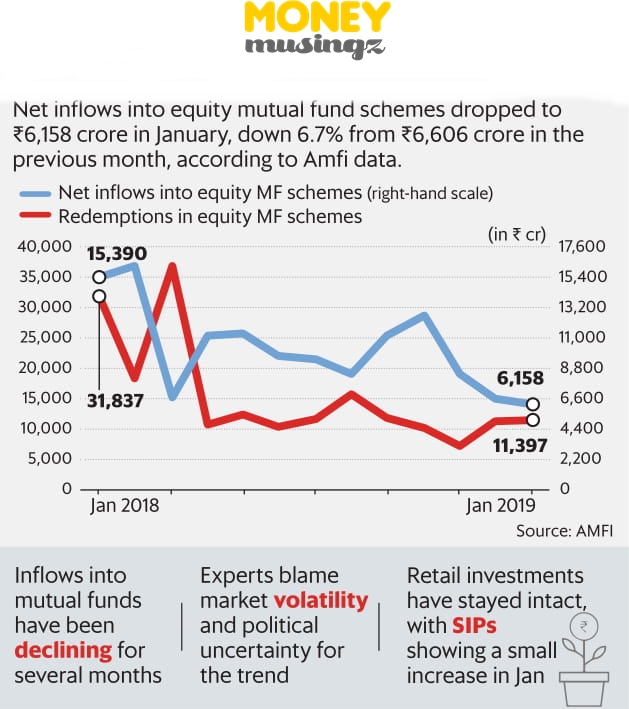

Net inflows of investments into mutual fund equity schemes have hit a 24-month low, with only ₹6,158 crore accruing in January 2019. The continuing volatility in stock markets and political uncertainty seem to have impacted overall sentiment, except for one silver lining—retail investment in such funds seems to be intact.

The dramatic drop in net inflows for January 2019, continues a trend that has been evident for several months. January’s net inflows are down 6.7% from ₹6,606 crore in December 2018. Compared with the ₹15,390 crore net inflows into equity mutual fund schemes a year ago, the fall is a steep 60%.

Equity funds in the data include pure equity funds as well as ELSS, tax savings vehicles investing predominantly in equities. The picture gets bleaker after factoring in fund flows from arbitrage funds— according to the latest data, arbitrage funds saw an outflow of ₹1,076 crore in January 2019. This places the net inflow at ₹3,838 crore at the end of January 2019, less than a third of what the industry collected last year.

The other worrying factor is the steady increase in redemptions: ₹11,397 crore was redeemed from equity funds in January 2019, against ₹11,234 crore in the previous month. Experts attributed this to volatility in the financial markets last year and tightening of rules on commissions in mutual funds by the Securities and Exchange Board of India over the past year. The general elections due in April/May are also likely to have weighed on investor sentiment.

However, it does seem that the retail investor is yet to give up on equity mutual funds. The amount collected through SIPs in January 2019 was ₹8,063.67 crore, compared with ₹8,022.33 crore in the previous month. SIP is an investment plan offered by mutual funds that allows investors to invest a fixed amount in a mutual fund scheme periodically.