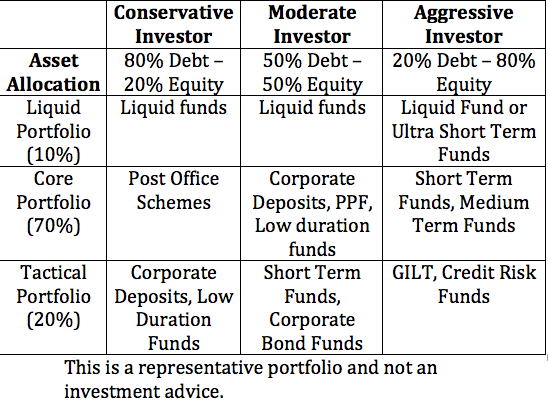

Investors should follow an asset allocation. Lets say I am a conservative investors, I will invest 80% in debt & 20% in equity. The point is don’t invest all 80% of debt in the same product. Split the 80% into 3 different buckets

(a) Liquidity portfolio – This is the portfolio, which allows you to have liquidity whenever required. 10% of your debt portfolio can be here (80% * 10% = 8%)

(b) Core debt portfolio – This portfolio is the main portfolio investment. Depending on your requirement in terms of risk and return, 70% of your debt portfolio can be here (80% * 70% = 56%)

(c) Tactical portfolio – Here is where some tactical call on debt can be taken to generate slightly superior returns on the portfolio. 20% of your debt portfolio can be here. (80% * 20% = 16%)

(4) So what falls in Liquid, core and tactical portfolio?

The image is strictly for education purpose and is subjective