Investors investing money in equity mutual funds through systematic investment plans have earned an average return of 10.26% in the last five years since the Narendra Modi-led NDA government came to power. The study done by NJ Wealth is on the basis of average performance of 133 equity mutual funds in large-, mid- and small-cap categories in the last five years.

These returns are lower than their benchmark indices in this period. In the last five years, the benchmark Nifty returned 11.58% on a compounded basis every year. The Nifty Midcap index gained 16.28% and the Nifty Smallcap index rose 12.48% on a compounded basis during this period.

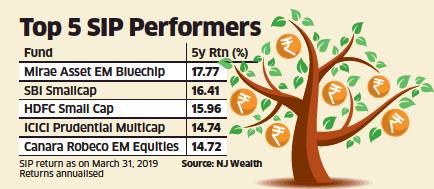

About half of these funds have performed better than the average returns. The best performing fund was Mirae Emerging Bluechip, returning 17.77% on a compounded basis every year, while the worst performer was Baroda Midcap, which returned 3.58% in this period. The analysis is based on an investor who started an equity SIP in April 2014 and continued it for five years.

SIPs have been the preferred mode of investment for retail investors with monthly mobilisations through this route moving up from ₹1,206 crore a month in March 2014 to ₹8,055 crore in March 2019. Investors flocked to equity mutual funds post demonetisation, shifting money from assets such as gold, fixed deposits and real estate.

Equity is one asset class that helps you beat inflation over a period of time. Historically, if you hold on to your equity investments for 7 years, the probability of making a loss is zero. Investors are convinced about this and hence are doing long-term investments through SIPs to meet their life goals be it buying a house, foreign vacation or retirement planning.

The returns from equity mutual funds through SIPs would be better for investors who had put money into equity mutual funds before April 2014. This is because the stock market had begun rallying almost eight months before Narendra Modi became the Prime Minister late in May 2014. The Nifty gained 32% between September 1, 2013 and May 30, 2014. The stock market and the rupee was in freefall before September 2013 as India was weighed down by widening current account and fiscal deficits, resulting in the economy being clubbed in the ‘Fragile Five’.

Investors, who had put money through SIPs in the period before September 2013, would have benefited the most from the almost an uninterrupted five-year rally.

In the last year or so, equity mutual funds have struggled to outperform their benchmark indices because the rally has been driven by a few stocks. Almost 90% of the Nifty returns during the last one year came from six stocks – Reliance Industries, HDFC Bank, Infosys, TCS, ICICI Bank and Axis Bank. With equity schemes having investment restrictions in every stock, the skewed performance has also hurt the returns of equity schemes.

Some financial planners said a better mix of investments in equity schemes could have improved returns.

While 10.25% is the average returns, an investor with a combination of active, passive investing and some addition of international funds, could have generated a little bit higher returns. Even though the SIP time is 5 years, since money comes in every month, the average time period for which the investor is invested is only 2.5 years. Given this, he believes returns from equities have been very good.