Inflows into pure equity schemes of mutual funds in February slipped to the lowest levels in 25 months at Rs.3,948 crore. Market participants attribute the continuous fall in equity inflows to the very poor performance by mutual fund managers. A study of around 360 open-ended equity schemes by Valueresearch showed 67% of them have given negative returns in the last one year.

In January, equity funds had seen inflows of Rs.5,082 crore while in December 2018, they had attracted only a very small Rs.4,442 crore, the lowest in 27 months.

Equity funds includes, equity funds, arbitrage funds and equity linked saving schemes. While debt funds includes income schemes, liquid/money market schemes, and gilt schemes. However if we look at pure equity funds, than it saw inflows of Rs.3,948 crore lowest in the last 25 months. ELSS schemes saw inflows of Rs.1,174 crore, while arbitrage funds saw outflows of Rs.482 crore in the month of February, showed data from Association of Mutual Funds in India.

If we just look at pure equity funds than, February marks fourth consecutive month of fall in inflows. In the month of January and December, pure equity funds had seen inflows of Rs.4,914 crore and Rs.5,765 crore respectively. The average monthly inflows into equity schemes in the period of April-February slowed down at Rs.9,110 crore from Rs.14,200 crore in 2017-18.

Despite flows slowing down in equity funds, contribution of SIPs stood at over Rs.8,095 crore in February as against Rs.8,064 crore in January. Market participants also say that, investments through lump-sums slowing down in the last few months, due to uncertainty in the markets. In the period from April to February, total contribution of SIPs stood at Rs.84,638 crore. In the last financial year the contribution of SIPs was Rs.67,190 crore while in 2016-17 it was Rs.43,921 crore.

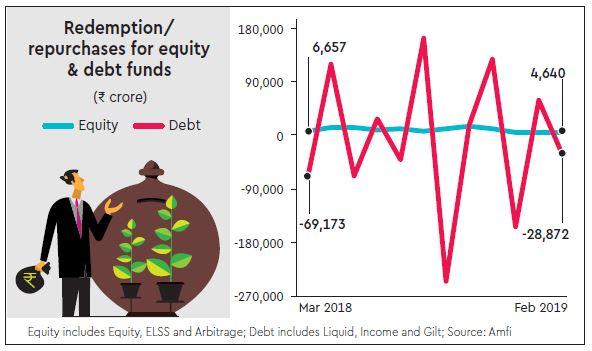

Debt funds witnessed outflows of Rs.28,872 crore in February. Liquid funds and income funds saw net outflows of Rs.24,509 crore and Rs.4,214 crore, respectively in February. While gilt funds saw outflows of Rs.149 crore.

The mutual fund industry saw outflows of Rs.20,083 crore in February. Other exchange traded funds also saw net inflows of Rs.5,234 crore in February.

Balanced funds saw outflows of Rs.1,077 crore in the month of February. The assets under management of mutual fund industry stood at Rs.23.16 lakh crore.