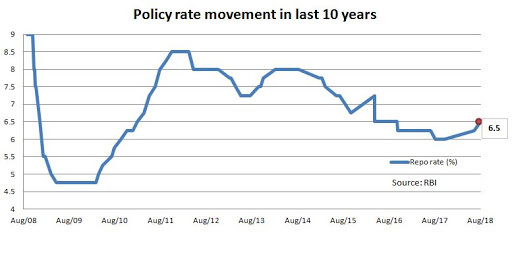

The RBI cited inflation concerns as it raised interest rates for the second time in as many months by 25 basis points, setting its benchmark repo rate at 6.5%.

The increase will push up the cost of loans for all borrowers, from consumers looking to finance their purchases of homes and cars to businesses looking to meet their capital needs.

The move was necessitated by the need to contain retail inflation after it quickened to 5% in June and given the backdrop of mounting domestic and global uncertainties, including the volatility in crude prices.

The RBI retained its forecast for economic growth in the current fiscal year at 7.4% and projected that the pace of expansion would quicken to 7.5% in the first quarter of FY20.

This is RBI’s second consecutive interest rate hike. The last time the RBI raised interest rates in two consecutive policies was in October 2013.

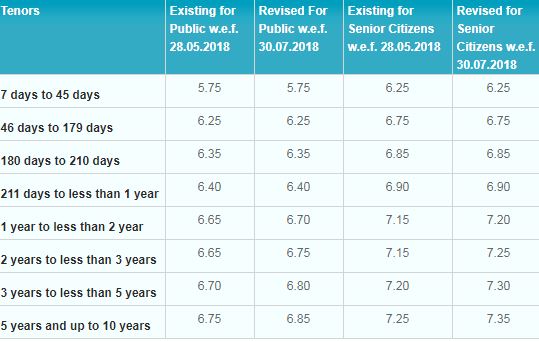

With the increase in policy rates, the interest offered on FDs is likely to increase. In fact, State Bank of India had already upped its deposit rates by 5 to 10 bps a day before the RBI’s announcement. (with effect from July 30)

The new rates are applicable on retail deposits below Rs.1 crore.

The hike in repo rate will have an impact on home loan EMIs. Considering banks’ MCLR will go up, the interest on loans will also go up.

As per the RBI mandate, all bank loans disbursed post April 1, 2016 are MCLR-linked and the lending rate cannot be below the MCLR rate. Over the last two monetary policy committee meetings, the repo rate has gone up by a total of 50 bps.