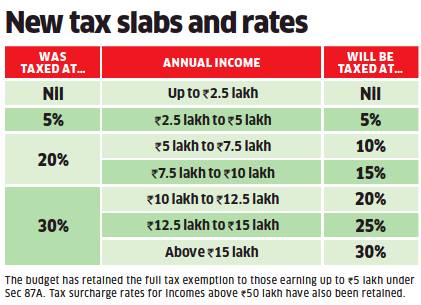

The budget has proposed an alternate income tax structure.

While it has indeed widened the tax slabs and reduced the tax rates, taxpayers who opt for the new regime will have to forego most of the exemptions and deductions that taxpayers avail of.

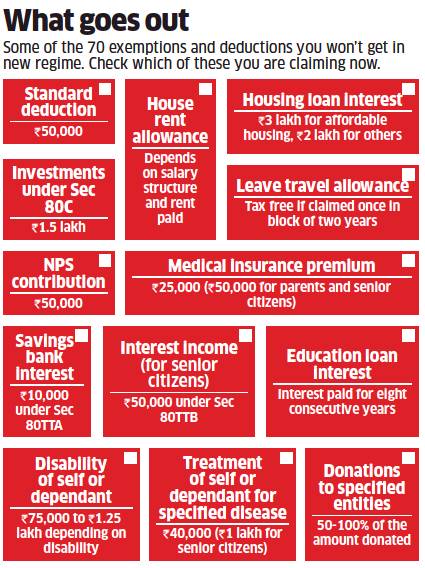

Out go all the exemptions and deductions under Chapter VI-A, including the house rent allowance (HRA), investments under Section 80C, NPS contribution, medical insurance premium and even the leave travel allowance which is tax free if claimed once in a block of two years. The deductions under Chapter VI-A add up to a huge amount.

The removal of tax exemptions and deductions certainly makes compliance less tedious, but avid tax planners who maximised their tax deductions will probably pay more tax under the new regime. In effect, the budget has tried to put more money in the hands of taxpayers by curtailing the incentives to save.

On its part, the Finance Ministry expects four out of five taxpayers to move to the new tax regime. It analysed the income and investment data of 57.8 million taxpayers and found that 69% would save on tax under the new system. Another 20% might want to switch to avoid the hassles and paperwork involved in tax planning.

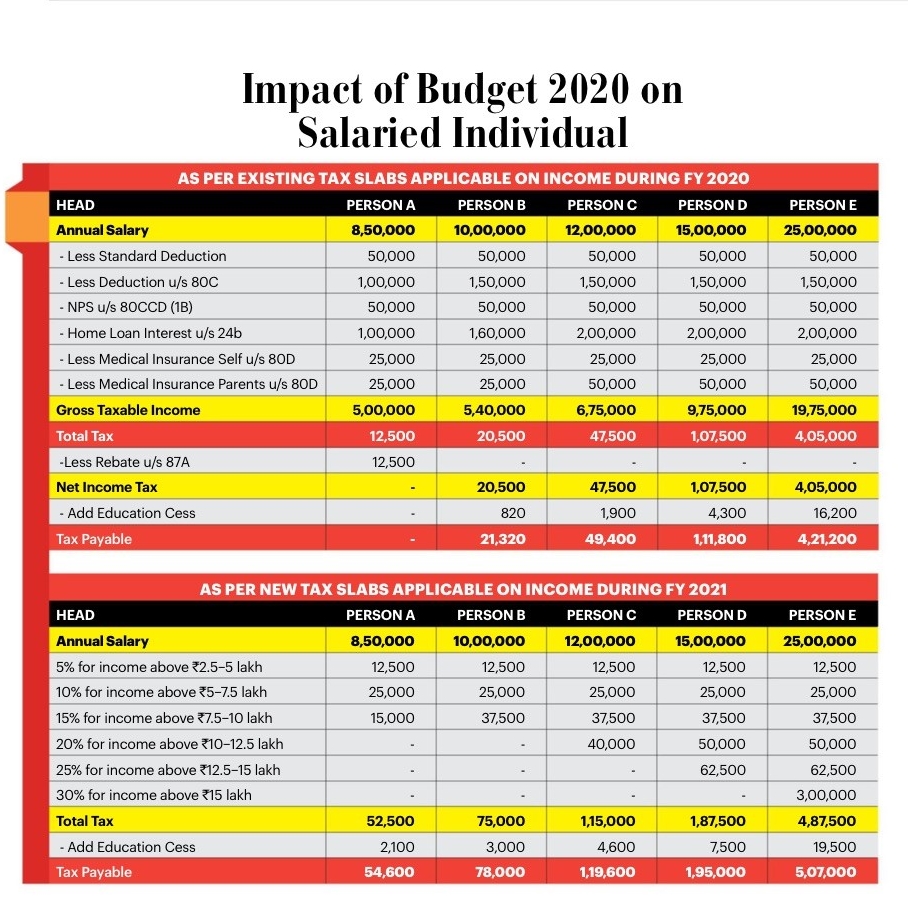

Tax was already quite confusing for the average Indian. With three more tax slabs, the new tax regime has only added to the confusion. Taxpayers are trying to figure out whether the new tax structure is more beneficial. Several websites have come out with calculators that help individuals figure this out. The Income-Tax Department itself has launched an e-calculator to estimate the tax liability under the new tax slabs. It compares taxes in the old and the new tax regime.

You don’t really need to do an elaborate calculation to know this. The answer is actually quite simple. Anyone claiming tax exemptions and deductions of more than ₹2.5 lakh in a year will not gain from the new structure.

This threshold of ₹2.5 lakh includes the standard deduction of ₹50,000 for which no investment is required. All salaried taxpayers are eligible for this, which leaves only an additional deduction of ₹2 lakh. Of this, ₹1.5 lakh is taken care of by Section 80C investments. The average taxpayer also claims exemption for HRA or claims deduction for the interest paid on a home loan. Then there are other deductions such as the contribution to the NPS, the interest on education loans, treatment of illness and for disabilities. There is also the small but widely claimed exemption of up to ₹10,000 for savings bank interest under Section 80TTA.

This threshold of ₹2.5 lakh deduction applies to income above ₹15 lakh. The breakeven point is even lower for those in the lower income brackets.

Finance Minister Nirmala Sitharaman said in her budget speech that a taxpayer earning ₹15 lakh will save ₹78,000 in tax under the new regime. However, this assumes that the taxpayer is not claiming any deduction at all. In reality, the standard deduction applies automatically to all salaried taxpayers. Also, there are several expenses that are eligible for tax benefits, such as tuition fee of up to two children which can be claimed as a deduction under Section 80C.

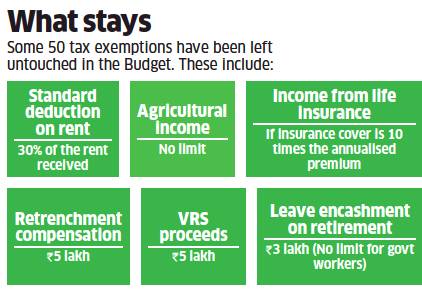

The new tax structure will suit those who don’t claim too many deductions or want to avoid the paperwork of tax planning. This could include non-salaried taxpayers (including consultants) who are not eligible for the host of exemptions and deductions under Chapter VI-A. It could also include senior citizens who do not draw a pension from their employer and are therefore not eligible for the standard deduction of ₹50,000.

However, senior citizens earn a big chunk of their income from interest and enjoy an exemption of ₹50,000 for interest income under the newly introduced Section 80TTB.

The option to remove tax exemptions and deductions is also worrying investment experts. Section 80C forces individuals to save, and they will be weaned off savings if there is no tax incentive.

In fact, tax benefits are the prime drivers of investment decisions in India. The NPS was always a very good investment opportunity but it started attracting investors only after the additional tax deduction of ₹50,000 was introduced in 2015. It became even more popular after the new rule that makes 60% of the corpus tax free on maturity came into effect.

On the other hand, some experts feel that the budget has done the right thing by separating tax benefits from investments. To be fair, taxpayers will have the option to switch to the new tax structure.

What’s more, CBDT chairman P.C. Mody has clarified that individual taxpayers will have the option to switch from the old regime to the new structure and vice versa every year. If a taxpayer has made certain investments or expenses in a certain year, he can shift to the old system. However, Mody also clarified that business owners won’t have this option to switch back and forth every year.

The budget has, however, left the surcharge on tax untouched. Taxpayers with income between ₹50 lakh and ₹1 crore will continue to pay 10% surcharge on the tax. The surcharge is 15% for income between ₹1 crore and ₹2 crore, 25% for between ₹2 crore and ₹5 crore and 37% for income over ₹5 crore.

So taxpayers earning just below these threshold limits will not benefit if they forego the exemptions and move to the new tax regime.