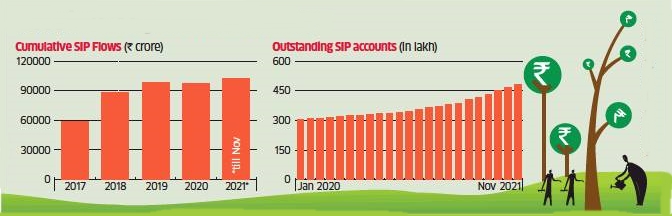

The cumulative inflows from systematic investment plans have crossed ₹1 lakh crore in a year for the first time, data from the Association of Mutual Funds in India show.

Buoyed by the continued support from retail investors, the domestic flows have partially offset the selling pressure from foreign portfolio investors. The previous record SIP flow in a calendar year was ₹98,612 crore in 2019.

Boosted by the SIP inflow, the domestic funds deployed ₹63,439 crore in the equity market while the FPIs invested close to ₹43,193 crore in the first eleven months of 2021. As a result, the share of the local funds in the total institutional equity AUM rose to 16.8% in November, the highest since February 2020, according to NSDL data.

The monthly SIP book grew in each of the seven months up to November. In the past three months, the monthly flow remained above ₹10,000 crore. As a result, the SIP book size averaged ₹9,337 crore per month in 2021 compared with the long-term average of ₹7,028 crore.

The impressive returns of SIP schemes and lack of better investment alternatives are the major reasons for the unabated enthusiasm of retail investors. The three-year and five-year SIP returns based on the investment in the Sensex stocks were at a 12-year high of 26.3% and 19.4%, respectively.

The equity assets under management increased at a two-year compounded annual rate of 25% to ₹17.43 lakh crore in November. The total folio count of the equity funds reached 7.8 crore of which 20% were added in the current year.

Individuals constituted about 54.9% of the total mutual funds’ assets in October 2021 compared with 51.7% a year ago, the data from AMFI show.