Came across these articles by Mayank Joshipura, who is a professor & chairperson (Finance), School of Business Management, NMIMS, Mumbai…and published in the Financial Express.

As they say, there is no free lunch in Finance and Economics. If you want to earn higher returns, you have to take higher risk. That’s what they teach in B-schools to the future fund managers. But, when it comes to investing, they have made a small exception to it. A portfolio, usually defined as a combination of assets or securities, can reduce your risk and improves the risk-return trade-off. So the diversification is a free starter in an otherwise no-free-lunch framework. But that’s it. Don’t expect anything freebies beyond this.

While this high-risk, high-return bonhomie works well across asset classes, it has turned on its head within the asset class. Let me explain. Equity has outperformed the bonds across the globe over a long period of time. A reward for opting for a bumpy, volatile and riskier ride than bond investing. And that’s the way it should be, in the high-risk, high-return world.

Low-risk, high-return!But the same is not the case within the asset class such as equity. There are two popular measures for the risk: Standard deviation and beta. Standard deviation measures the total risk of a stock whereas beta measures the systematic, the risk linked to the market, which you cannot diversify away.

The low-risk stocks have outperformed high-risk stocks across the globe, both in absolute as well as risk-adjusted terms. I know you won’t believe it without evidence as this is akin to free-lunch. So let us look at some evidence from Indian markets.

Indian evidence

NSE has launched two strategic indices with base data of December 31, 2003. Nifty-low-volatility and Nifty-high-beta-50. A low-volatility index is a proxy for low-risk investment strategy and the high-beta index is a proxy for high-risk investment strategy. If the traditional positive risk-return were to hold, the high-beta index would deliver higher returns than the low-volatility index. Of course with higher standard deviation and beta. But, that is not the case.

As you can see, the positive risk-return relationship goes for a toss. Since inception, the low-volatility index has delivered more than three times annualized return than high-beta index at half the risk. You can use the measure of your choice-standard deviation or beta. Besides, the dividend yield for the low-volatility index is superior to high-beta index. The same is true for 5-year performance.

Comparing results with the Nifty50 index, which is often used a proxy for the market, throws interesting insights. Low-volatility index has delivered superior returns than the market at less than much lower risk. Low volatility stocks outperforming the market and high-volatility stocks is a global phenomenon. But the question then is who doesn’t want to earn the higher return at lower risk? And if that is so, how such relationship can persist. Well, the answer lies in the fact that we all are human being and biases and preferences like overconfidence drive investors’ preference for high-risk stocks and ignore low-risk stocks.

Low volatility investing works on the principle of winning by losing less. While markets are not predictable, low volatility investing is boring and predictable. Low-risk stocks outperform in falling and range bound markets and underperform in rapidly rising markets. The case in point is last one year return. The Nifty delivered 18.17% return, whereas high-beta index delivered 22.53% return and low-volatility index delivered 16.05% return.

Investors with the myopic view towards investments always want to make quick money in the short period of time and high-risk stocks offer them the illusion of such possibility in fast-rising markets. Punjab National Bank stock being the part of the high-beta index may be a coincidence. But it says a lot about the long-term inferior performance of high-volatility stocks. Low volatility investing is a slow-burn with the potential to deliver great returns at much lower volatility. We should invest to create wealth and not for excitement or prove intelligence.

People invest in small cap stocks despite knowing that small-cap stocks are more volatile and risky than their large-cap counterparts in general. They are willing to take higher risk thinking that by taking the higher risk they will earn higher returns. The lure of finding the next multi-bagger stock and getting rich soon are the key reasons behind such choice.

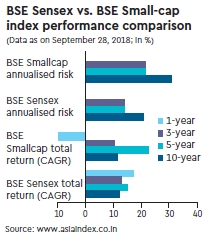

The easiest way to test whether small-cap stocks earn higher returns is to compare the performance of BSE Sensex and BSE Small-cap index; proxy for large-cap and small-cap portfolios respectively.

The graphics present the performances of BSE Sensex and BSE small-cap index. While it is clear that the risk measured by annualised standard deviation is almost 50% higher for the small-cap index than that of Sensex for three-year, five-year as well as ten-year periods, there is no consistent pattern visible in returns.

Return for Sensex is higher for the one-year, three-year and ten-year period, whereas small-cap index has the superior return for the five-year period. Now, I know that many of you would cry foul saying that I have chosen the time to pen his article when large-cap stocks have done far better than small-cap in the year 2018. BSE Sensex has delivered 7.44% return whereas BSE small-cap index has delivered -24.24% return from in first nine months of 2018. And if I choose a different period the picture will look very different.

But that is not true. Let us take 10-year period of December 2007 to December 2017, and the story remains the same. Sensex has gone up by 1.68 times from levels of 20,287 to 34,057, whereas BSE small-cap index has gone up by just 1.44 times from levels of 13,349 to 19,230. It is evident that even for a reasonably long holding period of 10 years, there is no reward for accepting additional risk. Yes, you will have periods in which small-cap stocks would do better than large-cap and there will be some periods where large-cap stocks will do better than small-cap stocks.

Mixed fortunes

Similarly, you will find investors who have made fortunes in large-cap stocks and you will also find investors who have made fortunes in small-cap stocks. Since risk associated with small-cap stocks is much higher than large-cap stocks, you will find extreme performance in small-cap stocks both on the way up as well as down.

While those who have lost money are less likely to make noise, what we normally hear is the trumpet beating of a few investors who have earned good returns in the given period and that makes us feel that “today’s small-cap are tomorrow’s large-cap” or for that matter, you can find your next multi-bagger by investing in small-cap stocks only. But, looking at the performances of the indices presented here, it is evident that there is no reward for taking the additional risk by investing in small-cap stocks.

So if you don’t want to brag about your skills of identifying next multi-bagger stocks and are simply interested in earning equity returns without taking too much risk, investing in a quality basket of large-cap stocks or a low-cost ETF tracking large-cap indices is always a better choice.