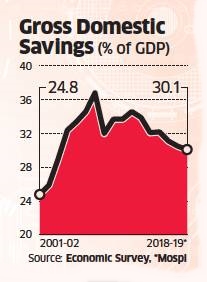

India’s slowing economy took a toll on much-needed savings too, with the savings rate touching a 15-year low, and household savings also falling. This has weakened India’s macro-economic position which is already hobbled by low investment and rising external borrowing to fund capital needs.

Household savings also declined as consumers spent more in purchasing durables and travelling. Indian households contribute to about 60% of the country’s savings. But India remains favourable compared to emerging market peers such as Brazil.

India’s gross savings fell to 30.1% of the gross domestic product in fiscal 2019 from 34.6% in fiscal 2012, and 36% in 2007-08. The previous low was 29% in 2003-2004. As a per cent of GDP, household savings fell from 23% in 2012, to 18% last year.

A falling savings rate could lead to Indian companies ending up borrowing more from overseas markets, weakening India’s external position as it would raise the nation’s external debt.

India’s external borrowing last fiscal rose to $543 billion, from $475 billion in 2015.

Economists also attribute the current slowdown in the economy partly to the fall in the savings rate.

When compared to BRICS economies and other emerging market peers, India stands out favourably. Brazil has a savings rate of 16% of GDP, Mexico 23%, and the Philippines 14.2%. But bigger rival China is at 46%.