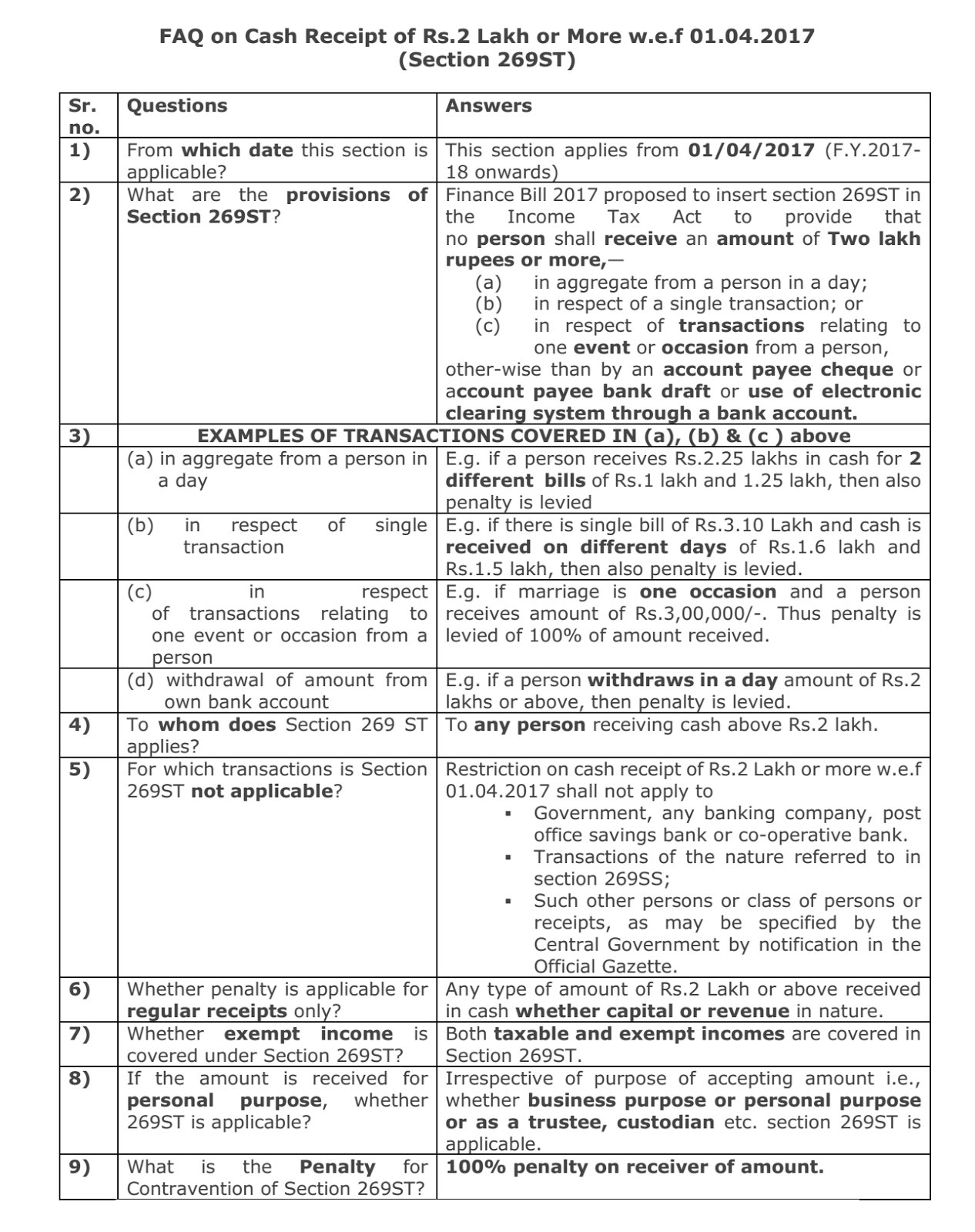

In a bid to curb black money as well as to limit the number and amount of cash transactions, the government has come out with some new rules and prohibited some types of cash payments. It may be recalled that the government had in March this year capped cash transactions at Rs.2 lakh instead of the earlier sanctioned amount of Rs.3 lakh. As per the fresh proposal, citizens were also required to pay a service charge on all cash transactions above Rs.2 lakh.

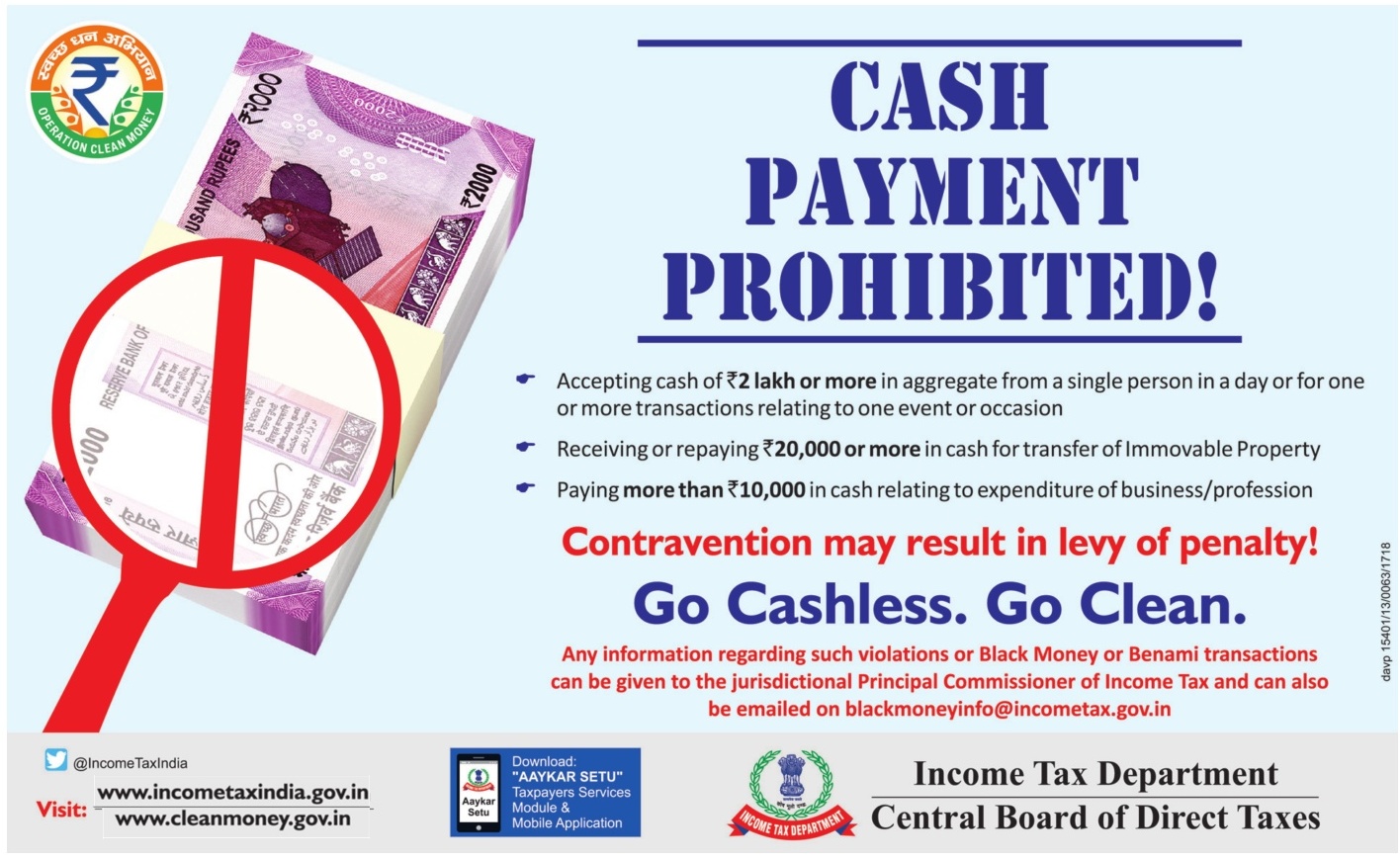

However, apart from prohibiting cash transactions of Rs.2 lakh and more, the government has now put a ban on some types of cash payments even of a lower amount. As per the new rules, accepting cash of Rs.2 lakh or more in aggregate from a single person in a day or for one or more transactions relating to one event or occasion is prohibited now. Besides, no one can receive or repay Rs.20,000 or more in cash for transfer of immovable property now. Not only this, paying more than Rs.10,000 in cash relating to expenditure of a business or profession is also prohibited.

This means you now need to be more careful while making cash payments. “A contravention of these rules may result in levy of penalty,” says the Income Tax Department on its website. It also says that any information regarding such violations or black money or Benami transactions can be given to the jurisdictional Principal Commissioner of Income Tax or can also be emailed to [email protected].