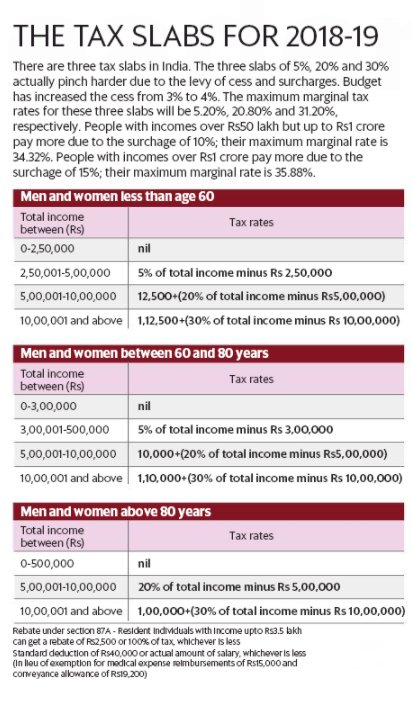

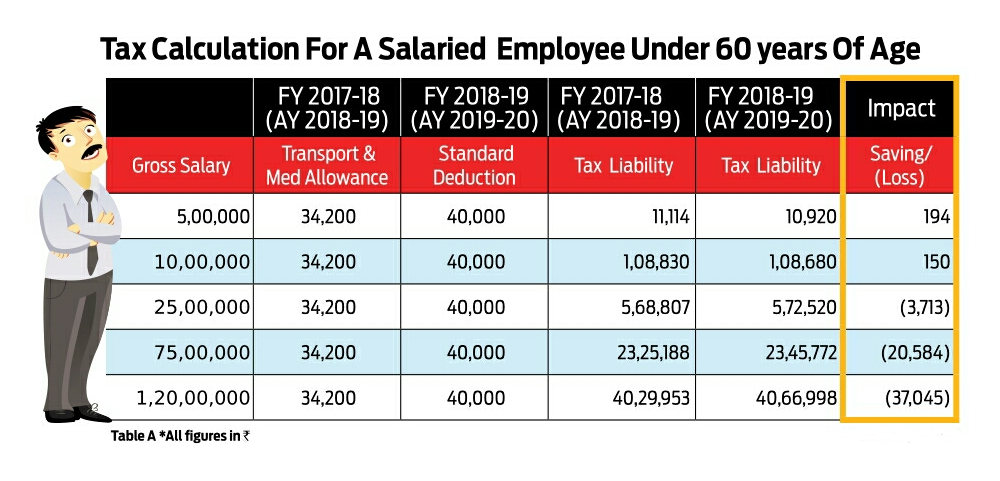

Income Tax Slab rates have not been changed.

Introduction of Standard Deduction of Rs.40,000. This replaces medical reimbursement and travel/conveyance allowance. At present, you can get medical benefits reimbursed from employer to the extent of Rs.15,000. Conveyance allowance can be Rs.1,600 per month, effectively Rs.19,200 per annum. This standard deduction of Rs.40,000 will replace the aforementioned benefits.

Tax Benefit for Health Insurance Premium:

The Budget 2018 speech, among the other changes proposed in direct taxes reads, “It is proposed to provide that in a case where premium for health insurance for multiple years has been paid in one year, the deduction shall be allowed proportionately over the years for which the benefit of health insurance is available.”

Currently, under section 80D of the income-tax Act, a resident individual can claim a tax deduction of up to Rs.25,000 in a year for the medical insurance premiums paid for self, spouse and children, and an additional Rs.25,000 for premiums paid for parents.

If the parents are senior citizens and you are paying their medical insurance premiums, you can claim an additional deduction of up to Rs.30,000—taking the total deduction to Rs.55,000.

A deduction is the first tool to use to reduce your tax liability. It is a reduction from your total taxable income.

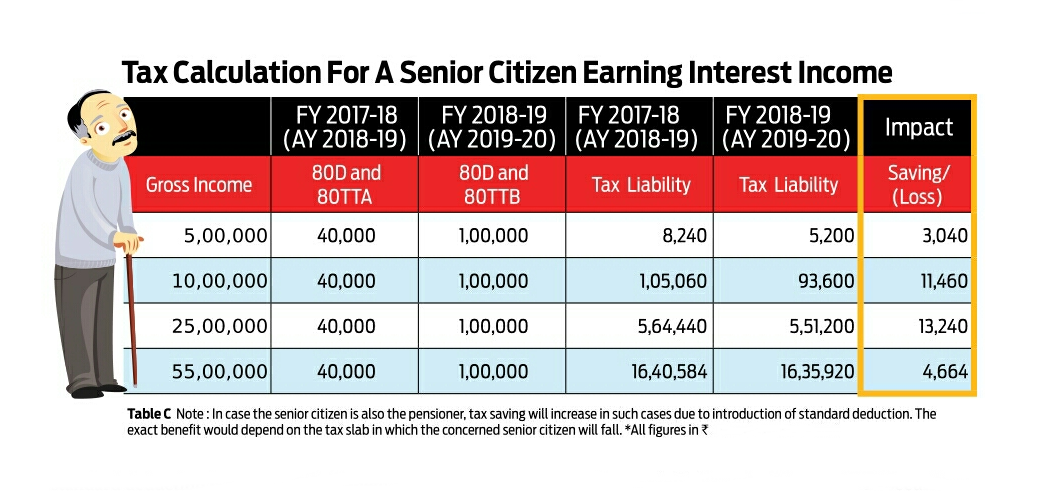

The Budget has also proposed to increase the section 80D deduction for senior citizens. Section 80D allows tax deduction for health insurance premiums paid. This has been proposed to be increased from up to Rs.30,000 to a maximum of Rs.50,000 now.

So, if you are also paying the health insurance premiums for your senior citizen parents, your deduction limit under this section of the income-tax Act would go up to Rs.75,000 from the Rs.55,000 earlier.

Both the new proposals would take effect from 1 April 2019 and be applicable for assessment year 2019-20.

For someone who is in the highest tax bracket of 30%—the effective income tax rate for whom would now be 31.2%, given that the education cess has been increased to 4%—the tax savings would be up to Rs.15,600, compared to Rs.9,270 now. While this deduction has not been changed for taxpayers other than senior citizens, the proposal to get the claim proportionately in multiple years for single premium policies can be useful. For instance, if your health insurance premium for a sum assured for a family of four (husband, wife and two children) in one year is Rs.20,000, you can claim this amount as a deduction under section 80D. However, insurance companies provide a discount if you take the policy for a period of 2 years, and your premium will be less than Rs.40,000 in that case.

Assuming that you get a 5% discount, you would pay Rs.38,000 for the 2-year cover. Under the current rules, you are only allowed to claim a deduction in the first year that too up to Rs.25,000 only.

As per proposals in the 2018 Budget, you would be able to claim the total premium paid, proportionately, over the 2-year period, which would mean a deduction of Rs.19,000 in both the years.

However, you must note that in order to claim this tax deduction, you should not have paid the premiums in cash. The benefit is available if payment is made in any manner except in cash. You can pay using any online mode like internet banking, credit or debit cards, or can even pay by a cheque. Also, section 80D deduction benefits are not available to group health insurance premiums paid by your employers.

The benefit is available to individuals for health insurance premiums paid for self, spouse, children, and parents. More importantly, it does not matter whether the children or parents are dependent on you or not.

A few other important announcements:

Health and education cess has now been enhanced to 4% from 3% earlier.

Benefit under Section 54EC (to save long term capital gains by investing in NHAI and REC bonds) has been now to limited to only capital gains arising from sale of land and building. Earlier, any kind of capital asset was defined. Moreover, the tenure of such bonds has been revised from 3 years to 5 years.

The three Government General Insurance companies (National Insurance, United India and Oriental Insurance) will be merged into a single entity and listed.

National Health Protection Scheme shall be launched that will provide medical coverage of Rs.5 lacs to poor families.

EPF contribution for new employees will be 8.33% for the first 3 years. For certain sectors such as textile, leather and footwear, Govt. contribution to EPF account will be 12%.

EPF deduction for women at 8% for first three years of employment.